This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

More and more Canadian families are worried about the economy being unstable. Canadians are feeling the effects of higher import costs because of trade tensions around the world. The rising cost of groceries and other common household items is putting a lot of financial pressure on people, making them rethink how they spend their money and look for new ways to stay financially stable.

This group shift toward being more mindful of money isn’t just a reaction; it’s part of a bigger movement to be more flexible when faced with outside economic pressures. People in all kinds of communities are looking for ways to meet their needs while also being environmentally friendly.

- Rethinking Household Spending in a Time of Inflation

- Budget Planning as a Resilience Strategy

- Smarter Consumer Choices in a Changing Economy

- Leveraging Community-Based Financial Resources

- Building Financial Flexibility for Long-Term Stability

- Practical Tools for Daily Financial Management

- Conclusion

-

Frequently Asked Questions

- What types of tariffs are currently affecting Canadian consumers?

- How are Canadian households adjusting to rising prices?

- What financial strategies are helping Canadians cope?

- How are small businesses adapting?

- Are there any government programs offering relief?

- What should Canadians expect moving forward?

- Recommended Reads

Rethinking Household Spending in a Time of Inflation

Most of the time, tariff threats start out as political or trade disagreements, but they quickly affect consumers. When import costs go up, those costs spread through the supply chain and show up on the price tags of everyday items. This has made Canadians rethink how they spend their monthly money.

The change in budgeting priorities is one of the most obvious ones. People are starting to be able to tell the difference between things they need and things they want. Groceries, rent, and transportation are some of the most important things to buy. On the other hand, people are putting off or cutting back on nonessential purchases more and more.

Some people are buying local goods and services instead of things that come from other countries. This not only protects people from price increases caused by tariffs, but it also helps local economies and makes communities more resilient. When they can, some people are buying household staples in bulk, especially things that are known to go up and down in price.

This small change in thinking is changing how families plan their finances when things are uncertain.

Budget Planning as a Resilience Strategy

More than just short-term fixes are needed to deal with economic stressors. Many Canadians are updating their long-term financial plans to take into account changes in prices and availability. More and more households are looking at their monthly budgets again, paying more attention to how they actually spend their money.

You can learn a lot from making small changes, like keeping track of your monthly expenses and comparing them to your planned budgets. The difference between what you think you will spend and what you actually spend can help you find patterns, cut down on overspending, and give you more financial freedom.

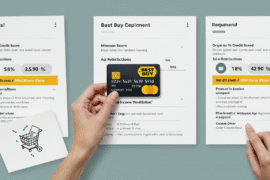

Canadians now use price-comparison websites and apps to find the best deals, making comparison shopping another useful tool. This habit, along with planning meals and shopping for groceries in a smart way, helps you avoid wasting food and money.

Smarter Consumer Choices in a Changing Economy

Because of inflation and price changes, people are thinking more carefully about what they buy. More and more Canadians are being careful about when and how they spend their money. They are choosing products that will last and are worth the money over ones that are cheap in the short term but cost a lot over time.

People are also becoming more aware of how prices and sales change with the seasons. Shoppers can time their purchases for when discounts are most likely by keeping an eye on trends for items that are in high demand.

Also, choosing to buy higher-quality, long-lasting goods, even if they cost more at first, may save money in the long run by needing fewer replacements and working better.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Leveraging Community-Based Financial Resources

When the economy changes, a lot of Canadians are turning to community groups and mutual aid resources for help. Libraries, nonprofits, and neighborhood groups are giving residents tools and services to help them get through tough financial times.

These resources often offer free or low-cost workshops on how to manage your money, budget seminars, and even one-on-one meetings. Food banks and discount grocery networks also help families who don’t have a lot of money.

Peer-to-peer support is also on the rise. Local forums and social groups share tips, swap opportunities, and community deals to help people make the most of their limited budgets.

Building Financial Flexibility for Long-Term Stability

Families that plan ahead for price changes are better able to deal with rising costs. More and more Canadians are putting money aside in case of unexpected costs. These savings, which should be enough to cover three to six months of living expenses, act as a safety net for both your finances and your emotions.

More and more people are also finding ways to make extra money. Canadians are looking for other ways to make extra money, like through freelance work, gig platforms, or turning their hobbies into cash.

Families can stay grounded during times of economic instability by using these steps along with regular financial check-ins and setting savings goals.

Practical Tools for Daily Financial Management

Canadians are using technology to help them deal with changes in the economy. You can set goals, keep track of your progress, and see how much you’re spending in real time with budgeting apps like Mint and YNAB (You Need A Budget).

Many Canadians are also using digital tools and doing things like meal prepping, buying in bulk, and keeping an eye on prices. Shopping locally has also become more popular, not just as a way to save money, but also as a way to be a responsible consumer.

| Practice | Advantage |

|---|---|

| Budgeting Tools | Real-time insight into spending habits |

| Buying in Bulk | Reduces per-unit costs and shopping frequency |

| Shopping Locally | Supports domestic economy, avoids import markups |

These habits help you be more intentional with your money, which means being consistent and flexible instead of reacting to things as they happen.

Conclusion

People are coming up with new ways to protect their finances as the economy changes and inflation continues to affect Canadian families. Canadians are dealing with rising costs by changing how they spend their money, putting their most important needs first, and using budgeting tools and community resources. Making smart decisions as a consumer, like shopping locally and buying in bulk, is also helping to ease the burden.

Saving money, finding new ways to make money, or making a budget that works for you will all help you build financial flexibility that will last through uncertain times. Families can get through these tough financial times with confidence if they stay informed and take action. This will help them not only survive but also thrive in a changing economy. To stay strong and healthy financially, it’s important to plan ahead, keep track of your spending, and support local economies.

Frequently Asked Questions

What types of tariffs are currently affecting Canadian consumers?

Canada is experiencing tariff impacts primarily related to imported goods from countries such as the United States and China. Items like food products, industrial components, and manufactured goods have seen cost increases as a result of ongoing global trade disputes and supply chain disruptions.

How are Canadian households adjusting to rising prices?

Households are responding by tracking their spending more closely, cutting back on non-essential expenses, exploring local alternatives, and planning meals to avoid waste. Budgeting and comparison shopping are becoming part of everyday routines.

What financial strategies are helping Canadians cope?

Canadians are turning to a mix of strategies including community programs, emergency savings, budgeting tools, and supplementary income options. Many are also looking to bulk buying and long-term planning to reduce the sting of price hikes.

How are small businesses adapting?

Small businesses are adjusting by sourcing materials locally, changing their pricing models, and offering customer incentives. Some are optimizing inventory management or scaling down overhead to remain competitive without passing excessive costs onto customers.

Are there any government programs offering relief?

Government efforts to mitigate inflation impacts include support for low-income households and targeted industry assistance. Provincial programs and tax relief measures are also being explored in response to rising costs across sectors.

What should Canadians expect moving forward?

Many experts think that prices will keep going up and down even though the global markets are still uncertain. But trends show that consumers are slowly moving toward buying local goods, spending money wisely, and planning for the long term, all of which may help balance out the effects of changes in the economy.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How Canadians Are Responding to Tariff Threats and Rising Prices

https://fangwallet.com/2025/08/12/how-canadians-are-responding-to-tariff-threats-and-rising-prices/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.