This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- A Comprehensive Investment Guide

- What Is Sovereign AI?

- The AI Powerhouse

- Market Dynamics And Nvidia

- Stock Prices And AI Innovations

- Analogies For Perspective

- Factors Driving Nvidia’s Stock

- The Risks Of Overvaluation

- Gauging Current Trends

- The Intersection Of Policy And Technology

- The Broader Tech Landscape

- The Importance Of Diversification

- Frequently Asked Questions

- What does it mean that Nvidia stock isn’t pricing in sovereign AI?

- Why is sovereign AI an important consideration for investors?

- What are the potential implications of sovereign AI on Nvidia’s growth?

- How can investors navigate the risks associated with sovereign AI?

- What signs should investors look for regarding Nvidia’s response to sovereign AI?

- Closing Remarks

- Recommended Reads

A Comprehensive Investment Guide

What Is Sovereign AI?

Sovereign AI refers to government-led development and deployment of artificial intelligence that prioritizes national control over data, infrastructure, and governance. It can touch healthcare, public services, defense, and economic planning through secure, compliant AI systems. The goal is to improve outcomes while protecting privacy and national interests. At scale, this requires robust compute, storage, networking, and skilled talent. These requirements create both opportunities and challenges for companies supplying AI infrastructure.

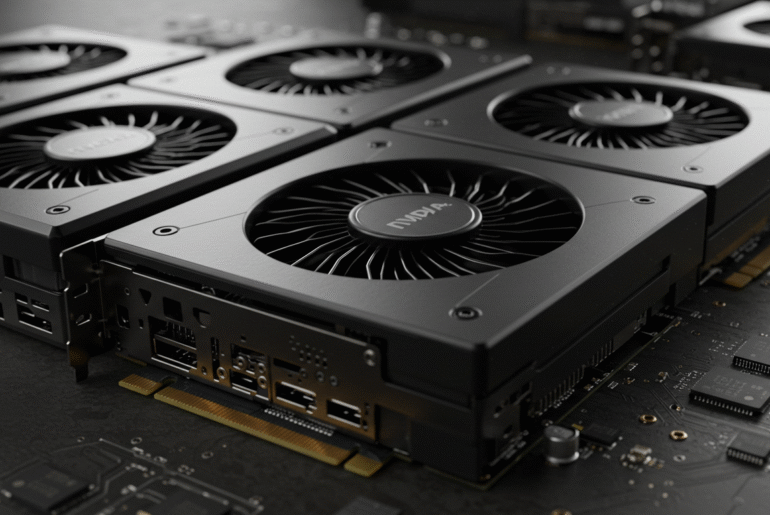

The AI Powerhouse

Nvidia is more than a chip designer; it is a platform provider for AI workloads across data centers, cloud services, and edge deployments. Its GPUs and software stacks accelerate training and inference for large models and real-time applications. Partnerships with cloud hyperscalers and enterprises expand Nvidia’s reach into multiple industries. This position makes the company central to many AI initiatives, including those aligned with national priorities. Investors often ask whether the stock reflects both current adoption and future potential.

Market Dynamics And Nvidia

Sovereign AI could reshape demand in healthcare, finance, logistics, and public services, areas where Nvidia already participates. Government projects may require localized compute and strict data residency, influencing vendor selection and system design. Such requirements can lead to long, multi-year buildouts that favor established suppliers with scale. However, procurement cycles and policy changes can also introduce timing uncertainty. These mixed forces make careful analysis vital for investors.

Stock Prices And AI Innovations

Nvidia’s valuation has benefited from broad AI adoption and expectations for continued growth. Yet sovereign AI introduces new variables such as regulatory frameworks, procurement pacing, and domestic competition. Investors should consider whether prevailing prices fully account for these uncertainties. Sensitivity to supply constraints and product roadmaps can also influence sentiment. A balanced view weighs long-term structural demand against execution and policy risks.

