Credit Karma is a free online service that empowers you to track your credit score, get personalized financial advice, and discover loan and credit card offers tailored to your needs. It's an essential tool for managing your financial health and making informed decisions.

If you're looking to remove hard inquiries from your credit report, start by reviewing your credit file for inaccurate entries. Dispute any errors with the credit bureau directly. Additionally, focus on building positive credit habits to offset the impact.

When deciding whether to tackle credit cards or student loans first, consider interest rates and repayment flexibility. Generally, high-interest credit card debt can quickly escalate, making it a priority, while student loans often come with lower rates and more lenient repayment options.

Linking your account to Bank of America for ACH push transfers is straightforward. Visit the bank’s website or app, navigate to the transfer settings, and follow the prompts to securely connect your bank account. Enjoy seamless transactions and hassle-free payments!

The American Express Ray-Ban Offer provides $35 back as a statement credit up to two times (maximum $70 total) when purchasing directly from Ray-Ban stores or at ray-ban.com/usa. Enrollment through an American Express account is required prior to purchase. The offer is valid until September 6, 2025, and applies to eligible American Express cards.

The Amex Refer a Friend program allows American Express cardholders to earn bonus points by inviting others to apply for an Amex card. The type of card determines whether you receive Membership Rewards, Hilton Honors, or Marriott Bonvoy points. Cardholders can share a personal referral link via text, email, or social media. Earn up

Looking for the perfect credit card to share with your partner? In this listicle, you'll discover the best options tailored for couples! From cashback perks to travel rewards, find out how you can maximize benefits together while managing finances seamlessly.

Improving your credit score is a powerful way to unlock financial opportunities. Start with short-term strategies like paying bills on time and reducing credit card balances. For long-term success, consider diversifying credit types and maintaining a healthy credit history.

American Express (Amex) is both a credit card issuer and payment network, while Mastercard is solely a payment processor that partners with banks. Amex cards often include luxury travel perks like airport lounge access and concierge service. Mastercard is accepted in more places globally, over 210 countries, compared to Amex’s 160+. Both offer solid

Looking for the best travel cards without an annual fee? You're in the right place! In this listicle, we'll highlight top picks that offer great rewards and perks, so you can maximize your adventures while keeping costs down. Get ready to explore!

From April to June 2025, 5% cash back credit cards offer great rewards at grocery stores, wholesale clubs, and streaming services. If you shop at Amazon, now's the time to maximize your savings. Keep track of these promotions and watch your cash back grow!

Deciding how many credit cards to have can be tricky. Generally, having 2 to 3 cards is optimal for building credit without overwhelming yourself. Track spending carefully; too many accounts can lead to debt and confusion. Balance is key!

Best Credit Card for Employee Benefits Top U.S. credit cards that support work-related spending and reward programs Statement credits, bonus points, and fraud protection features Tools for real-time spending tracking and budgeting Steps and documents required to open an account Tips to maximize usage, spending control, and balance transfers Introduction Employee benefit credit cards offer

Looking for the best retail credit cards to maximize your shopping rewards? In this listicle, you’ll discover top options that offer irresistible cash back, exclusive discounts, and valuable perks. Let’s find the perfect card to enhance your buying experience!

Credit cards can be powerful financial tools, offering convenience and rewards, but without careful management, they can also lead to costly debt. For Canadians looking to save money and manage credit wisely, adopting effective strategies is essential. This article outlines practical ways to save money on credit cards while maintaining healthy credit and reducing debt.

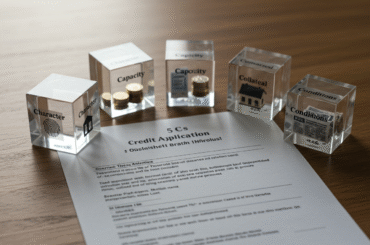

Summary Get to know the 5 C’s of credit: character, capacity, capital, the value put up for a loan, and conditions that help decide if the bank or lender will say yes to giving out a loan. Learn how your credit score and history with money matter to a bank or lender and count

The Bank of America Unlimited Cash Rewards Card offers an enticing 2% cash back on all purchases for the first year, a competitive edge for cashback enthusiasts. With Preferred Rewards, you can boost that to up to 3.12%, making it a compelling choice for savvy spenders.

In 2025, Chase Credit Journey continues to impress with its user-friendly interface and comprehensive credit monitoring tools. It offers personalized insights and tips, helping users understand and improve their credit scores effortlessly. A must-try for anyone!

In 2025, building your credit score is easier than ever with innovative apps designed for every financial journey. From user-friendly interfaces to tailored advice, discover the 10 best credit builder apps that can empower your financial future.

Looking for the best credit cards tailored for average credit? In this listicle, you'll discover top picks that offer great benefits, such as cashback rewards and manageable fees. Dive in to find a card that fits your financial lifestyle!

The Growing Threat Landscape Online shopping feels routine now, yet the fraud numbers keep rising. Global e-commerce losses surpassed $40 billion last year, and forecasts show little slowdown. Attackers automate card-testing bots, launch phishing kits within hours, and sell breached data in bulk. Consumers, meanwhile, still type the same sixteen digits into checkout fields. That

Top Look at top personal loan choices made for every credit score, good, bad, or in between See how fixed interest rates and loan terms can make payments easier or harder Learn about what 2025 interest rates may be and check out what each lender has to offer Find out how to get better

When planning your next adventure, it's crucial to have the right credit card in your wallet. In this listicle, you’ll discover the best credit cards for international travel that offer no foreign transaction fees, great rewards, and travel perks. Get ready to explore smarter!

The Fasten Credit Card is designed with flexibility in mind. It offers cashback on everyday purchases, no annual fees, and easy budgeting tools. Plus, you can track your spending through a user-friendly app, making it a smart choice for savvy spenders.

Looking for the best credit card in 2019? You've come to the right place! In this listicle, you'll discover top picks tailored for cash back, travel rewards, and low interest rates. Let’s dive in and help you find the perfect card for your needs!

Discover the new Citi Strata Card, featuring a $0 annual fee and up to 3X back on your spending. Whether dining out or shopping, this card rewards your lifestyle while keeping costs low—a perfect blend of value and flexibility!

The JetBlue Premier Card offers appealing benefits like bonus points on JetBlue purchases and in-flight discounts. However, its annual fee might deter some travelers. Evaluating how often you fly JetBlue can help determine if the rewards justify the cost.

Welcome to our list of the best credit cards for first-timers! Here, you'll discover options tailored just for you-cards with no annual fees, beginner-friendly rewards programs, and easy approval. With these picks, starting your financial journey will be a breeze!

Looking for the best second credit card? You've come to the right place! In this listicle, you'll discover top picks that complement your primary card, boost your rewards, and enhance your spending flexibility. Let’s dive into options tailored just for you!

Experiencing identity theft can feel overwhelming, but recovery is possible. Start by placing a fraud alert on your credit report, reviewing your statements for errors, and disputing fraudulent charges. Consistent monitoring and proactive steps will help restore your credit.