When it comes to mutual funds, recognizing the right moment to sell can be crucial for your financial health. From consistently poor performance to changing investment goals, here are 14 clear signs that it may be time to reevaluate your investment strategy.

Starting a business with no money may seem daunting, but it’s entirely possible. I launched my first venture by leveraging my skills, building strong networks, and tapping into free online resources. With creativity and determination, you can turn your idea into reality.

Nvidia is more than just a tech company; it's a catalyst reshaping industries. While Wall Street fixates on stock prices, it overlooks Nvidia's role in AI and beyond. As its influence expands, savvy investors should pay attention to the long-term power play at hand.

In a bold move, three market-beaters are backing up their buyback trucks, signaling confidence in their long-term strategies. With stock prices fluctuating, they're seizing the opportunity to reclaim value and reinforce their commitment to shareholders.

Are you looking to invest in reliable stocks? In this listicle, you'll discover the best railroad stocks that offer stability and growth potential. From industry giants to emerging players, each option is poised to keep your portfolio on track!

In the unfolding saga of AI dominance, Amazon and Nvidia present two divergent paths. While Amazon leverages its vast cloud infrastructure to integrate AI into everyday services, Nvidia pivots on its GPU prowess, fueling innovation. Their competition could define the future of AI.

As Nvidia continues to lead in AI and gaming technology, now might be the perfect moment to consider investing. With robust growth potential and innovative advancements on the horizon, this could be a golden opportunity you won’t want to miss.

The growing popularity of ETFs is reshaping the investment landscape, pulling some attention away from Bitcoin's foundational principle of self-custody. As institutional interest surges, it raises questions about the future of direct ownership in digital assets.

Revolut vs PayPal for Merchants Revolut usually gives better exchange rates than PayPal when you make payments in other countries. PayPal is well known all over the world. Many people use it to pay for things online. Revolut works more like an online bank. It lets you trade cryptocurrency and use tools to help you

In 2025, Zoe Financial became the best service for matching clients with financial advisors. It does this by connecting clients with advisors who have been thoroughly checked out. They make the often scary search for financial advice easier by using a personalized approach and strong resources.

Verizon is a stable investment choice that many people don't notice in today's market. It has a good dividend yield and strong fundamentals, making it a tempting choice for people who want a steady income and the chance to grow in a changing economy.

CLM is a great way to make a lot of money, but it's not for people who want to sit back and let it happen. Because it changes all the time, it needs to be watched and worked on all the time. CLM might be a good fit for your portfolio if you're willing to stay involved.

As we move into a future where data is king, three stocks stand out as game-changers for data centers: Nvidia for its cutting-edge GPUs, Equinix for its strong infrastructure solutions, and Digital Realty for its scalable real estate. They're all working together to shape the digital world of tomorrow.

Stocks closed sharply lower today as escalating tariffs stoked fears of an economic slowdown. Investors are grappling with uncertainty, weighing the potential impact on growth and corporate earnings amidst a turbulent trade landscape.

Proposed tariffs make it harder for Nvidia to grow in the AI sector. These trade barriers could raise prices and stifle new ideas, which raises important questions about the future of AI development in a market that is becoming more competitive.

Insider trading activity gives us useful information about the constantly changing world of healthcare. Recently, three healthcare stocks have seen a lot of insider buying. This makes you wonder if you should buy, sell, or hold. Let's look into what this means.

The Schwab Dividend ETF has seen a notable rally recently, driven by strong dividend growth and a stable economic outlook. Investors now ponder if this momentum can sustain itself as market conditions evolve. Continued vigilance will be key.

Running a business is tough, and sometimes it's hard to see the warning signs. If you notice declining sales, increased customer complaints, or cash flow issues, it might be time to reassess. Recognizing these signs early can save your company from closure.

At TechCrunch Disrupt 2025, Even Rogers and Max Haot showcased groundbreaking innovations in the space industry. Their insights revealed how private ventures are transforming space into a bustling marketplace, inviting entrepreneurs to explore limitless opportunities.

Dollarama's fair value continues to rise, reflecting strong performance and market demand. However, the stock's increasing valuation prompts a closer look-investors must weigh the potential for growth against the risks of overvaluation in today's market.

Are you looking for the best plans for roadside assistance? You are in the right place. We'll talk about the best choices that will help you feel safe on the road. You can expect in-depth comparisons, information about prices, and special benefits to help you make the right choice.

Microsoft's most recent earnings report showed both problems and chances, which caused its stock price to drop for the first time in a long time. Smart investors should take advantage of this moment to make money off of a strong company's potential to recover and grow.

Service Corporation International (SCI) stands out as a solid investment for long-term stability. With its strong market presence in the funeral service industry, this stock is not just for the present but can be part of a lasting legacy.

In a surprising move, WhatsApp has introduced ads within its app, marking a shift in its ad-free ethos. Users can now expect promotional content in chats, sparking discussions about privacy and user experience. How will this change the way we connect?

John Wiley & Sons has made a lot of money lately, which is a strong reason to raise their ratings. The company is likely to keep doing well in the education sector because it is committed to innovation and has strong earnings growth.

QuantaSing has made a name for itself as a promising player in the ed-tech space, especially with its recent plans for growth. Our analysts say that we should start coverage with a "Buy" rating because its new approach takes advantage of the growing digital learning market.

The SPAC king is back with a new blank-check deal, which has Wall Street buzzing. Investors are keeping a close eye on this experienced player as they try to navigate the ever-changing world of mergers and acquisitions once more.

Lowe's commitment to increasing shareholder value is still clear as we look toward 2025. The home improvement giant is ready for steady growth thanks to smart investments and a strong expansion plan. This makes it a great buy for investors who want to get the most for their money.

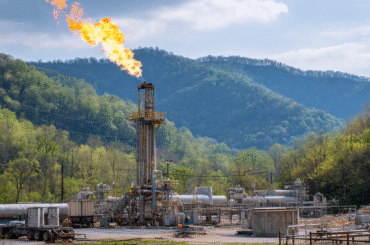

EQT is changing the way energy works in Appalachia by using natural gas as a way to grow in a way that lasts. They're not just powering homes; they're also making the world a cleaner, greener place by combining new ideas with smart ways of doing things.

Investing in Data Monetization Startups Data monetization startups turn raw data into new ways to make money. These companies use advanced data tools to find ideas in customer and business data. Growth is fueled by artificial intelligence, machine learning, and expanding data marketplaces. Popular models include Data-as-a-Service (DaaS) and Insight-as-a-Service. Investors should evaluate market fit,