Have you ever been angry because you couldn't get to your own money? Many people don't know about quiet laws that can limit their financial freedom, like fees for dormant accounts and complicated rules about inheriting money.

When refinancing a car loan, it's crucial to ask key questions. Inquire about the interest rate, loan terms, and any fees involved. Also, check if your credit score has improved and explore how it might impact your new loan options. Empower yourself with knowledge!

As college costs rise, many parents turn to Parent PLUS Loans to help fund their child's education. This guide explores how these loans work, eligibility requirements, and repayment options, ensuring you make informed decisions for your family's financial future.

Want to get the best deals on Southwest flights? You'll learn the best times to make purchases. Find out when you should buy to save the most money on your next trip, from booking windows to seasonal trends.

Want to find the best loans? You'll find the best-reviewed lenders, a list of their pros and cons, and real user reviews to help you make a smart choice.

Despite a focus on margin-driven growth, Prosperity Bancshares has seen its shares become increasingly affordable. Investors may find this a compelling entry point, as the bank balances profitability strategies with attractive valuations.

Introduction Knowing your credit card balance is important for making informed financial decisions. Two common terms, “statement balance” and “current balance,” reflect different aspects of your credit card activity. Understanding these terms helps you manage your finances effectively and avoid unnecessary fees. Credit Card Balances Managing your credit card balances requires more than checking numbers. Knowing

Discover how mobile-first banking improves financial access and healthcare in underserved areas, offering secure, low-cost services via smartphones.

The right loan management system can help banks, NBFCs, and fintech organizations stay competitive and efficient in 2025. As the modern fintech landscape continues to evolve, staying on top of compliance and the process of managing online loan installments to align with regulations and managing custom lending products must be your top priorities. While most

Want to change the way you bank? We will show you the best credit unions in Texas that have competitive rates, great customer service, and a wide range of financial products that are made just for you.

Navigating finances can be tough, especially for veterans with bad credit. In 2025, we've identified the 8 best personal loans tailored to help veterans rebuild their financial health. Discover options that prioritize your unique needs and financial goals.

When searching for the best credit union for personal loans, you want options that cater to your unique financial needs. In this listicle, you'll discover top institutions recognized for competitive rates, flexible terms, and outstanding customer service. Let’s dive in!

Compare Remitly and Revolut for U.S. users. See fees, transfer speed, multi-currency accounts, support, and best use cases for everyday money management.

A one dollar bill with a star might seem ordinary, but it's a collector's treasure! The star design indicates it's a replacement note, issued to replace damaged bills. This small detail makes it rare and sought after by numismatists. Fascinating, right?

Compare Payoneer and Remitly for international payments. Explore fees, currencies, global reach, account types, and features to pick the right service.

Learn important facts about credit reports, including how they affect credit scores, common errors, differences between agencies, and strategies for monitoring and improving financial health to make informed financial decisions.

In today’s competitive banking landscape, cash management isn’t just about accuracy — it’s about speed, security, and automation. Whether it's a regional credit union or a national financial institution, every bank today faces similar core challenges: reducing operational inefficiencies, reliably detecting counterfeit currency, and creating a seamless front-end and back-end cash processing experience. That’s where

Explore how Buy Now Pay Later compares with credit cards: benefits, risks, popular providers, credit effects, and tips for beginners in a clear, trustworthy summary.

Discover the best credit cards for dining to maximize rewards. Compare top dining rewards cards, earn points, miles, or cash back on restaurants, takeout, and delivery, and make every meal count

Discover the credit card trends 2025 shaping the future of payments. Explore digital wallets, eco-friendly credit cards, AI credit scoring, personalized rewards, and enhanced security features in the evolving credit card industry.

Introduction Veterans Day is a federal holiday dedicated to honoring those who have served in the United States Armed Forces. It is a time to reflect on their courage and sacrifices. As the holiday approaches, understanding its impact on banking, postal, and retail services can help you plan effectively. This guide provides practical tips to

Introduction Currency conversion is vital for individuals and businesses handling money from different countries. Whether sending money to family, visiting the Philippines, or trading internationally, converting US dollars (USD) to Philippine pesos (PHP) is necessary. This guide provides an easy-to-follow approach to convert USD to PHP efficiently. You will learn how to make smart money

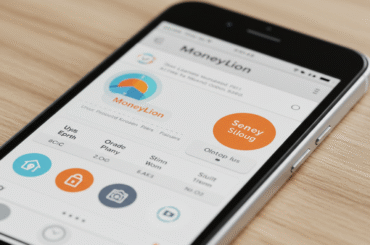

MoneyLion is a financial technology platform that offers banking and investment services tailored for everyday users. As of 2025, it provides features like personalized financial advice, low-cost loans, and tools to help manage your budget effectively.

A Pledged Asset Line (PAL) allows you to borrow against your investment portfolio, providing flexibility and liquidity when you need it. It's an ideal solution for accessing cash without selling assets, making it a smart choice for savvy investors.

Fidelity and Schwab have recently restricted trading on certain money market ETFs not issued by them. This move leaves investors seeking diverse options feeling frustrated, as these firms prioritize their own products. It's a significant shift in the brokerage landscape.

Outstanding checks can complicate your finances, but knowing their implications is important. These are checks written but not yet cashed or cleared. Regularly monitoring them helps maintain a clear view of your financial health. Stay proactive!

A sudden drop in your credit card limit can feel unsettling, but it's often linked to your credit utilization, payment history, or broader economic trends. Stay informed about your finances to navigate these changes and maintain your purchasing power.

If you're struggling with a low credit score, consider becoming an authorized user on a trusted friend's credit card. This can boost your score by leveraging their positive payment history. Just ensure their card is in good standing to see the benefits for yourself.

In the world of banking, merger and acquisition activity is showing surprising consistency. Our Bank M&A Deal Tracker reveals that despite economic fluctuations, deal-making momentum is mirroring last year's figures, indicating a resilient market.

It is important to know the basics of finance. A demand deposit is an important idea. This kind of deposit is very important in today's banking. A demand deposit is a type of bank or credit union account. You can take out money whenever you want without telling them first. A checking account is the