This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

- How to Reopen a Closed Bank Account Due to Inactivity

- Why Banks Close Accounts for Inactivity

- Can You Reopen a Bank Account Closed for Inactivity?

- Steps to Reopen a Closed Bank Account

- Considerations Before Reopening

- What to Prepare Before Contacting the Bank

- Common Obstacles to Reopening

- Choosing the Right Account Going Forward

- How to Keep a Bank Account Active

- Final Thoughts

- Frequently Asked Questions

- Recommended Reads

How to Reopen a Closed Bank Account Due to Inactivity

If the bank closed your account due to inactivity, you may still have options. Whether you forgot about the account, took a break from banking, or didn’t meet your bank’s activity requirements, it’s often possible to reopen it. This guide explains why banks close inactive accounts, how to reopen yours, and what to prepare before contacting your financial institution.

Why Banks Close Accounts for Inactivity

Banks monitor accounts that haven’t had any deposits, withdrawals, or other activity over time. If your account remains idle for 6 to 12 months, the bank may label it as “dormant” and eventually close it. This practice is often driven by internal policy and financial regulations. Here’s what typically happens when your account is closed due to inactivity:

- Loss of Access to Funds: Once closed, you won’t be able to access the funds in your account directly. You’ll need to contact the bank to recover any remaining balance.

- Dormancy Fees: Some banks charge monthly inactivity fees before closing the account.

- Impact on Banking Relationship: Losing an account may affect your eligibility for special offers, overdraft protection, or loyalty programs.

Understanding the reason behind the closure, whether it was due to inactivity, overdraft issues, or suspected fraud, can help you take the right steps toward resolution.

Can You Reopen a Bank Account Closed for Inactivity?

In many cases, yes. However, whether you can reopen the account depends on the bank’s policies, how long ago it was closed, and the status of the funds.

| Bank Scenario | Reopening Method | Estimated Timeframe |

|---|---|---|

| Same bank, recently closed | Call customer service | Instant to 2 days |

| Funds escheated to the state | Submit a reclaim request | Varies by state laws |

| Closed beyond bank’s retention period | Open a new account | 1–2 weeks |

Promptness, such as reaching out to the bank soon after the closure, improves your chances of recovery.

Steps to Reopen a Closed Bank Account

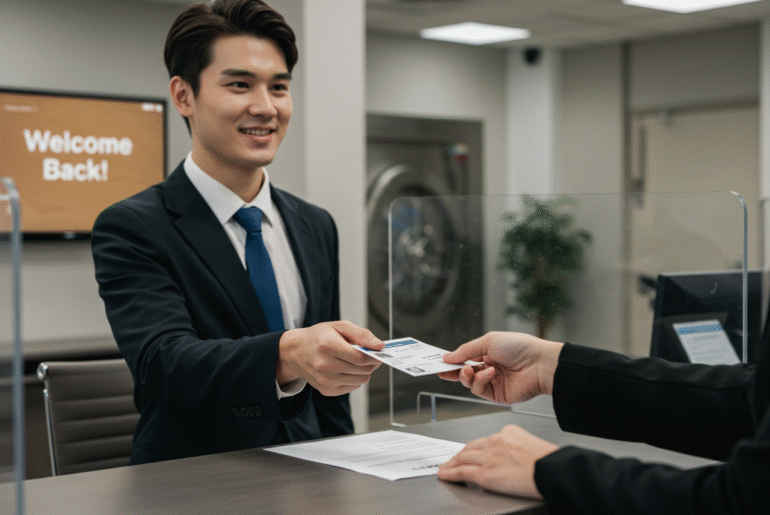

If your bank allows account reactivation, follow these steps:

- Contact Customer Service Promptly Ask about their process for reopening inactive or closed accounts.

- Verify Your Identity Be prepared to provide a valid government-issued ID, your Social Security number, and old account details.

- Request an Account Review Some banks may evaluate your prior account usage or history before reactivation.

- Address Any Outstanding Requirements If your account had a zero balance or if funds were transferred to the state, you’ll need to resolve those issues first.

- Make a Minimum Deposit (if required) Your bank may ask you to fund the account with a minimum balance before reopening it.

- Agree to Updated Terms Review and sign any new agreements, as the account terms may have changed since your closure.

Considerations Before Reopening

Before moving forward, consider the following questions:

- How long has the account been closed? If it’s been less than a year, reopening is often straightforward.

- Were the funds sent to the state? If so, check with your state’s unclaimed property office to start the recovery process.

- Is reopening better than opening a new account? Starting fresh might offer better features or fewer fees.

What to Prepare Before Contacting the Bank

Gather the following documents and information to avoid delays:

| Item | Purpose |

|---|---|

| Valid government ID | Confirms your identity |

| Social Security number | Required for account lookup |

| Old account number | Speeds up record retrieval |

| Proof of address | May be needed for identity verification |

Common Obstacles to Reopening

Be aware of these potential hurdles:

- Account Purged from Records: If the account has been closed too long, your records may no longer exist in the system.

- Funds Sent to State: You’ll need to file a claim through your state’s unclaimed property office to retrieve any lost money.

- Identity Verification Changes: If your name, address, or other information has changed, additional verification may be required.

Address these issues early to avoid unnecessary delays.

Choosing the Right Account Going Forward

If reopening isn’t possible or ideal, consider your options carefully:

- Decide on Account Type: Choose between checking, savings, or a hybrid account based on your needs.

- Look for Dormancy-Friendly Policies: Some banks notify you before closing for inactivity or offer extended grace periods.

- Compare Features: Consider banks with no or low fees, robust mobile apps, overdraft protection, and interest-bearing options.

- Evaluate Customer Support: A responsive bank can help you better manage your finances over time.

How to Keep a Bank Account Active

Avoid future closures with these tips:

- Make regular transactions (even small ones)

- Set up direct deposit or auto-pay for bills

- Monitor your balance to avoid overdrafts

- Use online and mobile banking tools to stay engaged

Final Thoughts

Reopening a closed bank account is often possible, especially if you act quickly and meet the bank’s requirements. Whether you decide to reactivate your old account or initiate a new one, utilize this opportunity to select the appropriate account and ensure consistent activity. Staying informed and organized ensures your banking remains smooth and stress-free in the future.

Frequently Asked Questions

Can I reopen a bank account closed due to inactivity?

Yes, but it depends on the bank’s rules and how long the account has been closed.

What should I do first?

Contact customer service or visit a branch to ask about their reopening process.

Will I need to provide documents?

Yes, bring a valid ID, your Social Security number, and, if possible, your old account number.

What if my money was sent to the state?

Check your state’s unclaimed property site and follow the process to reclaim your funds.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the comment form below for feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Reopening a Bank Account Closed Due to Inactivity

https://fangwallet.com/2025/06/07/reopening-a-bank-account-closed-due-to-inactivity/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.