This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Most people worry about putting money into gambling apps. Makes sense – it’s your hard-earned cash on some app you downloaded five minutes ago.

But here’s what the fearmongers won’t tell you – modern iGaming apps protect your money way better than most banks did 10 years ago. Let me show you exactly how.

How Military-Grade Encryption Keeps Hackers Out

When you deposit $100 into an iGaming app, it doesn’t just sit there waiting to get stolen. The app instantly wraps your data in 256-bit SSL encryption – the same protection the Pentagon uses for classified documents.

Here’s what that means in plain English. Your data gets scrambled into 1.1 x 10^77 possible combinations. To crack it, a hacker would need every computer on Earth working together for millions of years. They’d have better luck guessing every lottery number for the next century.

The protection runs deeper. These apps use the TLS 1.3 protocol, which changes the encryption keys every few seconds. Imagine a door that automatically gets a new lock while you’re walking through it. Even if hackers grab your data mid-transfer, they get useless gibberish.

Banks took 20 years to get mobile security right. iGaming apps had to nail it from day one – nobody trusts a sketchy app with their money. Such pressure created something unexpected – gambling apps with better security than your banking app.

AI That Catches Cheaters Before They Get to Cash Out

The real turn occurred in 2024 when operators started using AI that actually works. These systems now catch 50% more fraud than two years ago. We’re not talking about simple filters – this AI learns faster than scammers can adapt.

Real money poker apps show this best. Most of them can process millions of hands daily, and AI watches every single one. The system knows your playing style better than you do. How long you think before placing your bets. What stakes you prefer. Even how you move your mouse. So, when someone hijacks an account or uses a bot, the AI spots it instantly.

Last year, GGPoker’s AI caught a sophisticated bot ring in 48 hours. But these weren’t some amateur bots – they varied their play, changed timing, and acted human. Yet the AI noticed tiny patterns no person would spot. Result: 127 accounts banned, $1.2 million returned to real players.

The numbers prove it works. Fraud jumped 25% industry-wide from the previous year, but platforms using advanced AI cut their fraud by 40%. These systems analyze billions of data points each day – login locations, device fingerprints, betting patterns, even typing speed.

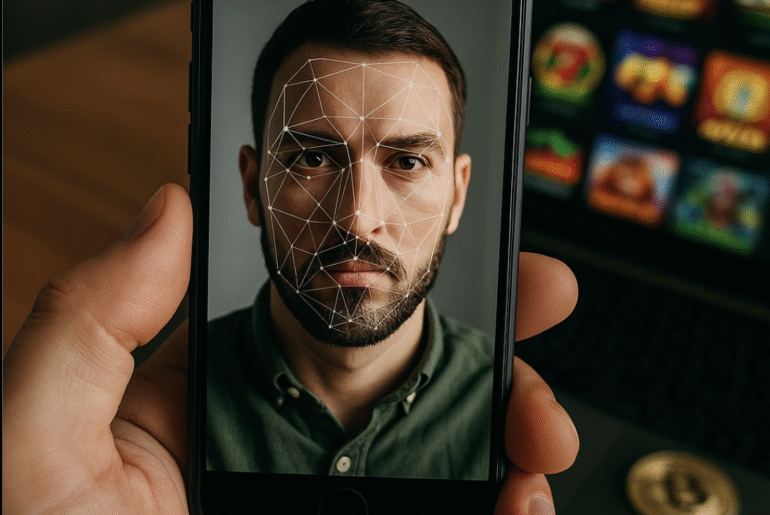

Why Your Face Is the Best Password

Passwords are dead. “Password123!” won’t protect anything anymore. Smart iGaming apps now use your face or fingerprint instead – and it’s nearly impossible to beat.

Modern facial recognition doesn’t fall for photos or videos. The tech uses 3D mapping and checks if you’re actually alive and breathing. Some apps even detect deepfakes. Your fingerprint is stored as a math equation, not an image. Useless to hackers even if they steal it.

The results speak volumes. Apps using biometrics see 73% fewer account takeovers. Makes sense – hackers can steal passwords from data breaches, but they can’t steal your face from across the internet.

Two-factor authentication brings extra safety. You know the drill – password plus phone code. But innovative apps go further with behavioral biometrics. They learn how you hold your phone, your typing rhythm, even the angle you prefer. It’s like having a bouncer who recognizes not just your face but your walk.

Blockchain IS the Unhackable Ledger

By 2025, every bigger iGaming platform will accept crypto. But it isn’t about being trendy – it’s a real security traditional banks can’t match.

Crypto deposits eliminate the middleman. No bank database to hack. No credit card numbers floating around. Just direct wallet-to-platform transfers – the blockchain records everything permanently but anonymously.

There are certain platforms that run everything on crypto, even their random number generator lives on the blockchain. Players can verify that every card dealt was truly random. Physical casinos can’t deliver such transparency.

Speed is important as well – but bank withdrawals take 3-5 days. What about crypto though? Usually under an hour. Less time for problems, less chance for fraud. One platform cut fraud attempts by 67% after moving to crypto-primary operations.

What Those Regulations Should Do

Nobody loves regulations, but they’re why you can trust licensed apps. Getting a gaming license is like getting security clearance – intense scrutiny, ongoing monitoring, severe consequences for violations.

The UK Gambling Commission requires operators to keep player funds separate from company money. But if the platform goes bust, your money stays safe. Malta demands operators hold 125% of player deposits in reserve. So, these aren’t suggestions – violations mean million-dollar fines and license loss.

The average security breach costs gambling companies $4 million. Losing a license? That kills the business. Such restrictions motivate casinos to follow rules and protect players.

Independent labs such as eCOGRA audit everything all the time. Game fairness, security protocols, and financial reserves – all checked regularly. Players can verify these certifications anytime, usually via a link in the app footer.

Leading operators spend $10-20 million yearly on cybersecurity. They also employ 50-100 security professionals. So, is it expensive? Yes. But the US online gambling market hit over $102 billion by 2025. One breach costs more than a decade of security investment.

Such investment shows impressive results. Advanced facial recognition catches 95% of identity fraud attempts. AI-powered monitoring flags money laundering within minutes, not days. Device fingerprinting stops multi-account fraud cold.

The threats keep getting new shapes. Deepfake attempts grew 10x from 2022 to 2023. Physical attacks where criminals literally watch over the shoulders surged in 2024.

But detection improves faster. New tools spot AI-generated faces with 99.7% accuracy. Behavioral analysis knows when someone’s not acting like themselves.

Every feature serves a purpose. Geolocation ensures legal play. Transaction monitoring prevents money laundering. Together, they make an invisible shield protecting honest players 24/7. So yes, our money is safer than you think.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the comment form below for feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: The Truth About iGaming App Security: Your Money Is Safer Than You Think

https://fangwallet.com/2025/06/15/the-truth-about-igaming-app-security/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.