Over the past decade, significant changes have occurred in municipal banking, including new reporting requirements, advancements in cybersecurity, shifts in interest rates and credit availability, and a growing public demand for financial transparency. Local officials have expanded the criteria by which they evaluate banks to include factors such as protecting public funds, operational efficiency and

A high-yield savings account (HYSA) is one of the smartest tools for growing your money safely. With interest rates significantly higher than traditional savings accounts, HYSAs can help you build your emergency fund, save for short-term goals, or simply earn more on idle cash. But not all high-yield savings accounts are created equal.

When you need quick cash, options abound! From personal loans to peer-to-peer lending, knowing the right approaches can make all the difference. Let's explore 12 effective ways to borrow money quickly and safely, ensuring you find the best fit for your needs.

Having good credit is essential for financial health. It opens doors to better loan rates, lower insurance premiums, and higher chances of rental approval. With a solid credit score, you're better equipped to navigate life’s big purchases and opportunities.

Understanding property insurance is crucial for protecting your assets. From homeowners and renters insurance to commercial policies, each type offers unique coverage. Knowing your options helps ensure you're adequately protected against potential risks.

In February 2025, it's important to find the right checking account for your small business. We looked through all the options and found the 10 best accounts that have the right mix of features for you, such as low fees, easy online access, and great customer service.

The Evolving Landscape of Digital Fundraising Digital fundraising has transformed how nonprofits collect donations. Platforms like Venmo and PayPal play a strategic role in improving donation collection, donor experience, and overall fundraising efficiency. Choosing the right platform directly affects how smoothly funds are received and managed. Implementation Process for Nonprofits 1. Documentation Preparation Collect all

As the Fed weighs potential rate cuts, it’s closely monitoring eight key economic indicators. Factors like inflation trends, unemployment rates, and consumer spending play pivotal roles in shaping its decisions. Understanding these can help us anticipate future moves.

Zelle is a fast, secure, and free digital payment service that allows you to send money directly from your bank account to others within minutes. Available through most major banks and credit unions in the U.S., Zelle simplifies transactions by removing the need for traditional payment methods.

Compare the best savings accounts in 2025 by interest rate, fees, and features. Learn how to choose the right account, create a savings plan, and apply online with ease.

Looking for the best car insurance in Ohio? You're in the right place! This listicle covers top providers, coverage options, and tips to save money. Expect straightforward comparisons and unique insights tailored to help you make an informed decision!

The USD/THB currency pair shows the exchange rate between the US dollar and the Thai baht. Knowing this exchange rate matters for travelers, businesses, and investors who use these currencies. Changes in the exchange rate affect purchasing power when exchanging or spending money. Many online tools are available to track the USD/THB rate and

Looking for the best joint accounts for couples? You're in the right place! In this listicle, we'll explore top options that cater to your shared financial needs. Get ready to find accounts with low fees, great rewards, and simple management features just for you two!

When it comes to preparing for your future, an Individual Savings Account (ISA) is a powerful, tax-efficient tool. A balanced Stocks and Shares ISA portfolio will ensure you receive maximum investment growth, reduce risks caused by market fluctuations, and earn a significant income for when you are ready to withdraw. However, after you've decided to

Looking to maximize your savings on everyday spending? In this listicle, we break down the best credit cards for gas and groceries. You'll discover options that offer cash back, rewards points, and exclusive discounts-perfect for fueling up and stocking your pantry!

Looking for the best banks in California? In this listicle, we'll explore top choices tailored to your needs, from exceptional customer service to competitive interest rates. Discover which banks could help you achieve your financial goals!

American Express specializes in premium credit cards with luxury travel perks and a robust rewards program. Revolut focuses on digital banking with low fees, budgeting tools, and multi-currency support. Amex Platinum and Gold suit frequent travelers, while Revolut Metal and Ultra fit digital-first users. Fee structures differ: Amex charges higher annual fees, Revolut keeps

Many people worry about their Social Security income being garnished by the IRS or creditors. While certain government debts can lead to garnishment, Social Security benefits are generally protected. Knowing these rules can provide peace of mind.

Revolut vs PayPal for Merchants Revolut usually gives better exchange rates than PayPal when you make payments in other countries. PayPal is well known all over the world. Many people use it to pay for things online. Revolut works more like an online bank. It lets you trade cryptocurrency and use tools to help you

Refinancing your mortgage can be a smart move to lower monthly payments or tap into your home's equity. Start by assessing your current loan, researching rates, and gathering necessary documents. Don't forget to calculate the costs and potential savings to make an informed decision.

If you don’t have a bank account, obtaining a cashier’s check can still be straightforward. Visit a local credit union or a check-cashing service; they often provide this service without requiring an account. Just bring valid ID and cash for the amount needed.

CLM is a great way to make a lot of money, but it's not for people who want to sit back and let it happen. Because it changes all the time, it needs to be watched and worked on all the time. CLM might be a good fit for your portfolio if you're willing to stay involved.

In 2025, sending money internationally has never been easier. From digital wallets to crypto transfers, each option offers speed and convenience. Explore the 6 best methods, considering fees, exchange rates, and security, to ensure your funds reach loved ones seamlessly.

In our listicle on the "Best Buy Credit Card Credit Score," you'll discover what score you need to qualify, tips for improving your chances, and insights into managing your credit responsibly. Get ready to boost your buying power at Best Buy!

You can sign a check over to someone else (this is called third-party check endorsement). However, not all banks or credit unions accept it. A proper endorsement means you need to sign the back of the check and mention who will receive it. There are legal matters that can change, so it’s important to

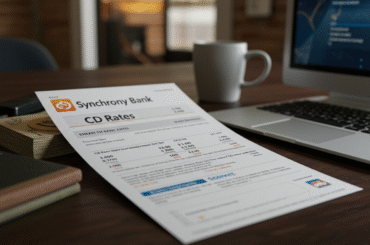

Introduction Certificates of Deposit (CDs) are a reliable way to save money. They offer a fixed interest rate over a set period, helping savers plan consistently. CDs typically carry low risk and let your money grow steadily. Synchrony Bank provides competitive CD rates with FDIC insurance for safety. Its online banking makes managing CDs simple

Looking for the best credit card options for kids? In this listicle, you’ll discover top picks that teach financial responsibility while offering parental controls. Each card balances convenience and safety, helping your child become financially savvy.

Looking for the best credit card to manage your utility bills? In this listicle, you’ll discover top picks that offer rewards, cashback, and perks tailored just for utilities. Save money while keeping the lights on—let’s dive in!

Don't give up if you want to get an auto loan but don't have any credit. Start by looking into lenders that give loans to people with bad credit. To make your application stronger, think about putting down a bigger deposit or adding a co-signer.

Building an emergency fund is crucial to financial security. Aim for 3 to 6 months' worth of expenses to handle unexpected circumstances. Start small-set aside a portion of each paycheck, and watch your savings grow over time. Prioritize this safety net!