Don't give up if you want to get an auto loan but don't have any credit. Start by looking into lenders that give loans to people with bad credit. To make your application stronger, think about putting down a bigger deposit or adding a co-signer.

Building an emergency fund is crucial to financial security. Aim for 3 to 6 months' worth of expenses to handle unexpected circumstances. Start small-set aside a portion of each paycheck, and watch your savings grow over time. Prioritize this safety net!

Ever feel overwhelmed by your monthly bills? A few strategic phone calls can help you save. Try contacting your internet provider for a retention offer, your insurance company for a better rate, or your credit card issuer to negotiate fees. Small steps can lead to big savings!

Renovating your home can be a smart investment in 2025. Focus on high-ROI projects like kitchen upgrades, bathroom remodels, and energy-efficient improvements. These enhancements not only build equity but also attract buyers, boosting resale value.

The One Big Beautiful Bill promises to reshape our tax landscape. For many, this shift could mean higher deductions and credits, while others may face new tax obligations. Understanding these changes is crucial for effective financial planning in the coming year.

When I decided to transform my basement, I envisioned a cozy retreat. By selecting the right furniture and fixtures, I created functional spaces for relaxation and entertainment. Each piece was carefully chosen to enhance comfort while reflecting my style.

Travelers eager for an adventure can snag a roundtrip fare from San Francisco to Singapore with United Airlines, starting at $641 for Basic Economy. For a bit more comfort, Regular Economy fares are available for $841, all-inclusive of taxes.

Want to find the right city that fits your youthful spirit? We'll look at the best cities for young people. These cities have lively cultures, lots of job opportunities, and active social scenes.

Looking for the best credit cards? You've come to the right place! In this listicle, we break down NerdWallet's top picks to help you find cards that suit your lifestyle-whether you're after rewards, cash back, or low interest rates. Your perfect card awaits!

In analyzing Super Micro Computer's recent earnings, it's crucial to differentiate between genuine growth signals and market noise. The company's robust revenue growth reflects solid demand, but temporary fluctuations could mislead investors. Stay focused on the fundamentals.

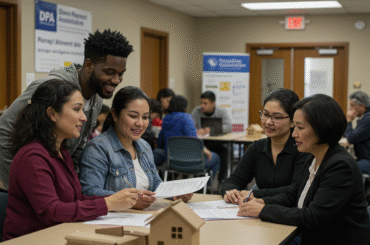

As the dream of homeownership becomes increasingly challenging, down payment assistance is stepping in as a vital resource. This growing tool helps aspiring buyers bridge the financial gap, making it easier to turn their homeownership dreams into reality.

Discovering free Pilates channels on YouTube has transformed my at-home workout routine. From beginner basics to advanced flows, I've compiled five of the best channels that offer clear instruction and motivating sessions. Get ready to roll out your mat!

Looking to maximize your business spending without the burden of annual fees? In this listicle, you'll discover the best no-annual-fee business credit cards that offer rewards, low interest rates, and valuable perks. Get ready to elevate your finances!

Looking for the best credit cards that come with exclusive lounge access? In this listicle, you'll uncover top picks tailored to your travel needs. Expect details on perks, fees, and which lounges you can enjoy-so you can relax in style before your flight!

Introduction Flying with Spirit Airlines can be affordable, but understanding their baggage rules is necessary. This guide explains what counts as a free personal item, the size and weight limits for bags, and ways to avoid extra fees. Staying informed helps you travel smoothly and save money. By following this guide, you’ll know how to

If you're looking to save on taxes when selling your home, the tax-free home sale exclusion allows you to exclude up to $250,000 ($500,000 for married couples) of capital gains every two years. Strategically timing your sales can maximize these savings.

Creating an effective spending plan with Simplifi can transform your financial health. Here are 8 essential hacks to streamline your budgeting: automate savings, categorize expenses, set realistic goals, and review regularly. Stay on top and make your money work for you!

Recent trading activity in Wayfair put options is drawing attention for its unusual spike. This surge might reflect broader market anxieties, signaling that investors are bracing for potential downturns in retail and e-commerce sectors.

Figma is rapidly emerging as a tech titan, transforming the design landscape with its collaborative interface. As teams shift towards remote work, Figma's real-time editing and cloud-based features are not just tools-they're essential for innovation.

Making FAFSA corrections is simple! Log into your FAFSA account, select "Make FAFSA Corrections," and update the necessary fields. Remember to review changes carefully before submitting to ensure your financial aid is accurate.

Want to find the best loans? You'll find the best-reviewed lenders, a list of their pros and cons, and real user reviews to help you make a smart choice.

As an investor, I've been closely watching Upstart Holdings. With its recent high short interest, the potential for a short squeeze is mounting. A rally could catch many off guard, making it a stock to watch in the coming weeks.

Investing for the first time doesn't have to be scary. New investors can steadily build financial security by starting with the right mindset, picking the right accounts (like a 401(k), Roth IRA, or brokerage account), and making regular contributions. You can build up a lot of wealth over time with small investments if you spread them out, have an emergency fund, and are patient.

Navigating grocery shopping as a single cook can be challenging; however, there are smart strategies to help you save money. From embracing meal prep to buying in bulk, these eight tips will make your grocery bills more manageable without sacrificing flavor or nutrition.

Planning for retirement can feel daunting, but knowing how much to save each month can ease your worries. To retire comfortably by 65, aim to save at least 15% of your income. Adjust this based on your current savings and lifestyle goals for a secure future.

Looking for the best car insurance in New Jersey? You're in the right place! Our listicle breaks down top providers, detailing coverage options, pricing, and customer satisfaction. Get ready to find the perfect policy that suits your needs!

As parents, sharing moments of our children online feels natural, but with A.I. advancements, privacy should be our priority. Photos can be analyzed and misused, potentially creating risks we can't foresee. Rethinking this habit is essential for their safety.

The Nordic Diet emphasizes whole grains, fatty fish, root vegetables, and berries, mirroring the traditional eating habits of Nordic countries. It's not just delicious; studies suggest it may boost heart health and support sustainable living. Curious to try?

In Episode 220, titled "I carry the baby, the bills, and the stress," we delve into the often-unseen burdens many parents face. This episode highlights the emotional and financial pressures that accompany parenting, offering insights and support for those navigating these challenges.

As investors brace for a muted stock market open, all eyes are fixed on upcoming U.S. inflation data and the highly anticipated summit between Trump and Putin. These events could significantly influence market sentiment and trading strategies.