Introduction Online education is changing all the time, giving people more options than before. There are many websites for learning, but Udemy and Skillshare are two of the top names in the space. Both of them focus on different people and have their own types of lesson styles. Knowing how each one works the way

Are you exploring safe investment options? In this listicle, you'll discover the best short-term Treasury ETFs that can help you preserve capital while earning some yield. Get ready to enhance your portfolio with these reliable picks!

Whether you're renovating or building, understanding construction terms like punch lists, flashing, and bleeding can empower you in the process. Knowing these terms helps ensure clear communication with contractors and better oversight of your project.

Ever wondered if the interest you earn on your savings account is taxable? The short answer is: yes, it is. But don’t worry—we’re here to break down how it works and share what you can do to avoid saving account tax. How is a savings account taxed in Canada? The interest you earn from your

British Gas vs ScottishPower for New Users Choosing an energy supplier in the UK can feel overwhelming, especially if you're a new customer. Two well-known names, British Gas and ScottishPower, offer a range of tariffs, smart technology, and green energy options. While both supply electricity and gas across the country, they differ in pricing, renewable

Introduction Choosing the right energy supplier can make a significant difference in your home's comfort, your wallet, and even your impact on the environment. Two major players in the UK energy market, British Gas and OVO Energy, both provide electricity and gas to millions of homes, offering essential services like smart meters, mobile apps, and

The Right Energy Supplier for Your Home British Gas and EDF Energy are two of the UK’s top energy suppliers. British Gas also provides home services, while EDF focuses on low-carbon electricity. Both offer fixed and variable tariffs under the energy price cap, and both support 100% renewable electricity on fixed plans. EDF scores higher

Introduction Octopus Energy is disrupting the UK energy market with flexible pricing and a strong focus on green energy. British Gas remains the largest supplier in the UK but now faces growing competition and evolving customer expectations. Both providers offer smart meters and mobile apps to help users monitor their usage. New customer incentives like

Benefits of Financial Automation Find out about eight easy ways to make your money work for you. These ways can help with monthly bills, savings, and making your money grow. See how setting things up to work on their own can help you reach your money goals. It can help you keep track of what

Introduction The world of cryptocurrency changes quickly. It moves fast and has both chances and risks, so people need to be careful. As blockchain becomes a bigger part of how money works, more people want to find out how to get something good from these digital coins. There are two main ways people get into

Introduction Zero-Based Budgeting (ZBB) is a way to make a budget that starts fresh each time. It does not use past numbers or old budgets to plan for the new one. With ZBB, you need to look at and think about every cost every time you make a budget. This way, you have to be

Social Influencer Marketing See how the rise of social media influencers is changing what people do and how companies make their marketing plans. Get to know what makes different kinds of influencers stand out, like nano, micro, and mega influencers, and how brands can use each of them in a good way. Learn how brands

MoneyLion, a top company in money and tech, gives out special coupon codes and deals to help more people use what they offer. You can get bonuses straight into your bank if you join promotions, getting up to $50. All deals follow set time limits and rules so that things are fair for everyone.

What You Should Know About Security Deposits A security deposit is money that tenants pay to landlords to protect against unpaid rent or damage beyond normal wear and tear. State laws regulate how much landlords can request and when they must return the deposit after a lease ends. Common reasons landlords keep deposits include property

Choosing Between British Gas and EON Next for Your Energy Needs British Gas serves over 7 million UK households with a mix of fixed and variable tariffs, smart meter options, and home services like boiler repair and emergency cover. E.ON Next powers around 5 million homes with 100% renewable electricity and competitive unit rates. It's

Introduction Navigating college financial aid can be challenging, but the CSS Profile plays an important role in securing institutional support. Managed by the College Board, this form helps colleges assess a family's full financial picture to provide grants and scholarships. Unlike the FAFSA, the CSS Profile dives deeper into income, assets, and special expenses. Understanding

