This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Updated by Albert Fang

Between the rise of inflation, supply chain problems, and stagnating wages, many Americans are living in challenging times financially. Even car insurance is becoming difficult to afford. Insurance recently took a record 19% jump, according to a 2023 consumer price index report—the most significant jump in 47 years. Auto insurance is still going up into 2024 by as much as 40% in some states.

Given this price surge, it’s unsurprising that many car owners are looking for ways to cut costs wherever possible. A common way of trimming expenses is to reduce or even drop their car insurance coverage. While driving without insurance is not recommended (nor legal in practically all the U.S.), dropping some coverage can be a good idea.

Why Has Car Insurance Increased So Much?

What’s the reason behind the significant surge in insurance premiums? There are a few forces at work here:

- First, there’s the inflation (as mentioned above) and supply chain issues. Combined, these two factors have raised prices for parts and labor, especially as replacement parts become more difficult to acquire even years after the supply chain disruption is supposedly over.

- Cars and trucks have also become increasingly sophisticated, with advanced computerized features and high-tech accessories. This makes replacement parts more expensive and can significantly raise the cost of labor, as some vehicles now require advanced training to service.

- Another reason for higher insurance premiums is an increase in extreme weather events. Extreme weather connected to climate change has seen a dramatic rise even in the past year, resulting in multi-billion-dollar payouts for insurance companies. To stay profitable, some insurance companies are pulling out of states like California and Florida entirely, making it difficult or impossible for motorists to get insured at all.

- There’s still some fallout from the pandemic regarding driver behavior. During the early days of the pandemic, when American streets were nearly empty for weeks, those drivers still on the roads could get away with driving recklessly. The days of quarantine are over now, but for some, the reckless driving habits have remained, which means more dangerous and expensive accidents.

- Finally, many insurance companies are technically insolvent. According to the Insurance Information Institute, insurers spent $1.12 in compensation for every $1 they collected in 2022. Most insurers depend on investment proceeds to cover that shortfall, and only insurance regulators stand between policyholders and even more significant price hikes.

Uninsured Motorists in the U.S.

With insurance rates as high as they are—and only getting higher—it’s no wonder some drivers choose to go without car insurance entirely. Cost-of-living pressures, unemployment, and other financial difficulties can force car owners to choose between insurance and more vital concerns.

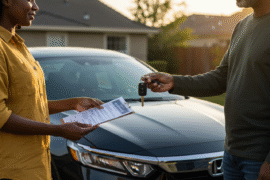

The statistics are clear — the percentage of uninsured motorists has risen since 2017 from 11.6% to 14% in the last five years — even though driving without insurance is illegal almost everywhere in the U.S. Doing so can carry severe financial, civil, and even criminal penalties. Though laws on driving uninsured vary from state to state, repeat offenders will likely face heavy fines, license suspension or revocation, or worse.

Types of Auto Insurance

Before we talk about what kind of insurance you should or shouldn’t drop, let’s delve into the main types of auto insurance and what they do for you.

- Liability coverage is legally required practically everywhere in the country. It covers property damage expenses incurred if you’re at fault in an auto accident. It also covers any associated legal costs if you get sued after the accident. In short, liability coverage stands between you and bankruptcy should you be in an at-fault accident.

- Collision insurance covers damage to your own vehicle in case of an accident, whether it’s with another car or another kind of obstacle. Collision damage does not cover things like theft, fire, flood, vandalism, or anything else that’s not a collision.

- Comprehensive coverage insures you against those types damage to your vehicle that collision insurance won’t cover. Collision and comprehensive coverage are often sold together.

- Uninsured motorist coverage is just what it sounds like — it provides extra protection in case you’re in an accident with an uninsured driver. This includes medical and injury-related expenses and may or may not include vehicle damage, depending on your state. Some states legally require this coverage.

- Personal injury protection (PIP) covers medical bills for you and your passengers in case of an accident, regardless of who is at fault. It will also cover other expenses, such as lost wages and funeral expenses. Like uninsured motorist coverage, PIP is required in several states.

Why You Should Keep Your Car Insurance

Now, let’s talk about whether you “really need” all that coverage.

Put simply, dropping all your car insurance is a terrible idea. Not only is it illegal, but it opens you up to financially crippling medical bills, liability lawsuits, and more. Going without any auto insurance invites personal and financial disaster.

There are some excellent reasons to keep what coverage you can, even if you’re struggling financially. Depending on your circumstances, repairing or replacing your vehicle out of pocket might be difficult or impossible, making comprehensive coverage look ideal in retrospect.

In some cases, dropping coverage may not even be an option. If your car is leased or still under financing, it’s likely your lender requires you to keep comprehensive and collision coverage under the terms of your loan. Before you drop or alter your coverage, check with your lender to see if that’s the case.

On the other hand, dropping certain kinds of coverage (besides liability) might be a good idea if you own your vehicle outright. While full coverage on your vehicle is great, it’s ultimately optional and may be outright useless if your car is older and has a low blue book value. Even collision coverage may not be worth it when it comes to older cars that have lost most of their value.

If you’re truly financially struggling and simply must drop coverage, the best option is to drop everything but liability. This will satisfy legal requirements and keep you from being financially destroyed by liability lawsuits. You may not be able to do this if your car is leased or still under financing—talk to your insurer to find out your options.

Other Factors to Consider

Before you make any final decisions about dropping your comprehensive car insurance, here are a few more things to consider:

First, do you live in an area that’s particularly vulnerable to natural disasters? If you live in a state prone to wildfires, hurricanes, tornadoes, or other extreme weather events that can cause significant vehicle damage, it may be worth your while to keep that comprehensive coverage after all. The same principle applies if you live in an area with a large number of wildlife-related accidents, particularly animal collisions, which collision coverage (ironically) may not cover.

Also, consider what you plan to do if the worst happens and your vehicle is damaged or totaled. Can you afford to repair it out of pocket? Do you have the means to replace it if it can’t be repaired? This is especially important if you finance your vehicle, since without coverage, you may find yourself making payments on two vehicles—one of which you don’t have anymore.

So when should you drop that comprehensive coverage? An excellent way to weigh this decision is to check the vehicle’s blue book value and then compare that to the deductible you have on your comprehensive policy. If the deductible is more than the vehicle’s value, then you would lose money if the car is totaled. Unfortunately, having the lowest possible deductible doesn’t really help this situation — many insurers will assume you’re at greater risk of making a claim and may adjust your monthly premiums up in response.

Another handy rule of thumb often used to help make this decision is that if your car was five or six years old when its mileage reached the 100,000 mark, then it’s probably time to drop the collision and comprehensive coverage. They just won’t be worth it.

How You Can Reduce Car Insurance Rates

There are some other steps you can take to lower your premiums, including:

- Shop around to compare car insurance quotes.

- Install anti-theft or safety equipment on your vehicle.

- Ask your insurer about discounts such as low-mileage, good student, or clean driving record discounts.

- Take a defensive driving course.

- If feasible, consider trading in your car for an older, more reliable model — older cars generally cost less to insure because they cost less to repair.

- Raise your deductible. When you bring up your deductible, you take a gamble: if you do get in an accident, you will pay more out of pocket for the repair or replacement of your vehicle — but in the meantime, your monthly premiums will be lower. You should only do this if you can reasonably afford it (and see the advice above about comparing the deductible to your car’s value).

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: When is it Okay To Drop Comprehensive Car Insurance?

https://fangwallet.com/2024/04/30/when-is-it-okay-to-drop-comprehensive-car-insurance/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo