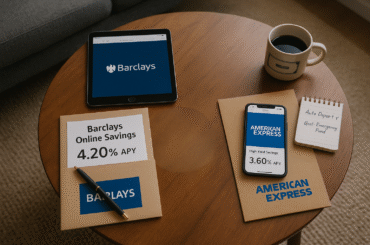

Barclays vs American Express for Savings See how Barclays Bank and American Express National Bank stack up side by side, so you can pick the best high-yield savings account for your money needs. Check out each bank’s interest rates, APY, and what makes each one stand out so you can spot the most appealing offers.

Recent Investing Stories

Binance and Bithumb Compared Binance has more people trading and more users than Bithumb, with about 224 million people active on the site. Both places have strong mobile apps so traders can get to markets wherever they are. Binance lets you trade over 500 cryptocurrencies, but Bithumb has around 170 tokens. Bithumb is trusted for

Which Cryptocurrency Platform Best Fits Your Needs? Both Bybit and Binance do well when it comes to helping crypto traders, with Bybit putting more focus on trading contracts and Binance giving a lot of options for easy spot trading. Bybit gives you smart features like copy trading, and Binance lets you do more things with

As we navigate the financial landscape of 2025, choosing the safest banks becomes crucial. Look for institutions with solid capital, low default rates, and strong customer reviews. Your peace of mind deserves a home where your money is truly secure.

As July heats up, savvy investors should keep an eye on these top five momentum-driven stocks. Each has shown robust performance and promising trends, setting the stage for potential growth. Dive in to discover where your investment strategy might gain traction this summer!

Top Reasons to Use Automatic Investment Apps See how automatic investment apps can help you plan for your money in an easy way with simple tools. Look at ways you can invest if you are new, thinking about how much risk you can take and the time you have. Find out about ways to manage

In a bold move, Bilal Bin Saqib has announced that Pakistan will deploy its Bitcoin reserves into decentralized finance (DeFi) projects to generate yields. This strategy not only aims to bolster the nation's economy but also signals a growing embrace of cryptocurrency innovation.

Save Money on Crypto Services and Exchanges Save up to $100 on different crypto services and exchanges. Get special deals like welcome bonuses, referral rewards, and Coinbase promo codes made for new users. Get free crypto from top platforms like Binance, Gemini, Kraken, and Coinbase. Learn how to use referral codes and reduce trading fees.

If you’ve ever dreamed of trading significant sums in the forex market but felt limited by your available capital, funded forex accounts might be the game-changing opportunity you’ve been looking for. These accounts allow traders to control large amounts of capital provided by proprietary trading firms, enabling them to potentially earn big profits without risking

Nasdaq Inc Philippines Market Trends and Insights Nasdaq Inc. builds a strong position in the Philippines by giving top technology solutions to companies in financial services. The Philippine Stock Exchange (PSE) now uses the Nasdaq Eqlipse Trading platform. This helps make the market’s setup better and adds more money movement. Teamwork and new steps stand

Trump's metals tariffs, designed to protect domestic industries, may inadvertently raise costs for everyday essentials like food and beer cans. As manufacturers face higher aluminum prices, consumers could soon see these increased costs passed on at the checkout.

There's a gentle revolution happening in bedrooms across the nation — and it has nothing to do with TikTok trends or viral dances. It's the buzz of a generation listening in on financial freedom. More and more teens have started asking big questions about money in recent years: “What's the stock market?” “How do I

Practical Tips for Investing as a Parent Get practical tips on how to invest smartly while handling the ups and downs of happy families. Find ways to put your family members’ needs first without losing your financial strength. Learn money strategies that link good school results with long-term money goals. See the secrets of happy

Elon Musk's vision for Mars isn't just science fiction; it's a potential investment goldmine. As private space exploration accelerates, savvy investors should consider aerospace stocks, tech innovations, and sustainable technologies shaping our Martian future.

Major Trends Shaping Capital Equipment See how advanced CNC making methods are changing the way people make and design big machines. Learn why it is important to know the value limits and buy costs if you want to do a good job with sorting and buying assets. Look at how built-in controllers and serial numbers

Fisher Investments Benefits for New Investors Fisher Investments Canada gives you wealth management that matches your goals and what you need from investing. They have years of global experience working with private people, families, and big groups that invest money. They use a smart way to invest that relies on data and makes sure choices

As we look toward 2025 and beyond, many wonder if Social Security will still be around. Our analysis shows that while challenges exist, reforms can help ensure it remains a vital resource for future generations. Let's explore the facts together.

Looking for the best CD rates in Wisconsin? You're in the right place! In this listicle, you'll discover top-notch financial institutions offering competitive rates that can help your savings grow. Let's dive into the details and find your perfect fit!

A recent forecast suggests Bitcoin may mirror the S&P 500's performance, potentially reaching new all-time highs in July. This correlation underscores the growing intertwining of crypto and traditional markets, offering fresh hope for investors.

Understanding your risk tolerance is crucial in both investments and life decisions. Assessing factors like financial stability, emotional resilience, and long-term goals can help you determine how much risk you're truly comfortable taking on.

As retail sales show signs of growth, three consumer stocks are poised for potential gains. Increased consumer spending indicates confidence in the economy, presenting investors with attractive opportunities in the consumer sector. Stay tuned!

As we move towards a decentralized world, investing in blockchain stocks can be a savvy move. Companies like Coinbase and Riot Blockchain are at the forefront, offering unique opportunities for growth. Explore these stocks to harness the potential of blockchain technology.

Under Trump's presidency, the Small Business Administration shifted its focus, tightening regulations and oversight. Many entrepreneurs felt the repercussions as funding became more challenging, sparking debates about access and support for small businesses.

As a homeowner, you might wonder what your property will be worth in the coming years. A home appreciation calculator can help you estimate your home's future value, taking into account current market trends and growth projections for 2026 and beyond.

In a surprising turn, markets have surged, buoyed by renewed optimism in trade negotiations and Bitcoin's recent rally. Investors are feeling a renewed sense of confidence, as these factors converge to create a more favorable economic landscape.

A market maker plays a crucial role in financial markets by providing liquidity and facilitating trades. By continuously buying and selling assets, they help ensure that investors can easily enter or exit positions, stabilizing prices and enhancing market efficiency.

In this listicle, you'll discover the best stocks for beginners that won't break the bank. With just a little money to start, you'll learn about affordable options, potential growth opportunities, and tips to build your investment portfolio smartly!

In this listicle, you'll discover the best tech stocks to buy now-ideal for boosting your portfolio! From innovative startups to established giants, we'll break down each stock's potential and why it deserves your attention. Get ready to invest smartly!

In the bustling realm of quantum stocks, Quantum Computing Inc. often flies under the radar. However, its strategic partnerships and innovative technology position it as a quiet but formidable contender, potentially redefining the future of computation.

Meta's recent investment in Scale AI signals a strategic pivot towards harnessing advanced artificial intelligence. For investors, this bold move highlights the potential for enhanced efficiency and innovation, making it crucial to monitor its impact on Meta's growth trajectory.