Exchange Rate Insights Between KRW and USD Why the KRW to USD Exchange Rate Changes The exchange rate between the South Korean Won and the US Dollar isn't fixed; it constantly shifts. Simply put, it tells you how much one currency is worth in terms of the other. For example, if the rate is 1

Introduction Understanding a company’s growth and performance is critical in financial analysis. Year-over-Year (YoY) analysis is an effective way to achieve this. By comparing financial data from one year to the next, businesses can uncover trends and gain valuable insights into their progress. This method provides a clear view of growth and helps companies plan

Top Features of Paid Survey Sites Find the best survey sites to help you earn extra cash in 2025. These trusted sites give rewards through PayPal accounts, Amazon gift cards, or several other ways. Learn how you can use paid survey sites to get the most out of your earning chances, some letting you get

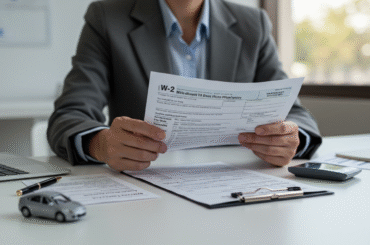

What Imputed Income Means and How It Affects Your Taxes Imputed income plays a key role in tax compliance and payroll reporting. It refers to the value of non-cash benefits you receive from your employer, such as company vehicles, domestic partner health insurance, or life insurance exceeding a set threshold. Although these benefits are not paid

Per Diem Jobs Structure Per diem is a daily allowance or payment provided to employees for work-related expenses, often during business travel or short-term assignments. The term comes from Latin and means “per day,” reflecting its temporary nature. Per diem jobs offer flexibility for both employers and employees, especially in industries with fluctuating workloads. These

Shop Around Before Choosing RV Financing Shopping around for RV financing allows you to compare offers from banks, credit unions, and online lenders. Each lender may have different qualification requirements, interest rates, fees, and repayment terms. By requesting quotes from multiple providers, you gain a clearer picture of what your monthly payments will look like

Autopay Benefits and Decision Factors Learn how autopay makes it easy to pay your car loan each month. It helps you handle your money better. Know the important things to look at, like interest rates, loan terms, and how open the lender is, when you choose an autopay provider. See how paying on time through

You can quickly move your Apple Cash money to your bank using the Apple Wallet app. Choose to move your money in minutes to a debit card, or pick the standard way and go to your bank. The regular way takes about 1 to 3 business days, but the faster way usually sends the

Food and Liability Insurance Benefits Food and liability insurance, including general liability, helps food businesses stay safe from money troubles. It protects from things like broken property, food poisoning, or people getting hurt and making a claim. The Food Liability Insurance Program (FLIP) has plans that fit food vendors, caterers, and food trucks. There are

The Role of CRM in Growing Customer Loyalty and Driving Profits Customer relationship management (CRM) is about giving each customer a personal touch, helping to build trust, and making stronger bonds. A CRM system keeps all the data in one place. This helps everyone make choices faster and makes things run smoothly for big and

Top Ways To Boost Income Through Side Jobs Make money in different ways by trying extra jobs and ways to earn without always working for it. This can help you feel better about your money and the way you handle it. Find new and fun ideas for earning on the side, like making videos or

Service Businesses Focus on Skill-Based Help Service businesses aim to give expert help and skill-based answers, not things you can hold. These businesses help clients by giving things like marketing, customer support, and event planning. There are many types of service businesses, from graphic design to career coaching. Starting one lets people use their skills

Tow Truck Services Tow truck services are very important for drivers who have car troubles or have been in accidents. These services do more than just tow a vehicle. They also help with things like jump-starting batteries, changing flat tires, and bringing fuel. Towing companies are very important for driver safety and movement. They give

Smart Money Tips for Newlyweds Newlyweds in the United States face their own challenges as they try to balance money after their bridal shower and honeymoon. Financial planning for newlyweds helps couples set goals together and build good spending habits early in marriage. Couples who are newly married often have to deal with mixing their