This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- The Basics of Car Insurance You Need to Know

- Assessing Your Coverage Options for Peace of Mind

- What Rideshare Drivers Need to Know About Car Insurance

- How to Compare Quotes and Find the Best Deal

- Common Discounts That Can Save You Money on Premiums

- Tips for Finalizing Your Policy and Staying Covered

- Navigating Claims and What to Do After an Accident

- Frequently Asked Questions

- Recommended Reads

The Basics of Car Insurance You Need to Know

When you begin exploring car insurance, it is important to gain insight into some concepts. This knowledge helps you select the coverage that fits your needs. First, learn about the different types of coverage available. Liability insurance is required by law in many places. It covers costs if you damage someone’s property or cause injury while driving. Collision coverage pays to repair your car if you hit something or someone hits you, regardless of fault. You might also want coverage that protects against theft or natural disasters. Each type of insurance serves a distinct purpose. Knowing what each does allows you to choose the right plan.

Insurance premiums, the amount you pay, can vary widely. Factors such as your driving record, the car you drive, and where you live affect your rates. Many insurers offer discounts you should consider. For example, you might qualify if you have multiple policies with the same company or maintain a clean driving history. Here is a quick list of common discount types:

| Discount Type | Potential Savings |

|---|---|

| Safe Driver Discount | Up to 20% |

| Multi-Policy Discount | 10–25% |

| Good Student Discount | Up to 15% |

| Low Mileage Discount | 5–15% |

Knowledge of the various coverage types and what influences your premiums will help you select the best car insurance for your situation.

Assessing Your Coverage Options for Peace of Mind

When choosing car insurance, review the coverage types offered and consider which make you feel secure. Start by checking your state’s minimum requirements, which usually include liability coverage to pay for damages to others if you cause an accident. Beyond that, think about your lifestyle and driving habits to decide if additional protection is necessary.

Consider these coverage options:

- Collision Coverage: Pays for damage to your vehicle caused by a crash, regardless of fault.

- Comprehensive Coverage: Covers damage from theft, vandalism, or weather events, excluding collisions.

- Uninsured/Underinsured Motorist Coverage: Protects you if an at-fault driver lacks sufficient insurance.

- Personal Injury Protection (PIP): Helps cover medical expenses for you and your passengers after an accident.

Also, review your deductible amounts carefully. A higher deductible generally lowers your monthly premium but increases what you pay out of pocket in a claim. The table below shows how deductible levels might affect your premium:

| Deductible Amount | Monthly Premium |

|---|---|

| $500 | $150 |

| $1,000 | $120 |

| $2,000 | $90 |

Evaluating these factors will help you choose the coverage that best fits your needs.

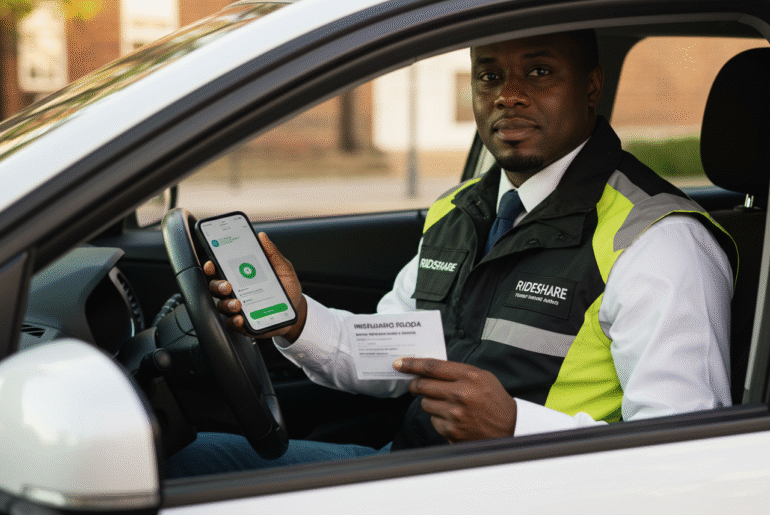

Driving for a rideshare company such as Uber or Lyft requires special insurance considerations. Most personal car insurance policies do not fully cover commercial use of your vehicle.

