This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

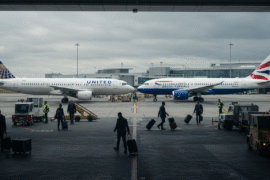

Traveling can be fun, but long layovers, crowded terminals, and expensive snacks can make it less enjoyable. Luckily, access to airport lounges is a nice break. The right credit card can make a big difference for people who travel a lot. It can give them access to exclusive lounges, free food and drinks, and a quiet place to relax before their flights. You can also get extra benefits like travel insurance, priority boarding, and even hotel upgrades with the right card. We’ll talk about the best credit cards that give you access to lounges, what to look for when choosing the right card, and how these perks can make your trip better.

- Why Airport Lounge Access Matters for Travelers

- Features to Look for in a Lounge Access Credit Card

- Top Credit Cards Offering Exclusive Lounge Perks

- Comparing Lounge Access Benefits Across Different Cards

- Guide to Airport Lounges and Credit Cards

- How to Choose the Best Card for Your Travel Needs

- Are Credit Cards With Lounge Access Worth It?

- Conclusion

- Frequently Asked Questions

- What is airport lounge access, and why is it important for travelers?

- Which credit cards offer access to airport lounges?

- Can I bring guests into airport lounges with my credit card?

- How do I know if a credit card with lounge access is worth the cost?

- Are there credit cards that offer lounge access without foreign transaction fees?

- What is the best card for airport lounge access?

- How can lounge access enhance my travel experience?

- Can I earn rewards or points with credit cards that offer lounge access?

- Recommended Reads

Why Airport Lounge Access Matters for Travelers

Traveling can be exciting, but the airport experience is often not very good. Long lines, crowded terminals, and snacks that cost too much can make you lose your excitement very quickly. That’s where airport lounges come in: they’re a place to relax in the middle of all the travel chaos. Having the right credit card can make a difference if you like to relax before a flight with free food and drinks or just want to be in a quieter place away from the noise and activity.

When picking the best credit card for airport lounges, think about things like free access to lounges, priority boarding, travel credits, and travel insurance. The Chase Sapphire Reserve, the American Express Platinum Card, and the Citi Prestige Card are all popular choices. These cards let you into private lounges and make your trip better overall. If you want to make your airport lounge experience better, think about upgrading your credit card the next time you plan a trip.

Features to Look for in a Lounge Access Credit Card

- Lounge Network Coverage: Ensure the card provides access to lounges in airports you frequently travel through.

- Guest Access Policies: Some cards allow you to bring guests for free, while others charge a fee.

- Additional Travel Perks: Priority boarding, free checked bags, and travel insurance can enhance your experience.

- Annual Fees: Higher-end cards often come with substantial fees, so weigh the benefits against the cost.

- Point and Mile Earnings: Opt for a card that maximizes rewards on travel spending.

Top Credit Cards Offering Exclusive Lounge Perks

Chase Sapphire Reserve

Renowned for its top-notch travel perks, this card offers complimentary access to over 1,300 airport lounges globally through Priority Pass Select.

- Relaxing Environments: Enjoy complimentary amenities like refreshments, Wi-Fi, and comfortable seating to alleviate travel stress.

- Exclusive Locations: Access lounges in major airports across continents, ensuring relaxation no matter where you travel.

- Add-on Guests: Most lounges allow cardholders to bring guests, making it easy to share quality time while waiting for flights.

The Platinum Card from American Express

A favorite among frequent travelers, this prestigious card grants access to Centurion Lounges, Priority Pass lounges, and other exclusive benefits.

- Centurion Lounge Access: Enjoy premium lounges with gourmet dining, high-speed Wi-Fi, and personalized services.

- Priority Pass Membership: Complimentary access to over 1,300 airport lounges worldwide.

- No Foreign Transaction Fees: Travel internationally without worrying about extra charges.

Citi/AAdvantage Executive World Elite Mastercard

Perfect for American Airlines flyers, this card includes Admirals Club membership, providing luxurious lounge access at major airports serviced by AA.

- Premium Lounge Access: Comfortable seating, complimentary snacks, and dedicated workspaces.

- Additional Perks: Priority boarding and free checked bags on domestic flights.

- AAdvantage Miles: Earn miles on every purchase, helping you reach your next reward flight faster.

Capital One Venture Rewards Credit Card

Includes two visits per year via Priority Pass, offering flexibility when traveling across different airlines.

- No Foreign Transaction Fees: Save money on international purchases.

- Flexible Points Redemption: Earn 2 miles per dollar on all purchases.

- Travel Protection Benefits: Rental car insurance and lost luggage reimbursement.

Hilton Honors American Express Aspire Card

Grants access to exceptional airport lounges through a complimentary Priority Pass membership while earning hotel points on flights.

- High Earning Potential: Accumulate Hilton Honors points quickly.

- No Foreign Transaction Fees: Ideal for international travel.

- Automatic Gold Status: Enjoy extra perks like room upgrades.

Comparing Lounge Access Benefits Across Different Cards

| Credit Card | Lounge Access | Guest Policy | Additional Perks |

|---|---|---|---|

| Chase Sapphire Reserve | Priority Pass (1,300+ lounges) | Guest access for a fee | Travel credits, trip insurance |

| Amex Platinum | Centurion, Priority Pass | Varies by lounge | Luxury perks, elite status |

| Citi/AAdvantage Executive | Admirals Club | Includes immediate family or 2 guests | AA perks, priority boarding |

| Capital One Venture | Priority Pass (2 visits/year) | Extra visits at a fee | Flexible rewards, no foreign fees |

| Hilton Honors Aspire | Priority Pass (1,300+ lounges) | Guest access available | Hotel rewards, Gold Status |

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Guide to Airport Lounges and Credit Cards

If you travel a lot and want to be able to use airport lounges, credit cards like the Chase Sapphire Reserve and Amex Platinum offer the best benefits. The Chase Sapphire Reserve gives you Priority Pass membership, which gives you access to more than 1,300 lounges around the world, as well as special travel credits and insurance. The Amex Platinum card lets you into Centurion Lounges and Priority Pass lounges, and it comes with luxury perks and elite status. The Hilton Honors American Express Aspire Card stands out because it gives you a lot of hotel points and free Priority Pass membership.

How to Choose the Best Card for Your Travel Needs

- Your Travel Frequency: If you travel often, unlimited lounge access might be worth the higher annual fee.

- Airline Loyalty: Choose a card aligned with your preferred airline for added perks.

- Reward Program Preferences: Opt for a card that earns miles or points useful for your travel goals.

- Additional Benefits: Look at other travel perks, such as insurance, priority boarding, or hotel elite status.

Are Credit Cards With Lounge Access Worth It?

For people who travel a lot and want to be comfortable and have easy access to airport lounges, credit cards that offer this service can be very useful. In addition to the luxurious atmosphere of lounges, these cards often come with perks like travel insurance, priority boarding, and elite hotel status. You can get the most miles or points and enjoy benefits that are right for you by picking a card that fits your travel goals. If you do a lot of research and make a list of your needs, you will be able to find the best credit card for your travel habits.

Conclusion

Getting into airport lounges can make your trip much better by making you more comfortable and convenient before your flight. The right credit card gives you access to special lounges, priority services, and great rewards, whether you travel a lot or only sometimes. You can find the best credit card for you by looking at your travel habits and comparing the benefits of different cards.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Best Credit Cards for Airport Lounges: Fly in Style

https://fangwallet.com/2025/08/01/best-credit-cards-for-airport-lounges-fly-in-style/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.