This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Highlights

- Pay-per-mile car insurance offers savings for drivers who don’t use their vehicles frequently.

- SmartMiles tracks mileage using a device or mobile app to ensure accurate billing.

- Combines a flat base fee with a per-mile rate, allowing monthly payments to reflect actual use.

- Ideal for retirees, remote workers, or infrequent drivers.

- Comparing SmartMiles with standard policies can help determine the most cost-effective choice.

Introduction

Have you ever asked yourself if you pay too much for car insurance? Pay-per-mile auto insurance charges you based on how much you drive. You only pay for what you use. A program called SmartMiles is one of these new ways to cover your car. This program can help people who do not drive many miles save money on their auto insurance. It may be good for people who are retired, work from home, or have clear driving habits. If you are in one of these groups, this could be just right for you. Let’s see how SmartMiles works and why it might be a better pick for your insurance.

Pay-Per-Mile Car Insurance Details

What Is Pay-Per-Mile Car Insurance

Pay-per-mile car insurance, sometimes called usage-based insurance, is a type of policy where you pay one base amount each month and then another small fee for every mile you drive. This way, you are not paying based on an average guess. With this plan, what you pay matches how much you actually drive.

This way is good for people who drive less. It is helpful for retirees or for people who work from home. For example, if you do not drive much each day or often take public transportation, this plan gives fair prices.

Even though pricing depends on how much you drive, the coverage you get is still good. You still have liability, collision, and other types of protection, just like you would with regular insurance. It is a good way to make sure that what you pay matches how you drive in real life.

How Is It Different From Traditional Car Insurance

Pay-per-mile car insurance is not like regular car insurance. It changes the price depending on how far you drive. With standard plans, there is a set cost each month. They use things like your age or driving record to set it, but not how many miles you go. Pay-per-mile insurance is more flexible with prices. It gives you a way to pay for just what you use.

Comparison Table

| Traditional Car Insurance | Pay-Per-Mile Car Insurance |

|---|---|

| Flat premiums based on risk factors | Monthly base rate + per-mile charge |

| Higher cost for high-risk profiles | Lower cost for low-mileage drivers |

| Suited for daily commuters | Ideal for infrequent drivers and retirees |

Pay-per-mile policies are for people who do not drive a lot. These give a way to save money if you drive less. This is a good choice for those who have a low-mileage life.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Introduction to SmartMiles

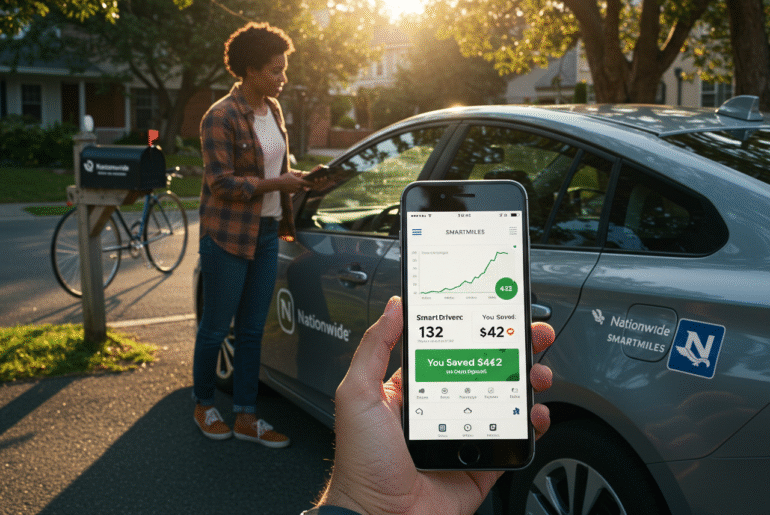

SmartMiles by Nationwide is an insurance plan for people who do not drive much. It is a program that uses a special device or phone app to follow how you drive. The way you drive and the miles you go help decide what you pay. This is good if you want to save money and do not drive a lot.

