This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Cash advance apps have become an increasingly popular tool for individuals looking to access a portion of their paycheck ahead of time. These platforms offer an alternative to high-interest payday loans, presenting themselves as more user-friendly and financially responsible solutions. But as with any financial tool, it’s important to understand how they operate, their pros and cons, and what to be cautious of before relying on them regularly.

How Cash Advance Apps Work

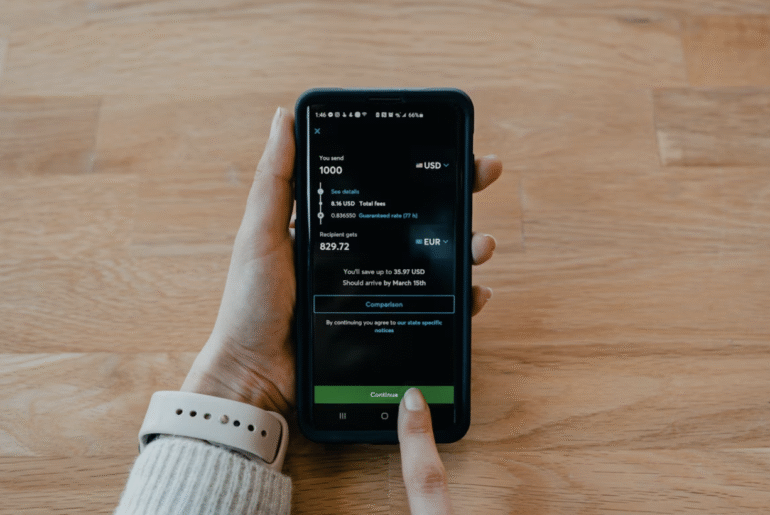

At their core, cash advance apps give users early access to wages they’ve already earned. After setting up an account and linking a bank, users can request a portion of their expected paycheck. The app then automatically withdraws that amount from their account on payday to recover the advance.

Unlike traditional loans, these services often avoid charging interest. Instead, they use a mix of subscription fees, optional tips, and express delivery charges as their revenue model. Because they don’t perform hard credit checks, they’re especially appealing to individuals with limited or no credit history. However, the absence of interest doesn’t necessarily mean they’re free or low-cost.

Some apps require employment verification, while others determine eligibility based on transaction history. This automation means users can get approved in minutes, but it also limits personalization or appeal processes if something goes wrong.

The Appeal of Speed and Simplicity

What makes these apps so attractive is their near-instant delivery and seamless interface. Many platforms can send money to your account within hours, especially if you opt for expedited funding. This level of access can make a big difference when facing urgent needs like car repairs or medical bills.

The apps are also designed for maximum ease of use. With minimal setup, clear instructions, and friendly interfaces, even users unfamiliar with financial services can get started quickly. Some offer budgeting tools and reminders, helping users monitor their cash flow and avoid overdrafts.

In contrast to traditional payday lenders or personal loans, which may involve paperwork, credit evaluations, and branch visits, cash advance apps present a more intuitive and less intimidating process. The immediacy and user experience they deliver are key drivers of their rising popularity.

Where the Money Comes From

Funding mechanisms for these apps vary. Some are offered as employee benefits through payroll systems. Others, however, are fully independent and accessible to anyone with a qualifying income. A growing number of users now rely on direct-to-consumer cash advance apps, which do not involve employers at all. These apps connect directly to users’ bank accounts, evaluate income flow and patterns, and grant access based on internal scoring models.

Because these apps are not tied to a specific employer, users benefit from greater flexibility. They can use them across multiple jobs or side gigs, especially in freelance or gig-based roles. This freedom is especially valuable in today’s decentralized work environment.

However, these models come with their risks. Without employer data, apps rely on predictive analytics and algorithms to determine eligibility. This can result in inconsistencies in how much you’re allowed to borrow or whether you’re even approved at all, particularly if your income varies month to month.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Despite marketing themselves as low-cost or “fee-free,” most cash advance apps include charges that add up over time. Monthly subscriptions usually range between $1 and $10, and many platforms charge for expedited delivery, typically between $3 and $10 per transaction.

One of the more controversial aspects is tipping. While tips are optional, some apps pressure users into believing that tipping improves their chances of future approval or higher limits. These costs, while seemingly small, can be deceptive. A user who takes advances multiple times per month may end up spending $30 or more in service and tip fees alone.

The real problem lies in transparency. Many users don’t fully understand how much they’re spending until they add it up over several months. This lack of clear disclosure means the overall cost of borrowing could rival, or even exceed, some traditional short-term lending products.

Credit Score Impact and Repayment Risk

Most cash advance apps don’t report to credit bureaus, which means borrowing and repaying funds through these platforms has no direct impact on your credit score. For some users, this is a relief, especially those trying to avoid hard inquiries or who have had issues with credit in the past.

However, this also means responsible use won’t help build your credit. There’s no long-term benefit in terms of improving your financial profile. Worse, some apps automatically withdraw repayment on a fixed schedule. If your paycheck is delayed or smaller than expected, this auto-withdrawal could trigger overdrafts or cause other important bills to bounce.

Certain platforms allow users to adjust repayment dates or cancel upcoming debits, which can provide a much-needed buffer. But others lock users into rigid repayment plans with little room for error. Reading the terms and understanding repayment policies is crucial before relying on these services regularly.

User Privacy and Data Security

Using cash advance apps means granting access to sensitive financial data. Most apps require direct links to your primary checking account, enabling them to monitor deposits and withdrawals in real time. Reputable apps use encryption and two-factor authentication to protect user information, but not all apps are created equal.

Users should be aware of how their data is handled beyond basic security. Some platforms may share transaction data or behavioral patterns with third parties for marketing or analytics purposes. This can raise red flags if your financial habits are being sold or leveraged for advertising.

Reviewing privacy policies before signing up is a must. Apps that ask for access to additional data—such as GPS location, contacts, or texts—should be approached with caution. Choose services that limit data usage to what’s essential for providing core financial features.

Responsible Usage and Long-Term Habits

Cash advance apps should be treated as a short-term tool, not a financial lifestyle. They can help with emergencies, but consistent use may point to deeper budgeting or income stability issues. Understanding when and how to use them responsibly is essential for long-term financial health.

Setting personal guidelines, like limiting advances to once per month or using them only for unavoidable expenses, helps avoid dependency. Monitoring how much you spend on fees can also provide a reality check. It’s easy to justify one-off charges in the moment, but those small costs add up quickly.

Some apps now include savings features or financial education tools, which can help users transition from borrowing to building. Choosing platforms with these added benefits may lead to healthier financial behavior over time.

Cash advance apps offer unmatched convenience, but they’re not without pitfalls. From fees and data sharing to repayment risks and privacy concerns, users must evaluate these services with a critical eye. When used sparingly and strategically, they can help cover urgent needs without long-term harm. But overuse—or misunderstanding how they work—can turn a quick fix into a recurring burden.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Everything You Should Know About Using Cash Advance Apps

https://fangwallet.com/2025/07/16/everything-you-should-know-about-using-cash-advance-apps/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.