This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- When Can You Be Charged a Late Fee?

- Introduction

- Late Fees and How They Work

- What is a Late Fee?

- Why Do Businesses Charge Late Fees?

- Where Late Fees Commonly Apply

- Legal Rules for Charging Late Fees in the U.S.

- Avoiding Late Fees

- What You’ll Need to Start Avoiding Late Fees

- Payment Agreements and Deadlines

- How to Prevent Late Fees

- When Can You Be Charged a Late Fee?

- Frequently Asked Questions

- Recommended Reads

When Can You Be Charged a Late Fee?

- A late fee is an extra charge you get when you do not pay by the set date. This helps businesses deal with problems in their cash flow.

- Late fees often show up when people are late on credit card payments, bills for water or electricity, and rent.

- State laws tell people and businesses how to handle late fees. Every business must stick to the late payment rules that are written in the first contract.

- Payment reminders, other ways to pay, and knowing state laws can help you stay away from problems.

- Talking in advance with the people who give you the service and checking the contracts can help stop late fees that are not needed.

Introduction

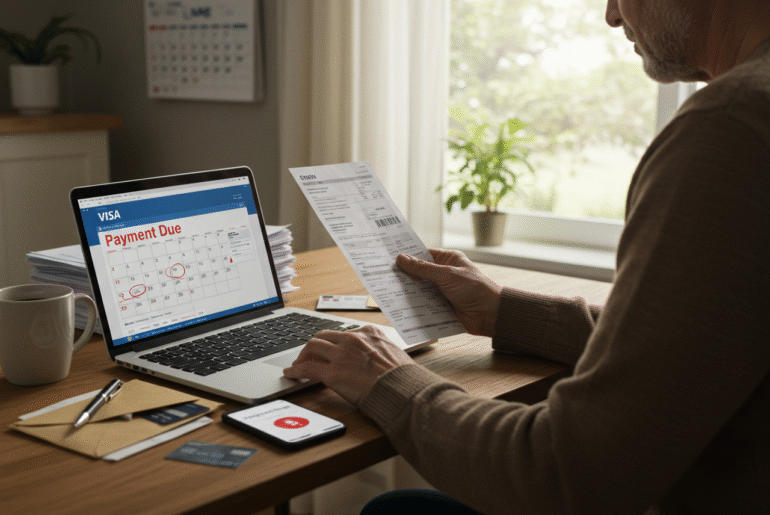

Late fees can catch you off guard, especially if you miss a payment date. A late fee is a charge that gets added to your balance when you don’t pay on time. The fee may seem small, but if you don’t pay, the costs can add up quickly. It’s important to understand when a late fee is applied, how it is calculated, and why paying on time matters. This blog shares real stories about late fees and explains what the law says, so you can manage your money and avoid extra charges.

Late Fees and How They Work

Late fees are more than just punishments. They help businesses receive payments on time. These fees can either be a part of what you owe or a fixed amount. You can find all the details about these charges in the payment terms of your agreement.

Understanding the rules for late fees can prevent unexpected charges. This is important if you pay a lender, your landlord, or a utility company. If you pay attention to your due dates and are aware of potential late fees, you can reduce your stress. Now, let’s take a closer look at how late fees work.

What is a Late Fee?

A late fee is an extra amount you pay if your payment is late. You have to pay this fee when you miss the due date. The extra money helps cover the issues or costs that the business faces when payments are delayed. For instance, if you have a credit card and don’t pay at least the minimum amount on time, the company may add a late fee to your balance.

Late fees are included in the payment terms of your agreement. You can find them in the first invoice or contract. A late fee can be a fixed amount or a percentage of what you still owe. This depends on the late fee policy you selected when you started using the service.

Understanding late payment fees is important for effective money management. You should review the late payment rules for your credit card or any other service you use. This can help you avoid extra charges and ensure you pay your bills on time.

Why Do Businesses Charge Late Fees?

Late fees help businesses keep their cash flow steady. When people pay late, businesses can have trouble paying their suppliers or workers. For small businesses, charging late payment fees helps people pay on time and makes it less hard to deal with unpaid bills.

Late fees help cover the time and work it takes to collect payments. This includes sending out reminders and following up on late bills. It also takes work to talk with customers about their payments.

In the end, charging late fees can make customers pay bills on time. This helps the business have steady money coming in. It also helps to stop problems the business may have if people pay late.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Where Late Fees Commonly Apply

Late fees can come from different money problems. If you pay your credit card, power bills, or rent late, you often have to pay more.

