This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

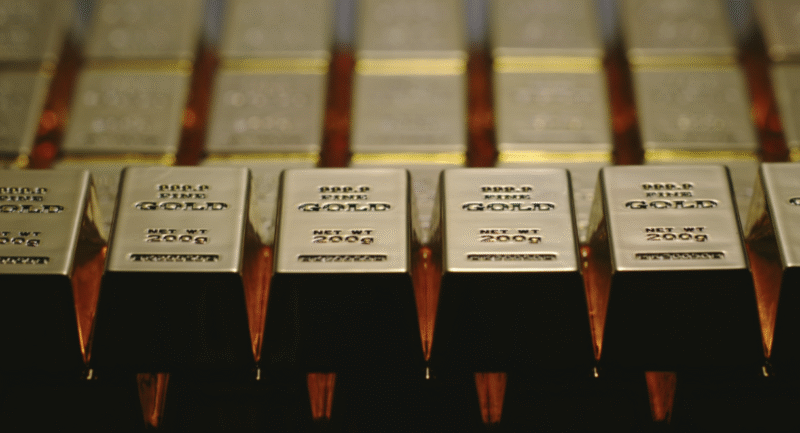

Have you noticed that people have recently been turning quite a lot to some alternative ways of saving for their retirements? That is, some alternative types of investments, apart from those that we are all used to by now, such as stocks and bonds? I suppose you have, given that investing in gold and other precious metals has become quite a popular option, especially in light of all the economic uncertainties we are facing nowadays. People are looking for ways to secure their portfolios, and thus their financial future, and they seem to have found it with these particular assets.

So, today, a lot of investors are turning towards gold, silver and other precious metals. And, that seems to be a good move, given that those assets are known to be quite valuable, as well as stable in that value. No matter what happens on the market, they remain valuable. What’s more, their value tends to increase during inflation, which is the opposite of what happens with those traditional assets, and that means that they can protect your entire portfolio. On top of all that, these assets are known for their liquidity, as they are always in demand, meaning that you can easily turn them into cash when you decide to do so.

It is clear, thus, that there are a lot of great reasons why you may want to invest in these assets. Of course, what you should know is that you need a specific account type to be able to do so, called a self-directed IRA, a SDIRA, or a gold IRA. You can read some more about it here, and get a better understanding of what it is and how it works.

Another crucial thing to know is that, when you set up this account, you will also have to partner up with the right company in order to be able to buy those alternative assets you are after. In short, you have to find and partner up with a gold IRA company. And, choosing the right one is of utmost importance, which is why you need to know how to exactly do that, and which is why we are now going to offer some tips that should help you out in that process.

Make a List

First things first, you will have to make a list of potential companies. After all, in order to be able to choose, you will have to know what you can choose among. So, it all begins with creating a list, after which you will proceed towards narrowing it down until you’ve made your final choice. How can you make that list, though?

Well, for one thing, you should talk to other investors and get their recommendations. The people who have already gone through these choosing and investing processes are sure to be able to share some helpful recommendations. But then, you should also search for these companies online, as most of them are sure to have their official websites, in an effort to help you get better informed. In few words, thus, you should use those two steps to make that list of potential gold IRA companies.

Visit Official Sites

Speaking of official websites, visiting those should be your next step. Why? Because you can find some quite relevant information about the potential companies there. Check which specific alternative assets they are selling, check out all the types of services they are offering, such as storage and similar things. And then, remember to also figure out how long those firms have been in business, as that is going to be quite indicative of the quality of their services.

Read BBB Reviews

The most significant thing to remember is that you should rely on some external sources of information in order to really assess the quality of the services provided by specific gold IRA companies. And, BBB reviews stand out as one of the most useful sources that you should use to your advantage. Reading reviews such as the one at https://goldco.com/goldco-leads-with-bbb-reviews/ will help you get a clearer idea about how reputable and reliable specific gold IRA companies really are, which is sure to impact your final decision. So, take your time to go through these and trust them in your researching process, as BBB is a source that is bound to help you get an objective overview of the firms you are considering.

Find Reviews at Other Useful Sources as Well

You may want to, of course, look for those reviews at some other useful sources as well. Surely, you’ll find them at different sites. Just make sure that the sites you’re trusting for the reviews are relevant and reliable, and that you will, therefore, get completely objective and truthful information about the companies you are researching.

Have Interviews

Now, here is something that should go without saying. But, we still have to mention it and emphasize its importance. Basically, I am talking about interviewing the different companies you have come across in your researching process.

Those interviews should serve to help you get answers to any questions you may have. I’m talking questions about the fees, about the general method of cooperation, and about pretty much anything else you want to know. Of course, you should also take note of the quality of communication here, because you want to choose a gold IRA company that is easy to communicate with and completely transparent about the fees and about everything else you think is important for you to know.

Compare Everything and Choose

Once the research is done, and once the interviews are completed, you’ll be ready to compare all the information and make your final choice. The idea here is, of course, not for you to get stuck on comparing only the fees, and to choose based on them alone, which is a mistake that quite a lot of people wind up making. Sure, do compare the fees and aim at getting reasonable ones, but don’t forget all those other important factors, such as experience, the assets offered, and, most of all, those BBB reviews.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How to Choose a Gold IRA Company: Relying on BBB & Similar Sources

https://fangwallet.com/2025/07/18/how-to-choose-a-gold-ira-company-relying-on-bbb-similar-sources/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.