This program is made to give good coverage at a lower price for people who do not drive a lot. It is great for you if you take short road trips or if you only drive now and then. With SmartMiles, you get flexibility and can save money.

Who Offers SmartMiles and How Does It Work

Nationwide has SmartMiles, which is a pay-as-you-go insurance plan. You use a plug-in device or an app with it. This will track the miles you drive and how you drive.

Policyholders have a base rate to pay every month. They also pay a fee for each mile they drive. This way, people can manage what they spend on insurance by how much they use their car. If they take a long drive now and then, their rate does not go up by much.

You can get discounts for safe driving. This makes the program cost even less. The app lets you see each trip, keep an eye on your costs, and track your habits as you go.

Features and Benefits of SmartMiles

- Monthly Payment Plan: Your payment each month will go up or down depending on how many miles you drive.

- Safe Driver Savings: You can get up to 10% off when you drive safely.

- Wide Coverage: It has options for liability, collision, and extra full coverage if you want it.

- Easy-to-Use Tools: You can watch your driving and see your costs with an app or a device in your car.

- Money-Saving Option: This is a good choice for people who work from home, those who have retired, or people who drive less each year.

SmartMiles Starter Guide

Starting with SmartMiles is easy. This program caters to individuals who drive infrequently. It uses special tools to keep track of how you drive.

Whether you are moving from a regular plan or looking for a cheaper way to save, SmartMiles helps you get started in a simple way. Here is how you do it.

What You’ll Need to Start With SmartMiles

- Photo of Your Odometer: A photo helps to check how many miles you have driven.

- Mobile App Access: Download Nationwide’s app to track your driving and view bills.

- Personal Information: You need to give your ZIP code, details about your car, and how you drive.

- Telematics Device: You may have to use a plug-in device from the insurer for real-time tracking.

These tools help make setup quick and easy. They also help you see and handle your insurance in a clear and simple way.

Determine If Pay-Per-Mile Is Right for You

To see if this kind of policy is right for you, think about how much and how far you drive. If you are retired, work at home, or drive less than 10,000 miles each year, SmartMiles can help you lower your payments.

Compare the price of normal policies with SmartMiles by using your average miles. If SmartMiles gives better value, then it’s the right next step.

Get a Quote and Sign Up for SmartMiles

First, ask Nationwide for a quote that is made for you. You will need to give your ZIP code, your car’s details, and about how many miles you drive. After this is all set, you will get a kit for setup and a telematics device.

The app and device team up to follow your driving and handle billing by themselves. This means you only pay for what you use. There are no surprises.

Final Thoughts

Pay-per-mile car insurance from SmartMiles gives you an easy and affordable way to take care of your auto coverage. With SmartMiles, what you pay is based on the real miles you drive. This plan lets you make good choices with your money. It fits the way people drive today. If you drive less, you still get full coverage for your car. You will not end up paying too much.

If you want to get a grip on your car insurance, get a free SmartMiles quote today. See how much you can save.

Frequently Asked Questions

Who should consider using SmartMiles?

SmartMiles works well for retirees, remote workers, students, and people who drive less than 10,000 miles in a year. It is good for those who want a low-cost insurance plan that fits the way they drive. SmartMiles gives people an option to get coverage that matches how much they use their car.

How does SmartMiles track my miles?

SmartMiles keeps track of the miles you drive with a telematics device or the Nationwide app. Sometimes you can also take photos of your car’s odometer to be used for this.

Can I save money with SmartMiles if I work from home?

Yes, you can. If you work from home, you use your car less. You drive fewer miles, and that means your insurance cost with SmartMiles will go down.

What happens if I drive more miles than expected?

There is no fee. You just pay for the extra miles you use at your per-mile rate. This is on top of your base monthly rate.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Pay-Per-Mile Car Insurance with SmartMiles

https://fangwallet.com/2025/06/11/pay-per-mile-car-insurance/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.