This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

The information presented in this article is accurate to the best of our knowledge at the time of publication. However, information is subject to change, and no guarantees are made about the continued accuracy or completeness of this content after its publication date.

Managing your finances effectively is key to achieving financial stability and securing a brighter future. With numerous financial decisions to make, it can sometimes feel overwhelming. Whether you’re saving for a vacation, a new home, or building an emergency fund, the path to financial health requires a combination of strategy, dedication, and small daily changes. Here, we’ll explore 30 practical tips that will empower you to save money, break down your financial goals, and give you control over your financial future.

- Financial Goals and Priorities

- Creating a Realistic Budget That Works for You

- Simple Strategies for Cutting Everyday Expenses

- Exploring Alternative Income Streams for Extra Cash

- Building a Savings Habit That Sticks

- Making Smart Decisions About Debt and Credit

- Conclusion

- Frequently Asked Questions

- Recommended Reads

Financial Goals and Priorities

Before diving into budgeting and savings strategies, the first step is understanding your financial goals. Start by identifying what you want to achieve and breaking your goals into manageable categories. This will help you focus on what matters most and prioritize your financial efforts.

Goal Breakdown:

- Short-term Goals (1 Year): Create an emergency fund or pay off small debts.

- Medium-term Goals (3-5 Years): Save for a new car, a wedding, or a down payment on a house.

- Long-term Goals (5+ Years): Plan for retirement, children’s education, or buying a home.

By categorizing and prioritizing your goals, you can make saving feel less overwhelming. It also helps keep you motivated as you track progress.

| Goal Type | Specific Goal | Time Frame |

|---|---|---|

| Short-term | Emergency Fund | 1 Year |

| Medium-term | Down Payment for Car | 3 Years |

| Long-term | Retirement Savings | 20 Years |

Creating a Realistic Budget That Works for You

A solid budget is crucial for staying on track with your savings goals. Start by evaluating your monthly income and expenses. Identify fixed expenses like rent or mortgage, utilities, and loan payments, as well as variable expenses like groceries and entertainment.

Budget Categories:

- Fixed Expenses: Rent, utilities, loan payments.

- Variable Expenses: Groceries, dining out, and entertainment.

- Savings & Investments: Emergency fund, retirement accounts.

Tracking your expenses for a couple of months will help you see where you can cut back or reallocate funds. The goal is to create a budget that allows flexibility but also pushes you toward your financial goals.

Sample Budget:

| Category | Budgeted Amount | Actual Spending | Difference |

|---|---|---|---|

| Rent | $1,200 | $1,200 | $0 |

| Groceries | $300 | $350 | -$50 |

| Utilities | $150 | $130 | $20 |

| Entertainment | $100 | $150 | -$50 |

| Savings | $200 | $200 | $0 |

Review your budget each month to adjust as needed. Regular checks will keep you on track with your savings while still allowing for some flexibility.

Simple Strategies for Cutting Everyday Expenses

Cutting back on daily expenses can lead to significant savings over time. By making small changes to your habits, you can free up money to put toward your goals.

Practical Cost-Cutting Strategies:

- Meal Planning: Plan your meals ahead of time to reduce impulse buys and avoid food waste.

- Limit Eating Out: Set a monthly dining-out limit and focus on cooking at home.

- Audit Subscriptions: Review your subscriptions (streaming services, gym memberships) and cancel those you no longer use.

- Shop Smart: Stick to a shopping list and look for discounts, sales, and coupons.

- Energy Efficiency: Switch to energy-efficient appliances and turn off lights when not in use.

Estimated Savings:

| Expense Category | Potential Savings |

|---|---|

| Dining Out | $100/month |

| Subscriptions | $50/month |

| Groceries | $75/month |

| Utilities | $40/month |

By implementing these small changes, you’ll see your savings grow each month without sacrificing your lifestyle.

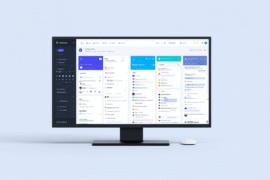

Voted "Best Overall Budgeting App" by Forbes and WSJ

Monarch Money helps you budget, track spending, set goals, and plan your financial future—all in one app.

Get 50% OFF your first year with code MONARCHVIP

Exploring Alternative Income Streams for Extra Cash

If you’re looking to boost your income, consider exploring side gigs or leveraging skills and hobbies for extra cash. Here are some options that don’t require a full-time commitment:

Potential Extra Income Streams:

- Freelancing: Use your skills in writing, graphic design, or programming on platforms like Upwork or Fiverr.

