Get a 30% discount when you use the Airbnb promo code S30 for places to stay and travel bookings Enter this code when you check out to find big savings You can use this code if you are new to Airbnb or if you have used it before Try to use the S30 code

Wondering if you can write off your timeshare as a tax deduction? While it sounds appealing, the IRS typically treats timeshares as personal property. This means most expenses related to vacation ownership aren’t deductible, but explore mortgage interest deductions if applicable.

Most stipends are treated as taxable income by the IRS. A few stipends may not be taxed if they meet certain IRS rules, such as commuting aid and education support. Employers should create clear plans and follow IRS guidelines to provide tax-free stipends. Both employers and employees must understand the tax effects of stipends

Waking up early might seem counterintuitive to some, but the truth is, it can be a game changer for your finances. Those quiet morning hours allow for focused planning, skill development, and networking-all essential for success. Don't let sleep hold you back!

When starting your credit journey, finding the right card can be daunting. In this listicle, you'll discover the best credit cards specifically designed for beginners with no credit history. Get ready to unlock financial opportunities and build your score!

Looking to maximize your Amex points? In this listicle, you'll discover the best ways to redeem those valuable points for travel, dining, and shopping. Get ready to unlock incredible experiences while ensuring you get the most bang for your buck!

If you've been eyeing the Microsoft Surface Pro bundle, now's the time to act! It's currently at its lowest price ever, making it the perfect opportunity to enhance your productivity and creativity. Don't miss out on this fantastic deal!

It's important to keep your digital things safe in the world of cryptocurrency. When you learn about cryptocurrency wallets, it's critical to understand cold storage. You can keep your cryptocurrency offline in a cold wallet. It keeps your private keys off the internet. This feature keeps hackers and other online threats at bay very well.

The way we rent cars is changing along with the way we travel. Peer-to-peer car rental sites like Airbnb Cars (powered by Turo) are changing the way people rent cars because of the rise of the sharing economy. Travelers can now rent cars directly from local owners instead of going through expensive rental companies that

In recent years, the term "private capital’s public puke" has emerged, highlighting how private investments often turn sour, spilling over into public markets. This phenomenon underscores the delicate balance between profit motives and public impact.

Discover the best paperless receipt apps that boost efficiency, accuracy, and sustainability with AI, OCR, and secure cloud storage.

Recent analysis reveals that private equity portfolios at major Canadian investors have been lagging behind expectations. As these firms reassess their strategies, many are questioning the long-term viability of their investments in this asset class.

Despite escalating trade tensions and tariff uncertainties, the bond market remains surprisingly resilient. Investors may be overlooking these risks, focusing instead on other economic indicators, which could lead to significant surprises down the line.

Jira is a strong project management tool. It helps teams plan, track, and finish software projects and other kinds of work. But Jira is not just for software development. It also supports agile project management and task management. With its flexible tools and excellent features, Jira is a valuable resource for teams across various areas.

It's important to know how to manage your inventory in the busy world of business. This is where the inventory turnover ratio, or stock turnover, comes in handy. This is a simple but powerful way to find out how well your business is running. This ratio tells you how quickly you sell and restock your

In today’s world of lawsuits, protecting your company from risks is important. This includes risks related to employment practices liability. We will help you understand Employment Liability Coverage. It is a key part of your business owner's policy. We'll look at the details of this coverage. We will talk about its benefits and show how

Navigating self-employment taxes can be tricky. One common mistake is overlooking business expenses. Keep meticulous records and consult a tax professional to ensure you're maximizing deductions and minimizing liabilities. Avoid these errors to stay financially healthy!

Rewiring your home can be an important step in keeping it safe and working well, especially in older homes with old wiring. It may seem hard, but knowing the basics can make it easier to deal with and help you make smart choices. We will explain why rewiring is necessary, how much it will cost,

As the tech world evolves, savvy investors are recognizing the potential of STMicroelectronics (STM). With its innovative semiconductor solutions and strong market positioning, STM is quietly becoming a key player, making it a smart bet for future growth.

Ready to retire two years earlier? Start by maximizing your retirement contributions and consider downsizing your home. Strategic investment choices and reducing debts can also boost your savings. Small lifestyle changes today can lead to financial freedom tomorrow!

The difference between active and passive income is important to reaching your financial goals. Active income requires you to trade time for money, such as through a job or freelance work.

Debt collection follows both federal and state rules, and the Fair Debt Collection Practices Act (FDCPA) is one of these. It keeps people safe from unfair and harsh ways of getting money back. The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) are the ones who check that these laws are

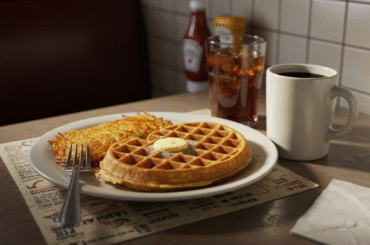

Waffle House menu prices are increasing on popular items like waffles and hash browns. Learn what's changing, why it’s happening, and how to save money on your next visit.

Canceling your auto insurance can feel daunting, but it’s straightforward. Start by reviewing your policy for cancellation details. Contact your insurer, provide necessary info, and confirm any refunds. Keep documentation for your records—it's that simple!

Google's Gemini 2.5 Pro, its most advanced AI model to date, has just been released for free! This cutting-edge technology promises remarkable enhancements in natural language understanding, making AI more accessible and powerful for everyone.

Explore the best Fourth of July 2025 deals at Home Depot, save up to 50% on appliances, tools, grills, and more. Find top brands and exclusive online offers now.

The Euro is facing significant challenges, leaving currency traders anxious about its future. As economic indicators falter, the question remains: how much lower can Euro futures dip? Understanding the nuances is crucial for navigating this turbulent phase.

As Netflix stock shows signs of losing momentum, all eyes are now on the upcoming Q2 earnings report. Investors hope strong subscriber growth and strategic shifts could revive confidence and spark a turnaround for the streaming giant.

Looking to maximize your savings in 2025-2026? Using a Kikoff referral code can be a smart move! By sharing your code with friends or family, you both benefit-enjoy rewards when they sign up. Explore this opportunity for easy cash back!

Lululemon's recent options activity is intriguing, showcasing a spike in unusual trades that hint at investor optimism. As the brand expands and innovates, understanding these market movements can provide insights into potential stock performance.