Analogies For Perspective

The AI buildout resembles a modern Gold Rush, where enabling tools may capture durable value. Many participants will chase opportunities, but outcomes will vary widely. Nvidia occupies a central position as a provider of vital components for AI infrastructure. That position offers upside, yet it does not eliminate volatility. Disciplined risk management remains critical.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Factors Driving Nvidia’s Stock

- Demand for GPUs: Expanding AI workloads increase the need for high-performance computing across industries.

- Cloud services growth: Integration with major clouds broadens distribution and supports full-stack solutions.

- Strategic partnerships: Collaborations with leading technology and industry players reinforce ecosystem strength.

These drivers are important but may not fully capture the scale or timing of government AI initiatives. Public-sector projects can be large but also complex. Implementation schedules may extend over several years. Monitoring execution milestones can help investors calibrate expectations.

The Risks Of Overvaluation

High multiples imply strong future performance and leave less room for disappointment. Policy shifts, export controls, or competitive advances could weigh on growth trajectories. Procurement delays or budget reprioritizations can affect revenue timing. Supply chain or manufacturing hiccups may also introduce volatility. Investors should evaluate scenarios rather than a single outcome.

Gauging Current Trends

Governments are publishing AI strategies and funding programs, signaling sustained interest in national capabilities. Startups continue to innovate at the model, tooling, and application layers, potentially partnering with or competing against incumbents. Ethical and responsible AI considerations are rising, shaping requirements and compliance. Data sovereignty and security remain central themes in public-sector deployments. Tracking these signals can inform investment theses over multiple years.

The Intersection Of Policy And Technology

Policy decisions influence where and how AI is built, from data residency to procurement standards. Incentives and grants may accelerate domestic infrastructure deployments. Conversely, regulatory barriers can slow adoption or change vendor eligibility. If governments favor local providers, global suppliers may adapt go-to-market models. Investors should incorporate policy scenarios alongside market forecasts.

The Broader Tech Landscape

Nvidia is not alone in the AI race, and competition can shape margins and market share. AMD advances alternative GPU platforms that may appeal due to performance or cost. Intel targets data centers and edge AI with varied silicon approaches. Hyperscalers like Google develop custom accelerators tightly coupled with their clouds. Understanding competitor roadmaps helps investors anticipate shifts in buyer preferences.

The Importance Of Diversification

Concentration in a single stock or sector increases exposure to idiosyncratic risk. Diversifying across industries and asset classes can stabilize returns during volatility. A thoughtful mix of growth and defensive holdings may improve resilience. Rebalancing helps maintain target risk levels as markets move. Diversification does not guarantee gains, but it can reduce the impact of negative surprises.

Frequently Asked Questions

What does it mean that Nvidia stock isn’t pricing in sovereign AI?

It means current valuations may reflect general AI demand but might not fully account for the scale, timing, and competition introduced by national AI programs.

Why is sovereign AI an important consideration for investors?

Government strategies can shift demand, rules, and vendor selection, which may change growth paths for AI suppliers and their partners.

What are the potential implications of sovereign AI on Nvidia’s growth?

It could expand opportunities through public-sector buildouts while adding risks from regulation, procurement cycles, and emerging rivals.

Stay informed on policies, track partnerships and product updates, and diversify holdings to limit single-name exposure.

What signs should investors look for regarding Nvidia’s response to sovereign AI?

Watch for government contracts, localized solutions, compliance features, and milestones in infrastructure deployments.

Closing Remarks

This optimized guide clarifies how national AI strategies could influence Nvidia and the broader market. It reframes the topic for search readiness with clear sections and practical insights for investors. The structure emphasizes accuracy, usability, and consistent formatting for strong SEO performance. Readers gain a balanced view of opportunities and risks without hype or filler. With disciplined monitoring and diversified positioning, investors can approach this evolving theme with greater confidence.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Nvidia Stock and Sovereign AI

https://fangwallet.com/2025/08/19/nvidia-stock-and-sovereign-ai/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.