This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

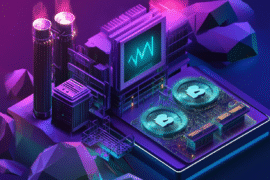

Billions in crypto are lost yearly to hacks and scams; cold wallets offer a better way to protect your assets. If you’re storing digital assets for the long haul, using a cold storage method could be your smartest move. But what exactly is a cold wallet, and how does it work?

A cold crypto wallet is often the best choice if you’re serious about security. It keeps your private keys offline, significantly reducing your risk of online attacks. In this guide, you’ll learn what a cold wallet is, why it’s one of the most secure storage options, and how to choose the right one for your needs.

What is a Crypto Wallet?

A crypto wallet isn’t like a physical wallet that holds cash. Instead, it manages your private and public keys, the cryptographic codes that give you access to your cryptocurrencies and let you send or receive transactions.

There are several types of wallets, including:

- Hot wallets: connected to the internet (e.g., mobile apps, browser extensions)

- Cold wallets: stored offline for maximum security

- Custodial wallets: held by third parties like exchanges

- Non-custodial wallets: fully controlled by the user

What is a Cold Wallet in Crypto?

A cold wallet is a type of crypto wallet that stores your private keys completely offline. Unlike hot wallets that are always connected to the internet, cold wallets have no online connectivity, making them extremely resistant to hacking.

Types of Cold Wallets:

- Hardware wallets: Physical devices like Tangem, Ledger, and Trezor

- Paper wallets: Printed QR codes or keys on paper

- Air-gapped devices: Computers or phones permanently disconnected from the internet

Cold wallets have several essential characteristics that make them popular for securing cryptocurrencies. First, they allow you to have physical control over your assets, meaning you can store your digital currencies in a way only you can access.

This added layer of security protects your funds from online threats. Secondly, cold wallets provide enhanced protection for your crypto, as they are not connected to the internet and therefore less susceptible to hacking and other cyberattacks.

Lastly, the reduced attack surface means there are fewer points of vulnerability compared to online wallets, making your assets safer. In simple terms, you can think of it as your safe or vault, explicitly designed for storing cryptocurrencies securely.

Why Use a Cold Wallet? Advantages

Cold wallets are popular among serious investors for good reason:

- Long-term safety: Ideal for HODLing assets for months or years

Immune to online threats: Not vulnerable to malware or phishing

Perfect for large portfolios: Especially for institutional or high-net-worth users

In short, if your goal is maximum protection, cold wallets offer cold storage crypto at its most secure.

When Does a Cold Wallet Make Sense?

Cold wallets shine in scenarios that require high security and infrequent access:

- Institutional investors or long-term holders who are looking to store large amounts safely.

- Cold storage strategies for minimizing exposure to internet threats.

- Offline backups for inheritance or disaster recovery planning

If you want a secure and straightforward cold crypto wallet, Tangem offers a hardware solution that fits in your pocket; no cables, no charging, just secure storage on the go.

Cold Wallet vs Hot Wallet [Comparison]

Here’s how cold and hot wallets compare across key categories:

| Feature | Hot Wallet | Cold Wallet |

| Accessibility | High — instant access | Low — requires physical access |

| Security | Vulnerable to hacks | Immune to online threats |

| Cost | Often free | Hardware costs vary |

| Setup/Maintenance | Easy, but riskier | Takes effort, safer long-term |

Are Cold Wallets Safe? [Risks & Best Practices]

Cold wallets are extremely secure, but not foolproof. Common risks include:

- Loss or damage to the device or seed phrase

- Misplacing a paper wallet or backup

- Physical theft if not stored securely

Best practices include storing backups in separate locations, using tamper-proof seals, and choosing wallets that offer backup recovery features.

How to Choose the Right Cold Wallet

Consider the following factors when selecting a cold wallet:

- Brand reputation and reviews

- User-friendliness

- Seed phrase management or backup recovery options

- Size and form factor (card, USB, etc.)

Top choices include:

1. Tangem Wallet

Tangem is a convenient hardware wallet designed in a credit card style, making it easy to carry around. It also integrates with a mobile app, allowing users to manage their cryptocurrencies efficiently on their smartphones.

2. Trezor

Trezor offers a user-friendly experience with its simple interface, making it accessible to both beginners and experienced users. It is built with open-source firmware, allowing for transparency and flexibility in how the wallet operates and can be customized.

Can You Use Both? Hybrid Wallet Strategy

Absolutely! Many users opt for a hybrid wallet setup. This approach allows you to use a cold wallet to securely store your cryptocurrency and a hot wallet to conduct day-to-day transactions. A cold wallet is like a safe that keeps your digital assets offline and secure, while a hot wallet is more like a checking account that you can easily access for quick purchases or trades.

Benefits of a hybrid wallet strategy include:

- Flexibility: Move funds only when needed

- Security: Keeps long-term assets protected

Common Misconceptions About Cold Wallets

Let’s take some time to clear up a few common misconceptions about cryptocurrency wallets:

- Cold wallets are not indestructible: While they provide heightened security for your cryptocurrency, they still require careful handling. It is essential to protect them from physical damage, such as drops or exposure to extreme temperatures.

- You don’t need to be a cryptocurrency expert to use a cold wallet: Many user-friendly options exist, such as Tangem. These wallets are designed to simplify the cryptocurrency management process, making it accessible for everyone, even those with limited technical knowledge.

- Not all hardware wallets are created equal: A wide variety of hardware wallets are available on the market, and they can differ significantly in terms of features and security protocols.

Overall, being aware of these aspects will enable you to navigate the world of cryptocurrency with greater confidence and security.

Is a Cold Wallet Right for You?

If you prioritize security more than convenience when it comes to storing your cryptocurrency, a cold wallet is the best option for you. Cold wallets keep your digital assets offline, which makes them more secure from hacking attempts and other online threats. This type of storage is ideal for individuals who wish to hold their investments long-term, often referred to as HODLing.

On the other hand, if you engage in frequent trading or need quick access to your funds, a hot wallet might be more suitable. Hot wallets are connected to the internet, which allows for easy and rapid transactions, but this accessibility also comes with increased risks, such as vulnerability to cyberattacks.

TL;DR

- Cold Wallet: Very secure, offline storage for long-term holding (HODL).

- Hot Wallet: Convenient, internet-connected storage, suitable for active trading, but riskier.

Ultimately, you should choose the type of wallet that aligns with your trading goals and habits. Alternatively, you could opt for a hybrid approach, using two kinds of wallets to benefit from the security of cold storage and the convenience of a hot wallet, depending on your needs at any given time.

FAQ: What You Need to Know

What is a cold wallet in crypto?

A cold wallet is an offline crypto storage device or method that protects your private keys from online threats.

Is a cold wallet better than a hot wallet?

It depends. For long-term safety and large amounts, yes. For frequent use, hot wallets offer convenience.

Can you access a cold wallet without internet?

Yes. In fact, the lack of internet is what makes it secure for signing transactions. You’ll need to connect it to a device only when you need to sign transactions.

What are the safest crypto wallets?

Tangem, Ledger, and Trezor are some of the most trusted hardware wallets available.

Is Tangem a cold wallet?

Yes. Tangem is a cold hardware wallet that stores your private keys offline and offers mobile app support for ease of use.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the comment form below for feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Why is a Cold Wallet Important?

https://fangwallet.com/2025/06/18/why-is-a-cold-wallet-important/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.