This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

In 2025, managing money is changing quickly. Many people today don’t need the same kinds of budgeting methods that used to work, which focused on saving money, avoiding debt, and making safe investments. As the economy changes, new ways of thinking are becoming more popular. These new ways of thinking focus on being flexible, investing strategically, and putting experiences ahead of things. These changes aren’t just about keeping money safe; they’re also about making life better, helping people grow, and bringing communities closer together. We’ll look at the new ways to budget, invest, and make money decisions. You can stay ahead of the curve, make smart financial choices, and have a rewarding financial journey by using these new methods.

- Embracing Flexibility in Budgeting for Modern Needs

- Shifting from Solely Saving to Strategic Investing

- Targeting Experiences Over Material Wealth

- Redefining Success Beyond Traditional Wealth Metrics

- Prioritizing Financial Education as Your Best Investment

- Creating Community Connections for Wealth Building

- How to Budget Money

- Conclusion

- Frequently Asked Questions

- Recommended Reads

Embracing Flexibility in Budgeting for Modern Needs

Adjustable Spending Plans

Even though they are traditional, rigid budgets don’t always show how your income and expenses change. Making flexible spending plans that let you change them based on your financial situation is a more modern way to budget. This method lets you group your spending into categories that you can add to or take away from as needed. This makes it easier to move money around without feeling like you have to follow strict rules.

Regular Review and Updates

Another way to stay on track is to check in on your money goals and spending on a regular basis. Monthly reviews help you keep track of your progress, make changes when necessary, and stay on track with your changing priorities. This can help you stay calm when unexpected costs or income changes happen, so your finances stay under control no matter what life throws at you.

Emergency Fund Focus

Building and maintaining an emergency fund is an important part of any financial strategy. A well-funded emergency reserve ensures that you can handle unexpected expenses without derailing your broader financial goals. This safety net is important to maintaining financial stability and peace of mind.

Shifting from Solely Saving to Strategic Investing

Why Invest Beyond Saving?

It’s important to save money, but savings accounts usually have low interest rates that don’t keep up with inflation. Investing, on the other hand, lets you take advantage of compounding returns and build wealth over time more effectively. In today’s world, it’s important to have a balance of saving and investing.

Popular Investment Options

| Investment Type | Description | Average Return |

|---|---|---|

| Index Funds | Low-cost funds that track market performance with diversified holdings. | 7% average annual return |

| Real Estate | Tangible assets that offer both rental income and appreciation. | Varies (average 8% – 10% annual return) |

| Exchange-Traded Funds (ETFs) | Funds with lower fees that hold a variety of stocks or bonds. | 6% to 8% annually |

| Peer-to-Peer Lending | Lending money to individuals or businesses to earn interest. | 5% to 10% annually |

Regular investing often leads to far better returns than simply saving, contributing to stronger financial futures.

Targeting Experiences Over Material Wealth

Benefits of Prioritizing Experiences

In 2025, people are starting to rethink what defines success and happiness. More individuals are prioritizing experiences over accumulating material wealth.

This shift leads to:

- Improved Mental Health: Travel, new experiences, and personal growth activities contribute to long-term happiness.

- Stronger Relationships: Shared experiences with loved ones strengthen bonds.

- Personal Growth: Embracing new experiences leads to learning and resilience.

| Experience | Material Item |

|---|---|

| Traveling to a new country | Luxury handbag |

| Attending a concert | Latest smartphone |

| Cooking class with loved ones | Designer kitchenware |

Focusing on experiences cultivates a meaningful lifestyle, bringing more lasting joy than acquiring material possessions.

Redefining Success Beyond Traditional Wealth Metrics

Broader Success Factors

In 2025, success isn’t just measured by financial wealth. People are starting to value:

| Success Factor | Why It Matters |

|---|---|

| Quality of Life | A balance between personal happiness and work. |

| Social Connections | Strong relationships with family and friends. |

| Personal Growth | Constant learning and skill development. |

| Impact on Others | Positive contributions to society and the environment. |

Evaluating success through these lenses encourages a more fulfilling financial journey and fosters a deeper sense of purpose.

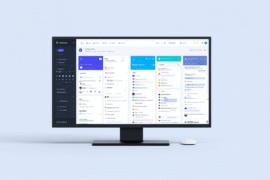

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Prioritizing Financial Education as Your Best Investment

Benefits of Financial Learning

Ongoing financial education is one of the best investments you can make. Here’s why:

- Empowerment: Knowing how money works allows you to make more informed decisions aligned with your goals.

- Assurance: A solid knowledge of financial principles reduces stress and anxiety around money.

- Flexibility: Staying informed helps you adapt to financial changes, ensuring long-term success.

| Helpful Digital Budgeting Apps | Features | Benefits |

|---|---|---|

| Mint | Real-time expense tracking | Helps you stay ahead of your spending habits |

| YNAB (You Need A Budget) | Proactive budgeting | Allocate every dollar effectively |

| Acorns | Round-up investments | Simplifies your investing efforts |

Creating Community Connections for Wealth Building

Advantages of Financial Communities

Financial communities can provide:

- Shared Knowledge: Learn from others’ experiences.

- Collective Motivation: Stay motivated by working with others toward common financial goals.

- Access to Unique Opportunities: Discover new investment and savings opportunities.

| Action | Potential Benefits |

|---|---|

| Join a Local Investment Group | Access shared resources and knowledge |

| Participate in Community Savings Plans | Motivation through group goals |

| Attend Financial Literacy Events | Network with experts and enhance skills |

Building community ties strengthens financial resilience and provides valuable support.

How to Budget Money

When creating a budget in 2025, consider the following steps:

- Figure out your after-tax income.

- Choose a budgeting system that works for you.

- Track your progress regularly to stay on top of your goals.

- Automate your savings to make saving easier.

- Practice ongoing budget management by reviewing and adjusting your plan regularly.

Why You Should Make a Budget:

- Helps prepare for emergencies: A clear budget sets aside funds for unexpected costs.

- Reveals spending habits and patterns: Knowing where your money goes is important for better management.

Conclusion

To deal with the changing financial realities of 2025, you need to be open to change, learn new things, and have a bigger idea of what success means. You can not only increase your wealth but also improve your life by moving from traditional saving to strategic investing, putting experiences ahead of material goods, and building strong financial communities. These smart ways to budget help you live more purposefully and make financial choices with confidence. You will find more happiness, growth, and success in your financial journey as you continue to use these modern methods.

Frequently Asked Questions

What are the traditional old money rules that smart savers are breaking in 2025?

A lot of people are moving away from strict saving, avoiding all debt, and making safe investments. People are using more flexible strategies in 2025, such as investing, putting experiences first, and thinking about how their financial decisions will affect the environment and society.

Why is it important to rethink the old money rule of avoiding debt at all costs?

Low-interest loans for education or property are examples of selective debt that can help you build wealth. If you handle these debts responsibly, your money will grow over time.

How is the definition of saving changing in 2025?

In today’s world, saving often means making smart investments in a variety of assets to protect your buying power and grow your wealth, especially when inflation is high and bank interest rates are low.

What does it mean to put experiences ahead of things you buy?

Putting travel, learning, and personal growth ahead of material things leads to lasting happiness and more meaningful memories, which makes life richer and more fulfilling.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: Break Old Money Rules to Grow Wealth in 2025

https://fangwallet.com/2025/08/07/break-old-money-rules-to-grow-wealth-in-2025/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

Collins, J. L. (2025). The Simple Path to Wealth (Revised & Expanded 2025 Edition): Your Road Map to Financial Independence and a Rich, Free Life. Simon and Schuster.