Banks and landlords need people to pay on time so their work keeps going well. A lot of agreements say you have to pay extra fees if you pay late. This shows why it is important to stay up to date with what you owe. Next, we will talk about how late fees can work with credit cards, utility bills, and rent.

Credit Card Payments

Credit cards usually charge late fees if you do not pay at least the minimum amount by the due date. This fee is not the same as the interest you pay on any money you still owe. If you do not deal with it, these fees can add up fast.

Credit card statements show the payment due date to let you know when to pay. They also list the late fee if you miss a payment. For example, a card company may charge you a $29 late fee if you pay after the due date. The fee can go up if you pay late again. These fees are there so that people pay on time.

To avoid paying late fees, you can set up automatic payments. You can also use reminders that tell you to pay before the due date. Make sure that the payment fits in your budget. This way, you are more likely to make payments on time and keep a good credit score.

Utility Bills and Rent

Paying your bills, like water, electricity, internet, and rent, on time is very important. If you do not pay them on time, there can be late fees. These charges might be a set amount or a part of what you owe. When you pay your rent late, the landlord can add extra fees after the grace period is over. This is done so people pay on time.

For example, if you pay rent late, your landlord can charge you a $50 fee. A company that gives you water or electricity might add a late fee the next business day if you do not pay on time. If you pay late many times, the fees can get bigger. This can make money problems worse.

Using payment reminders or paying bills early can help you keep up with payments. This can help you avoid extra costs and keep your money in good shape.

Legal Rules for Charging Late Fees in the U.S.

If you want to charge late fees in the U.S., you must follow certain legal rules. A business needs to inform people about these fees upfront. You should include the fee terms in an agreement or a bill. A person must read and accept it before the charge occurs.

Fee rules can vary from state to state. It’s important to check your state laws. Some states do not allow late fees at all. Others limit how much you can charge. In most places, there are rules to ensure the amount is fair and not excessively high.

If you do not comply with state laws, you might lose the fee or face penalties. To protect yourself, always provide clear rules about late fees, inform people in advance, and verify state laws before applying any charges.

When charging late fees in the United States, adhere to state laws. Communicate late fee rules in the initial contract. Ensure people see and understand the late fee policy. This helps prevent legal issues later on.

The Consumer Financial Protection Bureau (CFPB) regulates some aspects of late fees. However, there are also various rules from each state that significantly impact this. Below, we outline the main rules regarding late fees from both the federal government and states. We also indicate the highest late fees allowed in a few states.

Federal and State Laws About Late Fees

Federal and state laws can shape the way late fees are set. Even though there is no rule at the federal level that sets a limit for late fees in all states, there are rules for how companies talk about these fees. Federal law says the information about late payments should be easy to read and clear. The CFPB works to keep late fee rules fair for people.

State laws are not the same everywhere. Some states put a cap on interest rates or late fees. Other states have rules that give you a little extra time before you get charged a penalty. States like California and New York list what charges are ok and say that contracts must clearly show these details.

Businesses need to add late fee rules in the first agreements. This way, customers know about any extra charges they may have to pay. It is good to keep up with state rules. This helps you and your customers stay clear of legal trouble and maintain trust with each other.

Maximum Late Fees by State

Maximum late fees can be different in each state. A few states set strict limits, but other states let you and the other person set the fee if it’s written in a contract. For example, Florida says the late fee cannot be more than 5% of what is overdue. Texas lets people charge higher late fees if the contract says so, and it follows the rules.

Here is a quick look at the highest late fees and extra days you get to pay in some states:

| State | Maximum Late Fee | Required Grace Period |

|---|---|---|

| California | No maximum specified | No grace period |

| Florida | 5% of the past due amount | 15-day grace period |

| Texas | No maximum specified | 5-day grace period |

| New York | Lower of $50 or 5% of the amount | 5-day grace period |

| Illinois | $20 or 20%, whichever is higher | No grace period |

Always check your state’s laws about late fees and grace periods. This way, you can make sure you follow the rules when you charge or pay late fees.

Avoiding Late Fees

Late fees can be a hassle. They add extra cost to what you already have to pay. A little planning can help you avoid them with ease.

It helps to know when your bills are due. Mark these dates in a notebook or set reminders on your phone. This lets you see which ones come up soon.

- Always pay your bills on time if you can. If you think you may forget, set up automatic payments. This way, the money comes out each month without you having to remember.

