This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Getting back into the routine of investing can be challenging, particularly if you’ve faced some unexpected difficulties in life. If you’ve left the market for personal reasons, faced unexpected financial problems, or just lost interest, it’s never too late to get back on track. The good news is that you have the power to manage your financial future.

We’ll look at six useful tips that can help you get back in touch with your investment goals and make tomorrow a better day. Each tip is meant to help you get back into the investment world, refocus your strategy, and provide you the information you need to make smart choices.

- Assess Your Current Financial Situation

- Reevaluate Your Investment Goals

- Educate Yourself About Market Trends

- Diversify Your Portfolio Strategically

- Create a Consistent Investment Plan

- Stay Committed and Adjust as Needed

- Frequently Asked Questions

- What should I do first if I’ve fallen behind in my investing plan?

- How can I regain focus on my investment goals?

- Should I adjust my investment strategy?

- What role does education play in getting back on track?

- How can I stay disciplined in my investing practice?

- What should I do if I’m feeling overwhelmed by the current market?

- Recommended Reads

Assess Your Current Financial Situation

Before you start investing again, you need to take a good look at your current financial situation. Knowing where you stand financially will help you figure out what to do next to fix your investment strategy. Look at your income, expenses, debts, and savings first. The results will not only show you how healthy your finances are right now, but they will also show you how much you can invest. You might be able to save more money for your investment goals by making small changes to how you spend your money.

To make this assessment easier, consider creating a simple overview of your financial situation. Here’s a quick format you can use:

- Monthly Income

- Monthly Expenses

- Total Debt

- Savings

Next, identify your financial priorities and current obligations, which may include:

- Emergency fund status

- Retirement contributions already in place

- High-interest debt that needs paying off

- Short-term financial goals (e.g., travel, major purchases)

You can be more sure of how much you can invest and which strategies work best for your current situation if you have these things laid out. When it’s time to make smart and well-thought-out choices about your investments, this first step will pay off.

Reevaluate Your Investment Goals

Taking a moment to reflect on your investment aspirations can be beneficial in sharpening your financial focus. Life changes, market fluctuations, and evolving personal goals can all impact how you view your investment strategies. Consider the following aspects to help shape your current objectives:

- Time Horizon: Are you investing for short-term gains or long-term stability? Understanding your timeline helps tailor your portfolio to your needs.

- Risk Tolerance: Has your comfort level with risk changed? Before committing to more volatile investments, reassess your appetite for risk based on market conditions and your personal financial situation.

- Financial Milestones: What are your key life goals? Whether it’s buying a home, funding education, or planning for retirement, aligning your portfolio with your milestones is necessary.

It may also be helpful to put your goals on paper, creating a roadmap that guides your investment decisions. Here’s a simple table to illustrate hypothetical investment goals alongside their timelines and risk levels:

| Goal | Timeline | Risk Level |

|---|---|---|

| Retirement Savings | 20+ Years | Moderate to High |

| Child’s Education Fund | 10–15 Years | Moderate |

| Down Payment for a Home | 5 Years | Low to Moderate |

You can successfully move forward by figuring out what you want to achieve and then adjusting your plan to meet those goals. This proactive approach will help you stay motivated and give you more faith in your ability to make smart choices.

Educate Yourself About Market Trends

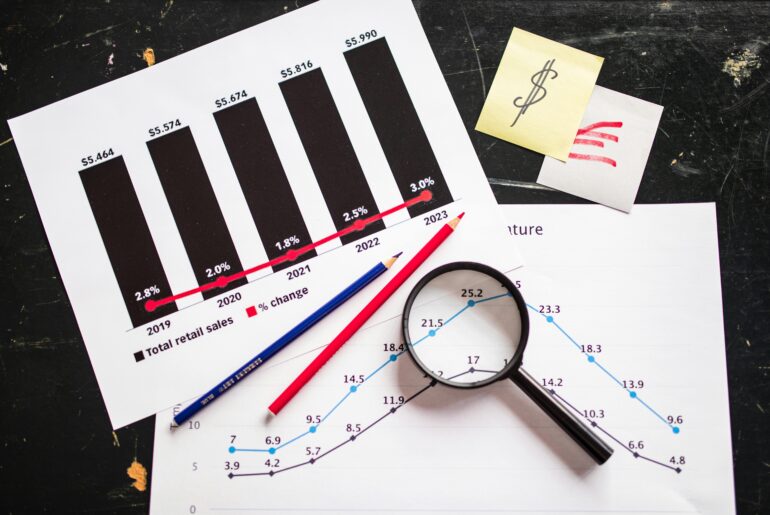

To make smart investment choices, you need to know what’s going on in the market right now. You can start by reading financial news sites and reputable websites that look at how the market is moving, what economic indicators are saying, and how different sectors are doing. Keeping up with these sources will help you understand what’s going on around the world and get ready for possible changes in the market that could affect your investments.

