This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- Introduction

- The Importance of Earnings Reports for Investors

- Concepts for Investors

- Super Micro Computer

- Key Metrics to Analyze in Super Micro’s Earnings Reports

- Why Earnings Reports Matter for Investors

- Common Pitfalls When Analyzing Earnings

- How Market Sentiment and Peer Performance Affect Super Micro

- FAQs

- Conclusion

- Recommended Reads

Introduction

Navigating company earnings reports can feel overwhelming, especially for new investors trying to separate meaningful insights from distracting data. This guide breaks down Super Micro Computer’s earnings reports to help you identify the best financial signals and avoid the noise that can cloud your judgment. By understanding these fundamentals, you will be better equipped to make informed investment decisions with confidence. The goal is to give you a repeatable process you can apply each quarter. With practice, you can interpret results faster and with greater accuracy.

The Importance of Earnings Reports for Investors

Earnings reports summarize a company’s financial performance over a specific period, usually a quarter or a year. They reveal critical metrics such as revenue, profits, and cash flow, which investors use to evaluate a company’s health and growth prospects. For investors interested in Super Micro Computer, these filings highlight execution against strategy and market demand for its products. They also provide management commentary that explains short-term movements. Taken together, they help investors judge progress and risk.

Concepts for Investors

When reviewing results, separate a signal from noise to avoid common mistakes. “Signal” refers to recurring data that reflects true business performance, such as consistent revenue growth and rising margins. Noise involves one-time items, seasonal quirks, or speculative interpretations that do not persist. Think of it like tuning a radio station: aim to hear the music clearly and ignore static. Using this mindset keeps you focused on trends that actually compound value.

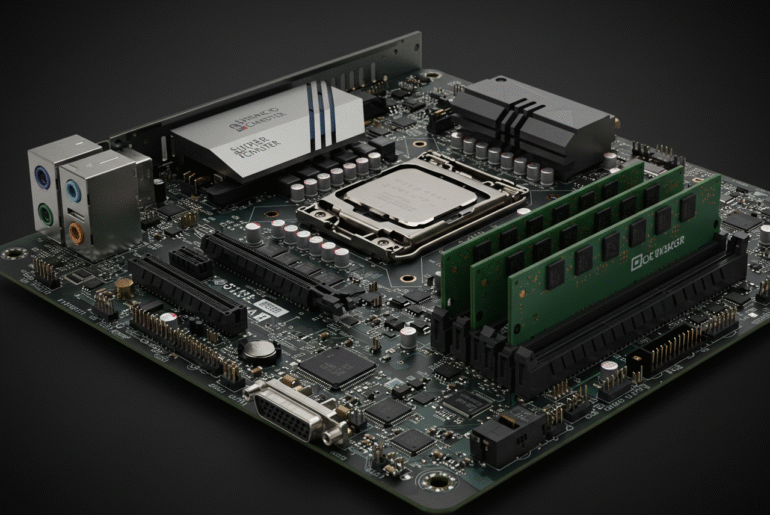

Super Micro Computer

Founded in 1993, Super Micro Computer (NASDAQ: SMCI) designs high-performance server and storage solutions used by enterprises and cloud providers. The company emphasizes energy-efficient architectures that can lower the total cost of ownership for customers. Its product cycles are tied to advances in processors, memory, and accelerators, which can drive pronounced demand waves. Supply chain conditions and component availability can affect shipment timing. Competitive intensity and pricing also influence margins and growth.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Key Metrics to Analyze in Super Micro’s Earnings Reports

To evaluate financial health, focus on a handful of durable indicators. These items, tracked together over time, offer a balanced view of demand, profitability, and cash strength. Review both year-over-year and sequential changes to understand directionality. Cross-check commentary in the shareholder letter or call transcript for context. Consistency across metrics usually signals quality execution.

- Revenue growth indicates market demand and business expansion across products and regions. Look for multi-quarter acceleration supported by new platforms and customers.

- Gross margin measures the spread between sales and cost of goods; stability or improvement suggests operational efficiency and pricing power.

- Net income captures profitability after all expenses; sustained growth points to scalable operations and disciplined costs.

- Cash flow from operations indicates the cash generated by the core business; a positive and improving cash flow supports reinvestment and enhances resilience.

- The order backlog, order growth, and an increasing backlog can indicate future revenue and demonstrate how supply aligns with demand trends.

Why Earnings Reports Matter for Investors

Earnings reports help determine whether to buy, hold, or trim a position based on fundamentals rather than headlines. They influence market sentiment as analysts and investors react to surprises versus expectations. Results also surface risks, such as component shortages or cost pressures, before they show in price charts. Understanding these drivers reduces overreliance on short-term moves. A structured review process helps you stay patient and consistent.

Common Pitfalls When Analyzing Earnings

New investors often overreact to single-quarter fluctuations without checking multi-period trends. Others ignore external forces like macro conditions or supply dynamics that may temporarily distort results. Relying only on analyst ratings or social chatter can crowd out firsthand readings of filings. Emotional decisions driven by fear or greed tend to amplify mistakes. Grounding your view in data and context keeps analysis objective.

How Market Sentiment and Peer Performance Affect Super Micro

Super Micro’s shares can move with broader technology sentiment, interest rate shifts, and policy developments. Comparing performance with peers in servers and cloud infrastructure clarifies whether trends are company-specific or industry-wide. Peer checks on growth, margins, and cash generation provide valuable benchmarks. They also reveal when valuation reflects optimism or caution versus the group. This context helps calibrate expectations for the next quarter.

FAQs

What does it mean to mix signal and noise in earnings reports?

It means confusing persistent trends with temporary or irrelevant data, which can lead to misjudging performance.

What key metrics should I watch in Super Micro’s earnings?

Track revenue growth, gross margin, net income, cash flow from operations, and order backlog for a holistic view.

How do external factors impact earnings?

Macro shifts, supply chain changes, or pricing in components can temporarily affect shipments, costs, and margins.

How can I avoid common analysis mistakes?

Use multi-quarter comparisons, read filings directly, diversify, and combine quantitative trends with qualitative context.

What is Super Micro’s growth outlook?

Demand tied to cloud computing and AI infrastructure suggests opportunity, but outcomes depend on execution and market cycles.

Conclusion

Reading earnings with a clear framework can transform noise into insight for better decisions. By concentrating on Super Micro Computer’s core indicators and verifying trends over multiple periods, you strengthen conviction. Consistency across growth, margins, cash flow, and backlog typically signals quality execution. Peer and macro contexts further sharpen interpretation and reduce bias. Apply this structured approach each quarter to stay fact-focused and investor-ready.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Super Micro Computer Earnings Explained

https://fangwallet.com/2025/09/02/super-micro-computer-earnings-explained/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.