This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

- A Launchpad for Your Next Adventure

- The Emotional Side of Retirement

- Pursuing Passions and Hobbies in Retirement

- Financial Planning for a Worry-Free Retirement

- Maintaining Social Connections After Work

- Nurturing Relationships During Retirement

- Organizing Your Future

- Frequently Asked Questions

- Final Thoughts on Retirement Planning

- Recommended Reads

A Launchpad for Your Next Adventure

Retirement isn’t the end of your journey; it’s an opportunity to start a new chapter. It allows you to trade deadlines for daydreams and a demanding schedule for a life designed entirely by you. While this transition is exciting, it can also be a significant emotional and financial adjustment. Careful planning can help you manage both aspects and create a future rich in purpose, connection, and joy.

The Emotional Side of Retirement

For many, a career provides routine and identity for decades. Ending this routine can bring feelings of uncertainty or loss, which are normal. Retirees often experience a mixture of emotions, from excitement to anxiety.

What You Might Feel

A sense of loss, lack of daily purpose, or feeling disconnected is common.

How to Find Your Footing

- Reframe your mindset; view retirement as a new beginning rather than an ending.

- Give yourself grace and adjusting takes time; it’s normal to feel uncertain.

- Find your tribe; connect with other retirees to share experiences and advice.

Pursuing Passions and Hobbies in Retirement

Retirement offers a chance to revisit old hobbies or discover new ones. Purpose contributes greatly to happiness and can be found outside traditional work.

Ideas to Get Started

- Be a mentor; share professional experience with younger generations.

- Join a cause and volunteer for charities or causes that matter to you.

- Learn something new and take classes, play an instrument, or master a language.

- Build a community; join clubs or groups centered around shared interests.

Creating a routine around these activities provides structure and fulfillment similar to a work schedule.

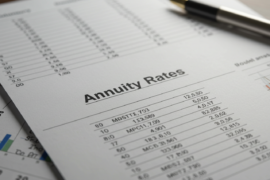

Financial Planning for a Worry-Free Retirement

A secure retirement depends on thoughtful financial planning. Ensuring your money lasts requires strategic preparation.

Steps to Consider

- Know your numbers, budget for necessity and leisure, and account for healthcare and inflation.

- Maximize your accounts and review 401(k), IRA, and other retirement accounts. In 2025, contribution limits are $23,500 ($31,000 for those 50+).

- Consider taxes and work with a financial advisor to develop a tax-efficient withdrawal strategy using traditional and Roth accounts.

- Plans for healthcare and health Savings Accounts (HSAs) offer tax-free medical expense savings.

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Maintaining physical and mental health is necessary for a long, fulfilling retirement.

Strategies

- Stay active: Engage in enjoyable exercises like walking, swimming, or dancing.

- Keep your mind sharp: Read, solve puzzles, or take classes to stimulate your brain.

- Regular checkups: Preventive care is vital to detect issues early.

Nurturing Relationships During Retirement

Strong social connections have a major impact on happiness and well-being. Staying socially active prevents isolation and enhances fulfillment.

Ways to Stay Connected

- Make new friends: Join clubs or interest-based groups.

- Reconnect with old friends: Schedule calls or visits regularly.

- Host gatherings: Invite friends and family for dinners, games, or movie nights.

Organizing Your Future

Planning ahead ensures your legacy is protected and your wishes are respected.

Key Actions

- Update documents: Review wills, trusts, and powers of attorney.

- Communicate clearly and discuss financial and healthcare plans with loved ones.

- Stay organized, use a password manager, and maintain orderly documentation for easy access.

Frequently Asked Questions

When should I start planning for retirement?

It’s never too early. Early planning maximizes compounding, but focusing on finances, health, and personal goals at any stage is beneficial.

How much money do I need to retire comfortably?

Retirement needs vary based on lifestyle, location, and healthcare costs. Creating a detailed budget and consulting a financial advisor helps project personalized requirements.

What non-financial aspects should I consider?

Routine, social life, and sense of purpose are critical. Hobbies, clubs, and social connections support a fulfilling retirement and prevent isolation.

How important are health and wellness during retirement?

Health is a core asset. Prioritizing physical activity, mental stimulation, and preventive care supports a long, happy, and fulfilling retirement.

Final Thoughts on Retirement Planning

Retirement is more than reaching a certain age; it’s a new opportunity to shape your life. Thoughtful planning across finances, health, hobbies, and social connections allows you to embrace new experiences and deepen relationships. By starting today, you can secure a comfortable, purposeful, and joyful retirement.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Retirement Planning Guide 2025

https://fangwallet.com/2025/09/01/retirement-planning-guide-2025/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.