This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Introduction

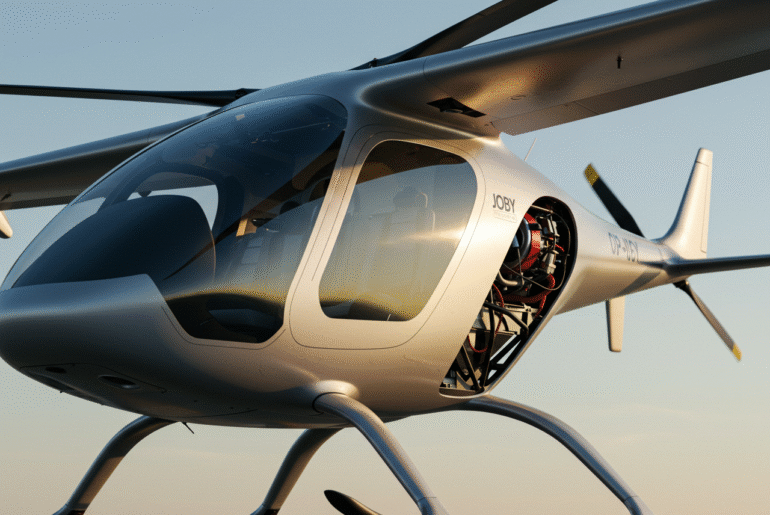

Joby Aviation’s purchase of Blade Air Mobility’s passenger business for up to $125 million signals a pivotal shift in urban air mobility, pairing a mature helicopter network with next-gen eVTOL aircraft. The deal includes Blade’s passenger operations in the U.S. and Europe, plus the Blade brand, giving Joby immediate market presence and ready-made terminals and lounges in the best cities. This combination aims to lower customer acquisition costs and compress timelines for commercial rollout of quiet, zero-operational-emissions air taxis. The transaction terms allow payment in stock or cash at Joby’s discretion, with performance-based holdbacks to align incentives.

- Immediate Market Access: Blade’s routes and loyal flier base give Joby instant demand in hubs like New York and in parts of Europe, including the South of France.

- Technological Integration: Joby can swap helicopters for eVTOLs over time, improving noise and local emissions while leveraging Blade’s proven booking and operations model.

- Competitive Leadership: Control of terminals, lounges, and brand equity strengthens Joby’s position against eVTOL rivals in first-launch markets.

Key Players In The Deal

Joby Aviation

Joby develops electric vertical takeoff and landing aircraft designed for quiet, efficient, point-to-point urban trips. With certification progress in the U.S. and international launch plans underway, Joby gains an immediate surface-to-sky customer pipeline via Blade’s network. The company highlighted New York infrastructure as especially valuable as it prepares for passenger services.

Blade Air Mobility

Blade operates passenger helicopter and seaplane services and will now have its passenger division run as a wholly owned Joby subsidiary, continuing under founder and CEO Rob Wiesenthal. Blade’s separate Medical division is not included in the sale and will remain public under the Strata Critical Medical brand. This separation lets Strata focus on mission-critical medical logistics while partnering with Joby over time for eVTOL medical flights.

The Future Of Urban Air Mobility

Reduced Travel Times And Accessibility

By bypassing road congestion, urban air taxis can reduce trips like Manhattan to JFK from typical ground times to just minutes. Blade’s existing routes and lounges, plus Joby’s aircraft roadmap, offer a path to scale services for both business and premium consumer use cases. As eVTOLs enter service, per-seat pricing could move toward mass-affordable tiers in high-demand corridors. Integration with known booking platforms should ease adoption for first-time riders.

Environmental Sustainability

Joby’s aircraft target zero operational emissions and substantially lower noise versus helicopters, an important factor for city acceptance. Transitioning Blade’s busiest routes to eVTOLs can reduce local air and noise impacts around heliports and vertiports. This approach supports municipal climate goals without sacrificing mobility. The planned transition also positions cities to meet growth in demand without proportional increases in ground traffic.

Regulatory And Infrastructure Needs

Scaling service hinges on regulatory approvals and fit-for-purpose infrastructure such as vertiports, upgraded heliports, and passenger lounges. The acquisition delivers terminals and lounges in markets like New York, streamlining certification-to-operations handoffs. Operating continuity under the Blade brand helps manage safety, training, and standard operating procedures during the transition to eVTOLs. These assets could shorten the time to the first commercial flights in multiple cities.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Regional Outlook

North America is Leading Innovation

New York and other North American metros are prime launchpads thanks to dense demand, existing heli infrastructure, and supportive stakeholders. Reports indicate Joby is preparing for early international service while deepening U.S. readiness, with the Blade deal framed as a “massive accelerant.” The combination is also expected to support the Dubai launch timing referenced by the company. These regional vectors suggest a multi-city, phased rollout strategy as certification milestones are met.

Strategic Investment Considerations

Investors assessing the eVTOL thesis should weigh technology maturity, regulatory timelines, and infrastructure control. Blade’s passenger footprint provides immediate revenue-adjacent operations and brand equity while Joby advances aircraft certification and operations. Monitoring battery performance, noise signatures, and safety cases remains necessary as fleets scale. Partnerships and acquisitions that join tech with proven operations, like this one, may lower launch friction and capital intensity.

- Technology Innovation: Battery endurance, safety systems, and noise reduction will drive utilization and public acceptance.

- Market Demand: Congestion relief and premium time savings underpin early adoption in high-traffic corridors.

- Company Partnerships: Aligning OEMs with established operators can compress time-to-market and reduce CAC.

- Sustainability: Zero operational emissions can unlock policy support and community buy-in.

Frequently Asked Questions

What is the main announcement regarding Joby and Blade?

Joby Aviation is buying Blade’s passenger business for up to $125 million, payable in stock or cash.

Why is Joby interested in Blade’s passenger business?

It provides immediate market access, terminals and lounges, a loyal customer base, and an operating platform to transition from helicopters to eVTOLs.

How will this acquisition benefit Joby’s operations?

Joby gains ready infrastructure and brand presence in core markets, reducing time and cost to launch commercial eVTOL service.

What will happen to Blade’s existing passenger services?

They continue as a wholly owned Joby subsidiary led by Blade founder and CEO Rob Wiesenthal, with the Blade brand retained.

When did the acquisition close?

The deal closed on August 29, 2025, following the initial August 4, 2025 announcement.

What happens to Blade’s medical business?

It remains public and rebrands as Strata Critical Medical, with a long-term partnership to access Joby eVTOLs for medical flights.

Conclusion

Joby’s acquisition of Blade’s passenger business reframes urban aviation by uniting a trusted premium mobility brand with next-generation electric aircraft. The transaction delivers lounges, routes, and customers on day one while Joby advances certification and operational readiness. With clear steps toward quieter, zero-operational-emissions service, the combined platform is positioned to make aerial commutes practical in the world’s busiest corridors. For readers and investors, the move offers a concrete path from prototypes to paying passengers, supported by existing infrastructure and brand continuity. Tracking certification milestones, infrastructure upgrades, and early route economics will be key to understanding how quickly this vision scales.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Joby Aviation Acquires Blade Helicopter Taxi

https://fangwallet.com/2025/09/02/joby-aviation-acquires-blade-helicopter-taxi/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.