This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Apple Pay and Apple Cash Limits

- Daily and Weekly Limits for Sending

- Maximum Apple Cash Balance

- Limits for Apple Cash Family Accounts

- Sending Limits for Minors

- Parental Controls for Family Accounts

- Requirements for Sending the Maximum Amount

- Identity Verification Process

- Supported Devices and Payment Sources

- How to Send Money Using Apple Pay

- What You Need Before Sending

- Steps to Send Money with Apple Cash

- Final Thought

- Frequently Asked Questions

- Recommended Reads

Apple Pay and Apple Cash Limits

Apple Pay works together with Apple Cash. This lets you send money right away. Your Apple Cash and debit card have set limits. These depend on the money you have. Green Dot Bank makes rules that you need to follow for these transactions. These rules help keep things safe and follow all the needed steps.

To send money, you need to have enough money in your Apple Cash card or you have to link it to a debit card that can be used. These steps help keep your money safe and make sending cash easy. Now, let’s talk about the daily and weekly limits for sending money.

Daily and Weekly Limits for Sending

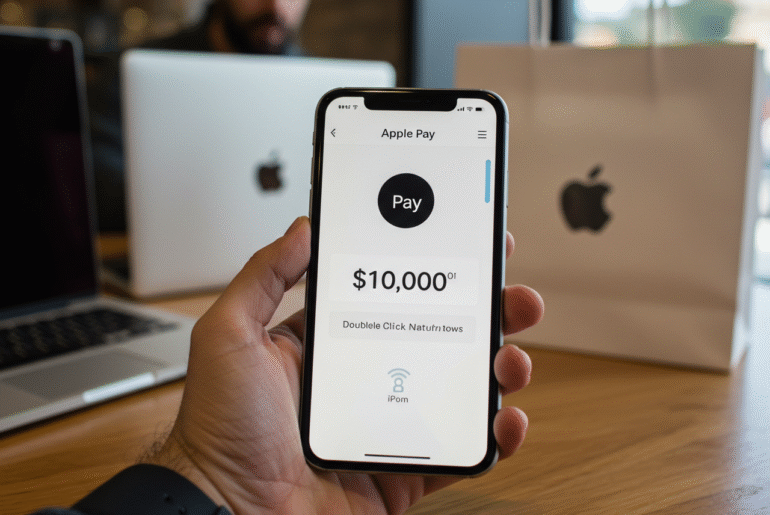

Apple Cash has set daily and weekly limits for sending money. People who are verified can send up to $10,000 at one time and up to $10,000 each week. Apple Cash Family accounts have lower limits to help keep young people safe. These accounts can send up to $2,000 at a time and $2,000 in a week.

Apple Cash Sending Limits:

| Category | Per Transfer Limit | Weekly Limit |

|---|---|---|

| Standard Apple Cash | $10,000 | $10,000 |

| Apple Cash Family | $2,000 | $2,000 |

| Tap-to-Cash Transactions | $2,000 | $2,000 |

These limits help manage how people make transactions and keep your account safe when using Apple Cash. With Apple Cash features, you get a reliable way to handle digital payments.

Maximum Apple Cash Balance

The highest amount of Apple Cash you can have depends on the type of account you use. If you are a verified user, you can keep up to $20,000. If you are in the Apple Cash Family group, you can have up to $4,000.

After your identity is verified, your balance may receive FDIC insurance, providing additional protection. Balance limits may change depending on laws or updated policies.

Limits for Apple Cash Family Accounts

Apple Cash Family accounts help parents manage money for their kids. A child can send or receive up to $2,000 each week. The family organizer supervises the account and sets usage limits.

These accounts support most Apple Cash features and include built-in safety controls. The goal is to help kids build smart money habits while staying secure.

Sending Limits for Minors

Minors using Apple Cash Family accounts can send or receive up to $2,000 per transaction and per week.

Security depends on the family organizer’s setup. Organizers can monitor the account, approve payments, and view a history of transactions. Children cannot use credit or debit card features, which prevents unauthorized spending.