Rideshare insurance typically varies depending on when you are driving:

| Rideshare Period | Description | Coverage Notes |

|---|---|---|

| Period 1: App is on, no ride accepted | Personal policy may exclude coverage | Consider adding rideshare endorsement |

| Period 2: En route to pick up passenger | Covered by rideshare company, but gaps may exist | Verify gaps in coverage |

| Period 3: Passenger in car | Rideshare company provides coverage | Usually full coverage |

To stay protected:

- Check your insurer’s policy: Many offer rideshare add-ons that cover Period 1.

- Don’t rely solely on Uber/Lyft coverage: Coverage in Periods 2 and 3 may have high deductibles or gaps.

- Compare rideshare-specific insurance: Some companies provide plans tailored to gig drivers.

Here are some insurers offering rideshare endorsements:

| Insurer | States Available |

|---|---|

| GEICO | Nationwide (varies) |

| State Farm | Most U.S. states |

| Progressive | Most U.S. states |

| Allstate | Select U.S. states |

Rideshare driving adds complexity to your insurance needs. Inform your insurer if you plan to drive commercially and secure the proper coverage before starting.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

How to Compare Quotes and Find the Best Deal

To find a good car insurance deal, collect quotes from multiple companies. Use the same coverage limits and deductibles for each quote to make accurate comparisons. Keep the following factors in mind:

- Premiums: The monthly payment required.

- Coverage Options: What protections are included, basic or comprehensive?

- Discounts: Availability of savings for bundling policies, safe driving, or car safety features.

- Customer Service: Reviews and ratings can reveal how quickly and effectively companies respond to claims.

Many insurers offer discounts that can significantly lower your premiums, including

- Multi-Policy Discount: Savings when combining auto with other insurance like home or life.

- Safe Driver Discount: Reduced rates for maintaining a clean driving record.

- Low Mileage Discount: Discounts for driving fewer miles than average.

- Good Student Discount: Savings for students who maintain good grades.

- Military and AARP Discounts: Special rates for veterans and group members.

| Discount Type | Potential Savings |

|---|---|

| Multi-Policy | Up to 25% |

| Safe Driver | 15–30% |

| Low Mileage | 5–15% |

| Good Student | 5–20% |

Always ask your insurer about available discounts when shopping for coverage. Review your policy annually and compare rates, as discounts and premiums can change over time.

Tips for Finalizing Your Policy and Staying Covered

Before signing your car insurance policy, read all details carefully. Look for any exclusions or conditions that may affect your coverage. Ask your agent to explain anything unclear.

Additional tips:

- Assess Your Coverage Needs: Consider your driving habits, vehicle, and finances.

- Compare Multiple Quotes: Avoid settling for the first offer.

- Bundle Policies: Combine auto with home or renters insurance to save.

- Review Annually: Update your coverage as your life changes.

What you do immediately after an accident can impact your claim’s outcome:

- Ensure Safety: Check on everyone’s condition and call emergency services if necessary.

- Document the Scene: Take photos of vehicles, injuries, and surroundings.

- Report to Your Insurer: Notify your company promptly with an honest account.

- Contact Other Party’s Insurer: Share information as appropriate.

- Keep Records: Save all correspondence and documents related to the accident.

Frequently Asked Questions

Rideshare insurance typically excludes coverage when your app is off or during personal use unrelated to rideshare activities.

Certain expenses related to rideshare driving may be deductible, but check with a tax professional for details.

Some policies extend coverage to delivery services, but it varies. Confirm with your insurer. Best Rideshare Insurance Companies for Various Needs:

- Best for Uber: Progressive

- Best for Lyft: Allstate

- Best for Food Delivery Drivers: State Farm

- Best for Military Members and Veterans: USAA

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Car Insurance for Rideshare Drivers

https://fangwallet.com/2025/05/24/car-insurance-for-rideshare-drivers/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.