Stocks took a hit today while bond yields soared, driven by unexpectedly strong Consumer Price Index (CPI) data. Investors are grappling with the implications for inflation and interest rates, raising concerns about economic stability ahead.

Recent Investing Stories

As an investor, tracking gold's fluctuating prices is crucial for making informed decisions. Analyzing trends and setting targets helps uncover opportunities in this precious metal, allowing for strategic buying and selling in response to market dynamics.

Many doctors find themselves overwhelmed by their finances, caught between high student debt and rising living costs. While a financial advisor can provide tailored expertise, a well-structured financial plan may suffice for those who prefer DIY investment strategies.

Many dream of wealth, but most never achieve it. Reasons include a lack of financial education, fear of taking risks, poor spending habits, and resistance to change. Knowing these barriers is the first step toward breaking free and building wealth.

If you find a home you love that's marked as contingent, you can still place an offer. While it won't be prioritized, it keeps you in the running should the first buyer back out. Always consult your agent for the best strategy!

The world of online trading demands more than good charts or high leverage. Modern traders look for a broker that respects their time, protects their funds, and offers a seamless experience from the first step of registration to the moment they withdraw profits. QuoMarkets has gained strong attention in this space by creating a trading

In a recent survey, Americans revealed their top picks for small businesses they wish to support with a $10K investment. From local coffee shops to eco-friendly products, these 116 ventures reflect our desire to nurture community and innovation in 2025.

When considering a high-end home, a million dollars might seem like a solid budget. However, in many markets, it's often just a starting point. Luxury properties frequently exceed this figure, especially in sought-after locations. Understanding this can save potential buyers from disappointment.

In today’s volatile landscape, it’s crucial to invest based on current market realities rather than idealistic visions. Acknowledging the present conditions helps us make informed decisions, ultimately leading to more sustainable financial growth. Adaptability is key.

In recent months, private equity firms have shifted to a 'risk off' approach, pausing their dealmaking activities. With economic uncertainty lingering, investors are adopting a cautious strategy, focusing on stability over bold acquisitions.

As Amazon dips into correction territory, investors are left wondering: should they panic? Historically, such downturns can be opportunities rather than disasters. Staying informed and assessing the bigger picture may lead to brave decisions, not fear-driven ones.

As we stand on the brink of a new space age, several stocks are poised for growth. Companies like SpaceX, Blue Origin, and others are leading the charge in satellite technology and interplanetary exploration. Keep an eye on these potential game-changers!

Building business credit is essential for securing loans and favorable terms. Start by establishing a legal business entity, obtaining an EIN, and opening a business bank account. Follow these nine steps to elevate your credit score and financial credibility.

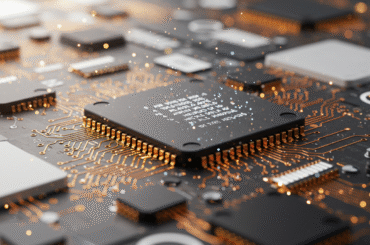

As AI continues to revolutionize industries, investors should keep an eye on leading stocks like NVIDIA and Alphabet. These companies are at the forefront of innovation, making them promising options for those looking to capitalize on this tech boom.

As the Fed weighs potential rate cuts, it’s closely monitoring eight key economic indicators. Factors like inflation trends, unemployment rates, and consumer spending play pivotal roles in shaping its decisions. Understanding these can help us anticipate future moves.

In June, savvy investors are eyeing three tech stocks insiders are snapping up. These speculative plays could signal potential growth, making them worth watching. Keep an eye on these picks to see if insiders' confidence translates into market success.

Unlock your language learning potential with Qlango's lifetime license for just $35! This limited-time offer allows you to access a wealth of interactive resources and personalized lessons, ensuring you can master a new language at your own pace. Don't miss out!

The argument between cloud mining and crypto staking is getting stronger as we look toward 2025. Cloud mining lets you make money from hardware without having to do anything, while staking gives you steady rewards for just holding onto assets. Which way will make more money?

Are you ready to take your trading to the next level? This listicle will show you the best trading books that give you useful information and strategies. You can expect to find expert advice and personal favorites that can change how you trade.

Investing in growth-stage AI startups is becoming increasingly complex. As competition intensifies and regulatory scrutiny mounts, understanding the technology's evolving landscape is crucial. The potential rewards remain high, but so too do the risks.

Managing your tax withholding in retirement is crucial for financial stability. Start by reviewing your income sources-such as Social Security and pensions. Adjust your withholding to avoid surprises, ensuring you meet your tax obligations without overpaying.

Introduction Tracking a country’s economic performance is important for understanding whether an economy is strengthening or weakening. One critical metric is the GDP growth rate, which reflects economic progress. Policymakers, businesses, and individuals use this measure to evaluate economic health and trends. Main The GDP growth rate shows how the value of goods and

As Wall Street navigates the transformative wave of AI, job markets are feeling the strain, and stock valuations are becoming increasingly volatile. It's clear: the time to embrace this technology is now. The old rules are out, and the race to innovate is on.

In California, $2.3 million can open doors to diverse dream homes, from coastal retreats to urban hideaways. These properties often blend luxury, modern amenities, and unique architectural features, offering a glimpse into the state's vibrant real estate landscape.

As the relentless rise of AI reshapes market dynamics, I find myself questioning the wisdom of holding onto our S&P 500 position. The potential for volatility and disruption is higher than ever-sometimes, enough really is enough.

Introduction Cryptocurrency is no longer only for holding and waiting. There are ways to make your digital assets generate money over time. These opportunities are available to beginners and experienced users alike. By learning different strategies, you can increase your crypto earnings while managing risk. This article explores seven effective methods to generate passive income

Looking to invest in the booming healthcare sector? In this listicle, you'll uncover the best healthcare ETFs that cater to various investment strategies. Expect detailed insights on performance, fees, and potential growth—perfect for making informed choices!

In today’s market, finding undervalued dividends can feel like striking gold. Discover three standout stocks where you can buy a dollar's worth of dividends for just 60 cents. These bargains not only promise steady income but also potential for growth.

Elon Musk's support for DOGE could be good or bad for Americans. Some people save money by paying lower transaction fees, but the currency's volatility and uncertainty could cause others to lose a lot of money. It's important to find a balance between risks and rewards.

ASML has officially entered buy territory, but this opportunity suits only patient investors. With its pivotal role in the semiconductor industry, long-term growth potential remains strong, while short-term volatility may test immediate investors' resolve.