Colorado draws many new riders with open highways, mountain views, and a strong outdoor culture. A first purchase can feel simple at the beginning. Attention stays on style, color, or engine size. Important details slip quietly into the background. Those details shape safety, cost, and long-term satisfaction in real ways. Many buyers also rush the

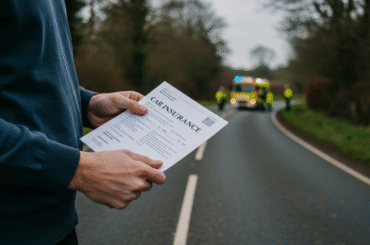

Looking for the best car insurance in NC? You're in the right place! In this listicle, you'll discover top providers that offer great rates and reliable coverage. From discounts to customer service ratings, we've got all the info you need to make an informed choice!

Buy Here, Pay Here (BHPH) car dealerships offer financing directly, allowing customers to purchase vehicles with in-house payment plans. While convenient, this method comes with risks, including high interest rates and potential vehicle repossession. Stay informed!

When searching for the best car insurance in New Mexico, you want options that suit your lifestyle and budget. In this listicle, you'll discover top providers, coverage types, and tips to find affordable rates tailored just for you. Get ready to hit the road with confidence!

Best Cheap Car Insurance in Oregon for July 2025 Oregon drivers usually pay about $76 each month for minimum coverage. For full coverage, the price is around $180. These costs are a bit higher than the average in the country, but you can still find good prices if you pick the right company. It does

Looking for the best car insurance in Ohio? You're in the right place! This listicle covers top providers, coverage options, and tips to save money. Expect straightforward comparisons and unique insights tailored to help you make an informed decision!

Keeping your car in top shape can save you from costly repairs down the road. By following these 13 essential maintenance tips, you’ll not only extend your vehicle's lifespan but also ensure a smoother and safer driving experience.

AAA membership offers savings on repairs and maintenance in addition to roadside help. AAA-approved shops provide 10% discounts on labor, with savings up to 75 dollars. Extra discounts are available on NAPA Auto Parts and AAA Premium Batteries. Membership levels (Classic, Plus, and Premier) provide different coverage and savings. Online accounts and the AAA

Short-term auto insurance gives you coverage for one day up to several months. It provides legal help without needing a long-term plan. This is great for when you borrow a car, rent one, or let other people drive. Policies can also cover damage to property and offer other options. You can keep your insurance

Are you looking for the best plans for roadside assistance? You are in the right place. We'll talk about the best choices that will help you feel safe on the road. You can expect in-depth comparisons, information about prices, and special benefits to help you make the right choice.

Looking for the best car insurance in Ohio? You've come to the right place! In this listicle, you'll discover top-rated options that combine coverage, affordability, and customer satisfaction. Get ready to find your perfect policy today!

Don't give up if you want to get an auto loan but don't have any credit. Start by looking into lenders that give loans to people with bad credit. To make your application stronger, think about putting down a bigger deposit or adding a co-signer.

Looking for the best auto insurance in Georgia? You’re in the right place! In this listicle, you'll discover top-rated providers, key coverage options, and tips to save on premiums. Get ready to choose a policy that fits your needs perfectly!

When refinancing a car loan, it's crucial to ask key questions. Inquire about the interest rate, loan terms, and any fees involved. Also, check if your credit score has improved and explore how it might impact your new loan options. Empower yourself with knowledge!

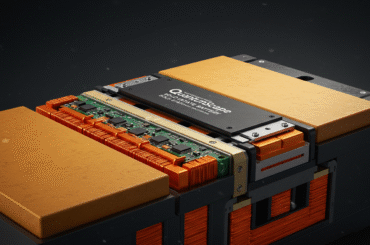

QuantumScape has generated buzz for its innovative solid-state battery technology, promising faster charging and greater energy density. However, the journey is fraught with challenges, making it a high-risk play for investors despite its groundbreaking potential.

Want to feel at ease? Check out our list of the best umbrella insurance options. We list our top picks to help you protect your assets with extra liability coverage.

Looking for the best car insurance in New Jersey? You're in the right place! Our listicle breaks down top providers, detailing coverage options, pricing, and customer satisfaction. Get ready to find the perfect policy that suits your needs!

Buying auto body paint supplies at wholesale prices reduces costs and provides more options. Learn the different types of paint supplies, including primers, base coats, clear coats, and specialty finishes. Find trusted wholesale suppliers and understand how to research, compare, and communicate with them. Discover tips for better deals, such as bulk orders and

Tesla's recent decisions have shifted its perception from a risky investment to a reckless one. With increasing competition and inconsistent leadership, investors must carefully reassess their confidence in its long-term viability.

Navigating the auto loan process with bad credit can feel daunting, but it's possible! Start by checking your credit report for errors, consider a co-signer, and shop around for lenders willing to work with you. Your dream car might be closer than you think!

Tesla is in a perfect storm because of rising sales, changing politics, and the rise of BYD. This change brings both problems and chances, changing the electric vehicle market and Tesla's future role in it.

When searching for the best car insurance in Illinois in 2025, look for providers that balance coverage options with affordability. Companies that prioritize customer service and claims efficiency stand out, ensuring peace of mind on the road.

Discover the best cars for commuting with top picks that combine fuel efficiency, comfort, and reliability for long daily drives.

When a car is totaled, the insurance check typically goes to the policyholder. However, if there's a loan or lease involved, the lender may receive the payment. It’s essential to understand your policy and communicate with your insurer to avoid surprises.

Looking for the best auto insurance in Washington State? You're in the right place! In this listicle, we'll break down top providers, coverage options, and unique benefits to help you find the perfect policy tailored just for you. Let's dive in!

Are you a senior over 70 looking for the best car insurance? In this listicle, we'll explore the top providers tailored to your needs, with options that offer affordability and comprehensive coverage. Discover policies suited for seasoned drivers like you!

Looking for the best car insurance in Missouri? You've come to the right place! In this listicle, we'll break down top-rated providers, comparing coverage options and prices. Get ready to discover which policies will suit your needs and budget perfectly!

In a remarkable shift towards sustainability, Norway leads the charge with an astonishing 76% of its car sales being electric. This groundbreaking statistic highlights the country's commitment to reducing carbon emissions and embracing innovative technology.

The way we rent cars is changing along with the way we travel. Peer-to-peer car rental sites like Airbnb Cars (powered by Turo) are changing the way people rent cars because of the rise of the sharing economy. Travelers can now rent cars directly from local owners instead of going through expensive rental companies that

In a pivotal year for Tesla, mastering the last four turns has showcased our agility in adapting to market shifts. As we head forward, the focus is on sustainable innovation and global expansion. Our journey isn't just about electric cars; it's a roadmap to the future.