Consider using the following resources to enhance your knowledge:

- Financial News Websites: Regularly browse sites like Bloomberg, CNBC, or Reuters for up-to-date data.

- Investment Podcasts: Listen to experts discuss trends and strategies in a conversational format.

- Webinars and Online Courses: Enroll in free or low-cost programs offered by financial institutions covering market basics and advanced topics.

You may also find it helpful to create a simple table to track key market indicators that interest you:

| Indicator | Last Value | Trend |

|---|---|---|

| S&P 500 | 4,500 | ↑ |

| NASDAQ | 15,000 | → |

| Dow Jones | 35,000 | ↓ |

Keeping this information current will help you understand the market and how it may affect your strategy. Knowledge is important; the more you know, the better you’ll be able to make smart investment decisions.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Diversify Your Portfolio Strategically

If you want to stay strong in different market conditions, you need to take a broad view of how to allocate your assets. A well-diversified portfolio can help you manage the risks and rewards of investing by spreading your money across different asset classes, sectors, and regions.

Don’t put all your money in one place. Consider incorporating a mix of stocks, bonds, ETFs, real estate, and even alternative assets if they align with your strategy. Diversifying your portfolio helps it survive downturns and thrive long- term.

Create a Consistent Investment Plan

Creating a consistent investment plan is essential for reaching your financial goals. It starts with understanding your unique circumstances. Begin by evaluating your current financial status, including your income, expenses, and existing investments. This information will serve as the foundation for crafting a plan that suits your needs. Consider establishing a budget to allocate funds toward your investment goals, ensuring you stay on track to grow your wealth over time.

After you have a good idea of your finances, make specific investment goals, like saving for retirement, a big purchase, or just an emergency fund. Set up a regular schedule for your contributions, such as once a month, once a quarter, or twice a year. This approach will help your investments grow all the time. This discipline helps you develop a beneficial habit and uses dollar-cost averaging, which helps reduce market volatility. Here’s a structure to consider for your investment plan:

| Investment Goal | Time Frame | Monthly Contribution |

|---|---|---|

| Retirement Fund | 30 Years | $500 |

| Emergency Fund | 5 Years | $200 |

| Home Purchase | 10 Years | $300 |

Stick to your plan and look over it at least once a year. This lets you change things as your goals and finances change. It’s important to stick with it, and it’s never too late to start or change your investments for a better financial future.

Stay Committed and Adjust as Needed

It’s important to stick to your investment plan, but it’s also important to know when to change it. It’s normal to run into problems along the way, but knowing when to make changes can help you get better results in the long run. Use the following strategies to maintain your momentum while staying adaptable:

- Regularly Review Your Goals: Assess your objectives periodically. Are they still relevant? If life circumstances change—such as a new job or growing family—update your goals accordingly.

- Stay Educated: Markets evolve, and so should your approach. Continue learning about new opportunities and trends through articles, webinars, and professional communities.

- Assess Risk Tolerance: Your comfort level with risk may change over time. Reevaluate your risk appetite and adjust your portfolio to reflect any new preferences or needs.

Consider setting a schedule for detailed portfolio reviews. This can help identify underperforming assets and determine whether your investments are aligned with your expectations.

| Action | Frequency |

|---|---|

| Portfolio Review | Quarterly |

| Risk Assessment | Annually |

| Financial Goal Check | Every 6 Months |

Don’t hesitate to seek advice when needed. Insights from financial advisors or trusted peers can offer fresh perspectives and reinforce your confidence in staying on track.

Frequently Asked Questions

What should I do first if I’ve fallen behind in my investing plan?

Start by assessing your current financial situation and reviewing your goals. Reflect on why you feel off track—whether due to market fluctuations, personal events, or time constraints and use that insight to create a more realistic plan moving forward.

How can I regain focus on my investment goals?

Revisit your goals regularly. Write them down in specific, measurable terms and visualize where you want to be. Setting smaller, short-term targets can make long-term goals feel more achievable.

Should I adjust my investment strategy?

Evaluate your current strategy to ensure it aligns with your goals and risk tolerance. If your circumstances have changed, consider adjusting your asset allocation or exploring new investment vehicles.

What role does education play in getting back on track?

Knowledge is vital. Educate yourself about market trends, asset classes, and risk management. Read books, attend workshops, or follow trusted financial sources to improve your confidence and decision-making.

How can I stay disciplined in my investing practice?

Consider developing a structured plan that includes regular contributions, even if they are modest. Automating your investments can help maintain discipline and ensure consistency regardless of market conditions.

What should I do if I’m feeling overwhelmed by the current market?

It’s normal to feel overwhelmed, especially during volatile periods. Please focus on the long term and adhere to your strategy. If needed, take a step back and avoid making impulsive decisions. Seek support from a financial advisor or community to regain clarity.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 6 Smart Tips to Restart Your Investment Plan, No Matter Your Budget

https://fangwallet.com/2025/06/04/6-tips-to-restart-your-investment-plan/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.