This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

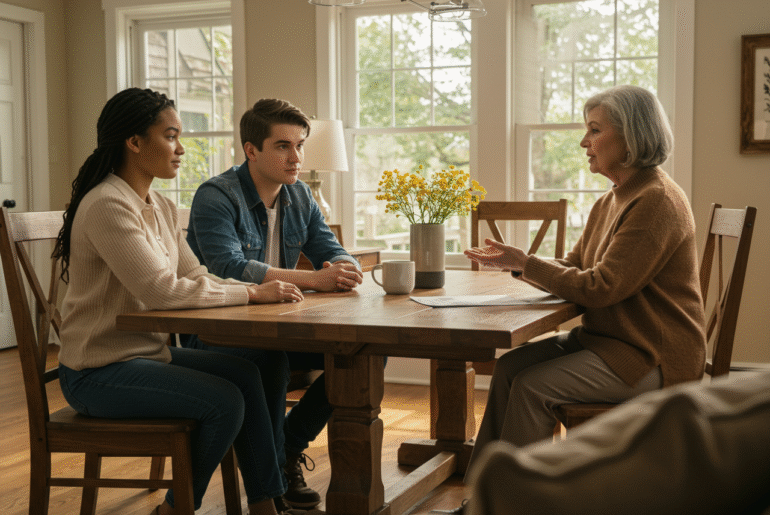

When to Say No to Financial Help for Kids

Sometimes, the most loving choice for your children or grandchildren is to decline requests for money. While it may feel natural to step in, financial help at the wrong time can harm long-term independence and put your own financial security at risk. Clear limits encourage responsibility, skill-building, and resilience that last beyond a single bailout. With a thoughtful approach, you can protect your future while empowering younger family members to stand on their own.

Why Saying No Can Be an Act of Love

Refusing financial support can be a powerful lesson in responsibility, resilience, and healthy money habits. A compassionate “no” helps younger family members make better decisions while ensuring you safeguard your retirement and emergency savings. When communicated with care, boundaries foster long-term independence and mutual respect. Over time, this balance strengthens relationships by pairing support with accountability.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Situations to Hold Back on Financial Assistance

When They Have Not Learned to Manage Money

Handing over cash to someone who overspends or struggles with debt often reinforces poor habits. Focus on building skills instead of providing one-time fixes that delay real progress. Consider practical, growth-focused support that equips them to make better choices. This approach maintains constructive assistance while preventing the recurrence of mistakes.

- Tip: Offer budgeting guidance or simple tools (spreadsheets, budgeting apps).

- Resource: Recommend financial literacy courses or workshops.

- Referral: Suggest a certified credit counselor for debt strategies.

When It Threatens Your Financial Security

Your retirement and emergency funds should remain protected and separate from family requests. Large gifts or ongoing transfers can jeopardize your stability and cause stress later. Preserve your financial base so you never become reliant on your children down the road. Provide non-cash support that still moves them forward.

- Alternative: Offer advice or mentorship in place of money.

- Plan: Help them draft a realistic budget and orderly action plan.

When They Need to Face Consequences

Allowing natural consequences, such as late fees or paused services, teaches accountability that bailouts often erase. You can still support learning without removing every obstacle. Discuss what went wrong, what’s in their control, and how to avoid repeats. This approach pairs empathy with responsibility and long-term growth.

- Debrief: Talk through lessons from the mistake.

- Prevent: Set reminders, autopay, or safeguards for next time.

When It Creates Dependency

Repeated financial rescues can undermine self-reliance and problem-solving skills. Over time, this pattern can turn into expectation rather than gratitude. Replace recurring transfers with structure, goals, and coaching toward independence. The aim is durable confidence in money management, not temporary relief.

- Goals: Define clear earning, saving, and budgeting targets.

- Earning: Encourage part-time work, side projects, or skill-building gigs.

- Tracking: Review progress monthly to reinforce momentum.

When Tax Implications Could Backfire

Large financial gifts may trigger filing requirements or reduce lifetime estate and gift tax exemptions. For 2025, the IRS annual gift tax exclusion is $19,000 per recipient (up from $18,000 in 2024), which helps donors give without using lifetime exemption or filing Form 709 in many cases. Planning gifts with these limits in mind prevents surprises and preserves flexibility. For complex situations, professional advice is worth it.

- Confirm: Check current IRS limits before transferring large amounts.

- Coordinate: Talk to a tax or financial advisor for multi-year plans.

When It Stifles Motivation

Automatic bailouts can reduce initiative and ambition by removing the need to adapt. Instead, provide support that sparks growth and problem-solving. Open doors, share perspectives, and celebrate progress rather than writing checks. This keeps motivation high and dependence low.

- Mentorship: Offer feedback, frameworks, and accountability.

- Network: Make introductions to employers or mentors.

- Projects: Encourage small wins that build confidence.

How to Set Financial Boundaries Without Guilt

Be clear and consistent about what you can and can’t provide, even when emotions run high. Offer non-monetary support, like tools, templates, and learning resources, that still helps them move forward. Recognize wins to reinforce good habits and keep momentum strong. Over time, consistent boundaries protect relationships and finances alike.

FAQ

Will saying no harm my relationship with my child?

Handled with care, boundaries build trust rather than erode it. A consistent, compassionate “no” teaches life lessons and encourages mutual respect.

How can financial independence be encouraged?

Provide mentorship, practical tools, and opportunities to earn and budget. Consider financial literacy courses or counseling to build durable skills.

Are there limits on how much money can be gifted without tax consequences?

Yes. For 2025, the IRS annual exclusion is $19,000 per recipient. For larger gifts or multi-year strategies, consult a tax advisor to avoid unintended consequences.

How should repeated requests for money be handled?

Apply boundaries consistently and offer alternatives that build self-sufficiency. Explain why protecting long-term financial security matters for everyone.

Final Thoughts

Choosing not to provide money can be a constructive, caring decision that supports long-term growth. By setting clear limits, encouraging accountability, and offering mentorship instead of cash, you help younger family members build resilience and independence. This approach also safeguards your retirement and emergency savings, reducing stress for the whole family. With the right mix of boundaries and guidance, you foster healthy money habits that last. Reframing the conversation around skills, goals, and progress makes “no” a positive step for everyone involved.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 6 Financial Boundaries for Your Adult Children

https://fangwallet.com/2025/08/26/6-financial-boundaries-for-your-adult-children/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.