Parental Controls for Family Accounts

Parental controls are critical for Apple Cash Family accounts. Through Family Sharing, parents or guardians can enforce safe money practices.

Features Include:

- Payment approval required through linked phone numbers.

- Activity alerts sent at scheduled times.

- Transaction security checks before sending money.

Apple Cash sends notifications to organizers to help monitor activity and spending limits.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Requirements for Sending the Maximum Amount

To send the maximum amount, you must use a compatible Apple device running the latest iOS version. A supported debit card must be added to your Wallet app.

Whether on iPhone or Apple Watch, you need to meet certain Apple requirements, including verifying your identity.

Identity Verification Process

Apple requires identity verification to unlock higher limits. You’ll need to confirm your identity using Face ID or Touch ID and submit requested personal details.

Verification ensures compliance with Green Dot Bank rules and enables FDIC insurance protection. Once verified, all Apple Cash features are accessible.

Supported Devices and Payment Sources

To use Apple Cash, you must have a supported device and payment source with the latest software. Eligible options include

- Physical and virtual debit cards issued by approved U.S. banks.

- The Apple Card.

- Any U.S.-issued debit card that can be added to the Wallet app.

These requirements ensure system compatibility and secure transactions.

How to Send Money Using Apple Pay

You can send money using the Wallet app or Messages app. Transfers are usually funded from your Apple Cash balance.

Apple Payment Services LLC supports transfers and is designed to be user-friendly. Whether paying a friend or for a service, the process is quick and reliable.

What You Need Before Sending

Before sending money, ensure:

- You have an active Apple Cash balance or a linked debit card.

- Auto-reload is optional but helps prevent failed transactions.

- You have enough funds to cover the payment.

Apple’s platform ensures all systems are ready for smooth transactions.

Steps to Send Money with Apple Cash

To send money using Apple Cash:

- Open the Wallet app or the Messages app.

- Enter the amount you want to send.

- Review and confirm the transaction, then tap Send.

Funds can come from your Apple Cash balance or a linked debit card.

Open the Wallet or Messages App

Launch the Wallet app to access Apple Cash, or use Messages for peer-to-peer transfers. Ensure your device is supported and properly configured.

In Wallet, select Apple Cash to begin. In Messages, tap the Apple Cash button to send a payment.

Enter Recipient Information and Amount

Enter the recipient’s phone number or Apple ID. Make sure the amount complies with your balance and Apple’s limits.

If using Instant Transfer, note that a fee is charged based on the amount. Review your transaction before sending to ensure accuracy.

Final Thought

Apple Pay makes sending money simple and secure, but understanding the limits is important. Verified users can send and receive up to $10,000 per transaction and per week, while Apple Cash Family accounts have a $2,000 cap. Account balance limits also vary: $20,000 for verified users and $4,000 for family accounts. To access maximum limits, identity verification and a supported device are required. For families, parental controls add an extra layer of oversight and safety, ensuring a responsible and protected digital payment experience.

Frequently Asked Questions

What is the maximum amount you can send with Apple Cash?

Verified Apple Cash users can send up to $10,000 per transaction and $10,000 per week. Apple Cash Family users are limited to $2,000 per transaction and $2,000 per week for safety and parental oversight.

How much money can I keep in my Apple Cash account?

The maximum Apple Cash balance for verified users is $20,000. For Apple Cash Family accounts, the limit is $4,000. These limits help manage digital funds securely and may be adjusted by Green Dot Bank based on policy updates.

What do I need to send the maximum amount with Apple Pay?

To send the maximum amount, you must verify your identity, use a supported Apple device with the latest iOS, and link a valid U.S.-issued debit card. These steps unlock higher limits and FDIC insurance coverage.

Can minors use Apple Cash, and what are their limits?

Yes, minors can use Apple Cash Family accounts, managed by a parent or guardian. They can send or receive up to $2,000 per transaction and per week, with parental controls enabled for approval, alerts, and spending history.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: What’s the Max You Can Send on Apple Pay?

https://fangwallet.com/2025/06/21/apple-pay/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.