- If you can’t pay on time, call the company and explain. They may give you an extra few days. They should know about your problem rather than not say anything.

- Reading bills and emails also helps. Some companies change due dates, so check your mail to stay in the loop.

- Finally, if you see a late fee even when you paid on time, reach out at once. Often, they will take it off if it was not your fault.

With the right steps, it is easy to avoid late fees. Simple habits will save you trouble and money over time.

What You’ll Need to Start Avoiding Late Fees

To keep up with payments and not get late fees, collect all the first invoices, bills, and papers that show what you have to pay and when. This helps you check what you owe and know if there may be any late fees. You can use a calendar or set reminders on your phone to see when things need to be paid. This way, you pay on time and do not incur any extra interest or late charges. By doing this, you can stay on top of your money and what you need to pay.

Payment Agreements and Deadlines

It’s important to know the details of your payment agreements. These documents tell you about payment terms, grace periods, and rules for late fees. When you know the due dates and how much you owe, you can manage money better and lower the risk of paying extra interest.

Look at the details for late payment terms and any invoices that you have not paid. Check your billing statements often. This will help you follow agreements and not miss any fees that might come up.

How to Prevent Late Fees

Setting up a simple way to track your payments can help you stay away from late fees. Start by reading your payment agreements and the bills you get. Look for things like when you need to pay and if there are any extra charges for being late. You should set up reminders so you pay on time and keep your money moving. If you do not understand something, reach out to the people who give you the service. Ask them to explain things and talk about your choices if you need more time to pay. When you follow these steps, you will be more likely to pay on time and save money by not getting extra fees.

Step 1: Look Over Your Contracts and Billing Statements

You should read your contracts and billing statements. Take your time with this. Make sure you know what they say, and look for any fees or things you did not expect. This will help you know what you are being charged for and if there is a mistake there. If something does not look right, you can ask about it. It is good to have all your bills and contracts in one place so you can get to them when you need to.

Step 2: Set Up Reminders for Due Dates

Setting up a reminder system can help you avoid paying late fees. A digital calendar or mobile app is good for tracking when you need to pay. Make sure you set alerts at least one week before the due date. This gives you time to plan and makes it less likely you will have problems with cash flow.

Step 3: Talk Early With Service Providers

Keeping in touch with the service providers can help cut down on late payments. If you think there may be a delay or trouble with money, let them know right away. This shows that you take care of your business. When you talk early, you may also be able to talk about paying in a way that works better for both. Use the billing statements and invoices to clear up any mistakes. This will help everyone feel sure about what is going on, so you can trust each other and even change how and when you pay if you have to.

When Can You Be Charged a Late Fee?

Avoiding late fees is important to keep your cash flow steady and make sure you have good money habits. Watch your payment dates, set reminders, and talk early with the people you pay. This can help you keep up with your bills and stay on top of what you owe.

Paying your bills on time and checking invoices often helps you stay away from late payments. This way, you miss late fees or extra charges. Always read over your billing statements. Look at the grace periods, too. Following the late fee rules can keep your money safe and help you feel more secure about your future money plans.

Frequently Asked Questions

Can a late fee be charged without prior notice?

Yes, a company can charge a late fee without giving separate notice if the contract or agreement clearly states this rule. Most companies send reminders as a good practice, but they are not always required to. This is why reading the payment terms before agreeing to anything is so important. It protects you from being surprised by extra charges.

Are late fee amounts different depending on the state or service?

Yes, late fees can differ by state law and the type of service involved. Some states set a cap on how much a late fee can be, while others allow companies to charge what is agreed upon in the contract. This makes it important to check your local regulations. Knowing your rights can help you avoid unfair or excessive charges.

What can I do if I am charged a late fee by mistake?

If you are charged a late fee by mistake, contact the company right away. Provide proof that your payment was on time, such as bank statements or confirmation emails. Many companies are willing to reverse the charge if the error is clear. Acting quickly and staying polite can lead to a fast fix.

Are late fees negotiable?

Yes, some late fees are negotiable, especially if you have a good payment history. Contact the company early, explain your situation, and ask if the fee can be reduced or waived. Many companies value their customers and may offer a one-time courtesy. It’s always worth asking respectfully.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: When Can You Be Charged a Late Fee?

https://fangwallet.com/2025/07/30/when-can-you-be-charged-a-late-fee/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

Consumer Financial Protection Bureau. (2024, March 5). Credit Card Penalty Fees (Regulation Z) Final Rule. Federal Register.