- Online Tutoring: Teach subjects you excel in through platforms like Tutor.com or Chegg.

- Sell Handmade Goods: If you’re crafty, consider selling your products on Etsy.

- Market Research: Participate in online surveys or research studies through sites like Swagbucks or Survey Junkie.

You can also make quick money by selling things you don’t use around the house. You could try selling things on sites like eBay or Facebook Marketplace.

Potential Items to Sell:

| Item | Estimated Value |

|---|---|

| Old Electronics | $50 to $200 |

| Designer Clothing | $20 to $100 |

| Collectible Items | $10 to $150 |

| Furniture | $30 to $500 |

By diversifying your income streams, you can increase your overall savings without committing to a second full-time job.

Building a Savings Habit That Sticks

Creating a consistent savings habit takes time, but it’s achievable with a few smart strategies. The key is to make saving automatic and build a habit over time.

Tips for Building a Savings Habit:

- Set Up an Emergency Fund: Aim to save 3-6 months of living expenses for unexpected events.

- Use Savings Apps: Use apps that automatically transfer money into savings, like Acorns or Digit.

- Employer Match: Contribute to your retirement account up to the full employer match to maximize savings.

- Track Your Spending: Regularly review your expenses and identify where you can cut back.

One method that works well is the “pay yourself first” strategy. This involves automatically putting a portion of your income into savings before covering any expenses.

Making Smart Decisions About Debt and Credit

Managing debt wisely is critical for maintaining financial health. The first step is assessing your current debts and prioritizing high-interest ones to save on interest over time.

Tips for Managing Debt:

- Pay More Than the Minimum: Paying more than the minimum balance on credit cards reduces interest costs.

- Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into one loan with a lower rate.

- Monitor Your Credit Score: Regularly check your credit score and report for errors or opportunities to improve.

Debt Types and Interest Rates:

| Debt Type | Average Interest Rate | Recommendation |

|---|---|---|

| Credit Cards | 15% to 25% | Pay off ASAP |

| Personal Loans | 10% to 15% | Consider consolidation |

| Student Loans | 3% to 7% | Explore repayment plans |

Reducing high-interest debt will give you more flexibility with your finances and help you reach your savings goals faster.

Conclusion

You can’t become financially stable overnight, but you can take charge of your financial future by making smart savings plans, budgets, and plans for the future. Setting clear goals, cutting out unnecessary costs, looking for new ways to make money, and keeping track of your debt will all help you get to a place where you feel financially secure. You need to be consistent. If you make small changes today, you can make big improvements in your financial health over time.

Frequently Asked Questions

What are some easy ways to cut everyday expenses?

Try meal prepping, cooking at home more, and switching to generic brands. Reviewing and cancelling unused subscriptions can also save you money.

How can I budget effectively?

Track your income and expenses, set clear financial goals, and review your budget monthly. Adjust it as needed to stay on track.

What are some smart shopping tips?

Make a shopping list, take advantage of sales and coupons, and consider buying used items from thrift stores or consignment shops.

How can I save on utilities?

Switch to energy-efficient appliances, turn off lights when not in use, and take shorter showers or use cold water for laundry.

How can I save money on transportation?

Carpool or use public transportation, walk or bike short distances, and maintain your vehicle for better fuel efficiency.

What are some tips for saving on entertainment?

Attend free community events, use streaming services instead of cable, and host DIY entertainment nights with friends or family.

How can I manage my subscriptions wisely?

Review your subscriptions regularly, cancel any you don’t use, and look for discounts or bundles.

How does saving for emergencies affect overall savings?

An emergency fund helps you avoid relying on credit for unexpected expenses, ensuring financial security during tough times.

How can I reduce debt effectively?

Focus on paying off high-interest debts first, consolidate loans if possible, and avoid accumulating new debt by sticking to your budget.

How can I save money on groceries?

Plan meals, buy seasonal produce, use loyalty programs, and shop with a list to avoid impulse buying.

What are some uncommon ways to save money?

Negotiate bills like cable or insurance rates, use cash for discretionary spending, or barter services with friends.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the contact us form to provide feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well - better yet, sharing on social media. Thank you for the support! 🍉

Article Title: 30 Practical Ways to Save Money

https://fangwallet.com/2025/11/05/30-practical-ways-to-save-money/The FangWallet Promise

FangWallet is an editorially independent resource - founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Subscribe to get a free daily budget planner printable to help get your money on track!

Make passive money the right way. No spam.

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author's alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.