Many dream of wealth, but most never achieve it. Reasons include a lack of financial education, fear of taking risks, poor spending habits, and resistance to change. Knowing these barriers is the first step toward breaking free and building wealth.

If you find a home you love that's marked as contingent, you can still place an offer. While it won't be prioritized, it keeps you in the running should the first buyer back out. Always consult your agent for the best strategy!

In an age where AI and automation threaten many jobs, certain side gigs remain resilient. Personal coaching, skilled trades, and creative arts thrive on human touch, empathy, and unique craftsmanship-qualities machines can't replicate. Embrace these opportunities!

Keeping your car in top shape can save you from costly repairs down the road. By following these 13 essential maintenance tips, you’ll not only extend your vehicle's lifespan but also ensure a smoother and safer driving experience.

Planning for long-term care costs is essential for securing your financial future. Start by assessing your potential needs, exploring insurance options, saving strategically, discussing plans with family, and staying informed about state aid programs.

Looking to maximize your savings on everyday spending? In this listicle, we break down the best credit cards for gas and groceries. You'll discover options that offer cash back, rewards points, and exclusive discounts-perfect for fueling up and stocking your pantry!

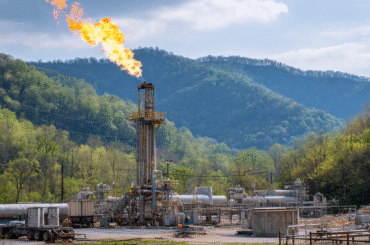

EQT is changing the way energy works in Appalachia by using natural gas as a way to grow in a way that lasts. They're not just powering homes; they're also making the world a cleaner, greener place by combining new ideas with smart ways of doing things.

In this listicle, explore the top ways to make the most of Best Buy's no-interest financing options! You'll discover tips for budgeting, enticing deals on electronics, and how to maximize your purchase power without overwhelming debt. Get ready to save smart!

Investing in Data Monetization Startups Data monetization startups turn raw data into new ways to make money. These companies use advanced data tools to find ideas in customer and business data. Growth is fueled by artificial intelligence, machine learning, and expanding data marketplaces. Popular models include Data-as-a-Service (DaaS) and Insight-as-a-Service. Investors should evaluate market fit,

Webull vs E*TRADE Expected Returns on $1000 Webull and E*TRADE are two popular trading platforms that investors often compare when choosing where to grow their money. Both allow commission-free stock trading but differ in features, account options, and available investment products. Webull attracts frequent traders with advanced tools, while E*TRADE appeals to those who want

Introduction Choosing between Bluehost and SiteGround can affect your website's speed, stability, and overall experience for visitors. These two hosts are popular and each has distinct advantages. Picking the right provider matters for WordPress sites and other business websites because server performance impacts user experience, search rankings, and conversions. SiteGround offers faster performance and

Getting out of debt can feel overwhelming, but small changes can lead to big results. Start by creating a budget that prioritizes essentials and debt payments. Consider leveraging the snowball method, where you tackle smaller debts first, for motivation.

As investors, we often only think about the obvious risks, but there are three potential economic landmines that we should be aware of. If you don't pay attention to these things, your portfolio could go off the rails because of the shadow banking sector's growing instability and the weakness of the supply chain.

Travel plans can change suddenly, and unexpected events may leave guests worried about losing money. Airbnb has structured refund and cancellation policies to help protect both travelers and hosts, but these rules can be confusing without a clear explanation. Whether a host cancels, a property does not match what was promised, or a personal emergency

Looking for the best credit card options for kids? In this listicle, you’ll discover top picks that teach financial responsibility while offering parental controls. Each card balances convenience and safety, helping your child become financially savvy.

Looking for the best credit card to manage your utility bills? In this listicle, you’ll discover top picks that offer rewards, cashback, and perks tailored just for utilities. Save money while keeping the lights on—let’s dive in!

Looking for the best insurance as a first-time driver? You’re in the right place! In this listicle, you’ll find top options that balance affordability with comprehensive coverage. Get ready to hit the road knowing you're well-protected!

If you've been eyeing the Apple iPad Air, now's the perfect time to buy! It's currently on sale for just $370, making it an excellent deal for a powerful tablet. Don’t miss out on this opportunity to enhance your tech experience!

Eating healthy on a budget is achievable with a little planning. Focus on whole foods like grains, beans, and seasonal vegetables. Meal prepping can save both time and money. Remember, small changes make a big difference without breaking the bank.

Before signing a lease, it's crucial to negotiate key terms that can affect your living situation. From rent price to maintenance responsibilities, understanding these 12 essential terms can empower you to secure a better deal for your new home.

A one dollar bill with a star might seem ordinary, but it's a collector's treasure! The star design indicates it's a replacement note, issued to replace damaged bills. This small detail makes it rare and sought after by numismatists. Fascinating, right?

Compare Payoneer and Remitly for international payments. Explore fees, currencies, global reach, account types, and features to pick the right service.

Looking for peace of mind in your California home? This listicle explores the best home warranty options tailored to your needs. Dive in to discover top providers, coverage details, and customer reviews that can help make your choice easier!

Smart Ways to Invest in Emerging Markets in 2025 Investing around the world isn't just limited to the US and Western Europe anymore. Emerging markets are getting more attention from investors because they have the potential for growth, a growing number of consumers, and changing financial systems. These economies are going through a change, which

Traditional 401(k) Contributions and Immediate Tax Savings Traditional 401(k) contributions lower your Adjusted Gross Income (AGI), providing immediate tax savings. Roth 401(k) contributions do not reduce AGI since they are made with post-tax dollars, but withdrawals in retirement are tax-free. Optimizing 401(k) contributions can help you qualify for additional tax deductions and credits by lowering

Legal Considerations for Side Hustles Learn how to make your side hustle follow US laws and avoid extra risks. Understand how job contracts and company rules help manage side work and lower conflicts. See why keeping the right paperwork is important to protect your small business in a legal way. Get to know the tax

A recent forecast suggests Bitcoin may mirror the S&P 500's performance, potentially reaching new all-time highs in July. This correlation underscores the growing intertwining of crypto and traditional markets, offering fresh hope for investors.

As we move towards a decentralized world, investing in blockchain stocks can be a savvy move. Companies like Coinbase and Riot Blockchain are at the forefront, offering unique opportunities for growth. Explore these stocks to harness the potential of blockchain technology.