Cash bonds are a stable way to invest, especially when the bond market is good. If interest rates are about to drop, putting money into bonds instead of cash can lead to better returns. In the past, bonds have earned more than cash in these situations. A mixed bond collection can balance risk and

Recent Investing Stories

The Schwab Dividend ETF has seen a notable rally recently, driven by strong dividend growth and a stable economic outlook. Investors now ponder if this momentum can sustain itself as market conditions evolve. Continued vigilance will be key.

Determining how much retirement income you need can feel overwhelming, but it's important for a secure future. Consider your lifestyle, expected expenses, and any additional income sources. A common rule of thumb is aiming for 70-80% of your pre-retirement income.

Meme stocks are shares of companies that gain popularity through social media and internet forums, often driven by viral trends rather than traditional financial metrics. Investors flock to these stocks, sometimes leading to wild price swings and speculative trading.

At TechCrunch Disrupt 2025, Even Rogers and Max Haot showcased groundbreaking innovations in the space industry. Their insights revealed how private ventures are transforming space into a bustling marketplace, inviting entrepreneurs to explore limitless opportunities.

Dollarama's fair value continues to rise, reflecting strong performance and market demand. However, the stock's increasing valuation prompts a closer look-investors must weigh the potential for growth against the risks of overvaluation in today's market.

Introduction Certificates of Deposit (CDs) are a reliable way to save money. They offer a fixed interest rate over a set period, helping savers plan consistently. CDs typically carry low risk and let your money grow steadily. Synchrony Bank provides competitive CD rates with FDIC insurance for safety. Its online banking makes managing CDs simple

Direct indexing allows investors to own individual stocks within an index, rather than investing in a mutual fund or ETF. This personalized approach offers tax efficiency and customization, enabling you to align your portfolio with specific values or goals.

Microsoft's most recent earnings report showed both problems and chances, which caused its stock price to drop for the first time in a long time. Smart investors should take advantage of this moment to make money off of a strong company's potential to recover and grow.

Service Corporation International (SCI) stands out as a solid investment for long-term stability. With its strong market presence in the funeral service industry, this stock is not just for the present but can be part of a lasting legacy.

John Wiley & Sons has made a lot of money lately, which is a strong reason to raise their ratings. The company is likely to keep doing well in the education sector because it is committed to innovation and has strong earnings growth.

QuantaSing has made a name for itself as a promising player in the ed-tech space, especially with its recent plans for growth. Our analysts say that we should start coverage with a "Buy" rating because its new approach takes advantage of the growing digital learning market.

The SPAC king is back with a new blank-check deal, which has Wall Street buzzing. Investors are keeping a close eye on this experienced player as they try to navigate the ever-changing world of mergers and acquisitions once more.

Lowe's commitment to increasing shareholder value is still clear as we look toward 2025. The home improvement giant is ready for steady growth thanks to smart investments and a strong expansion plan. This makes it a great buy for investors who want to get the most for their money.

AI is doing better than traditional traders on Wall Street in today's fast-paced financial world. You can use these same tools by using advanced algorithms and data analysis. This is how you can improve your trading strategy and stay ahead.

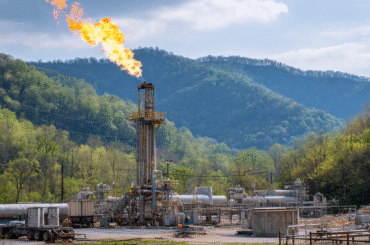

EQT is changing the way energy works in Appalachia by using natural gas as a way to grow in a way that lasts. They're not just powering homes; they're also making the world a cleaner, greener place by combining new ideas with smart ways of doing things.

Webull vs E*TRADE Expected Returns on $1000 Webull and E*TRADE are two popular trading platforms that investors often compare when choosing where to grow their money. Both allow commission-free stock trading but differ in features, account options, and available investment products. Webull attracts frequent traders with advanced tools, while E*TRADE appeals to those who want

As investors, we often only think about the obvious risks, but there are three potential economic landmines that we should be aware of. If you don't pay attention to these things, your portfolio could go off the rails because of the shadow banking sector's growing instability and the weakness of the supply chain.

A lot of older Americans are being scammed out of money through fake phone calls and crypto investments. Because this group doesn't know much about money, scammers take advantage of their trust and confusion to steal millions. It's important to raise awareness and keep weak communities safe.

Today, navigating the real estate market seems hard. Buyers may wonder if now is a bad time to invest because interest rates are going up and prices are going up and down. Yet, opportunities abound for those willing to research and strategize. Timing can be very important.

In the world of investing, not all rallies lead to profit. Typically, rallies conclude in one of three ways: a sharp sell-off, a gradual decline, or a sustainable uptrend. Only the last option truly enriches investors. Choose wisely and stay informed!

Important lessons about money have changed how it is handled over the years. Financial habits have changed thanks to advice on everything from smart investing to good budgeting. This has led to a level of stability that once seemed impossible.

Animoca's Tower cryptocurrency saw an incredible 214% increase in July, showing how fast the Web3 gaming industry is growing. This rise shows that more gamers are interested in and engaged with blockchain-based experiences, which means that digital play has a bright future.

Three stocks that stand out have reached all-time highs as markets keep going up, which shows that investors are very confident. These companies have strong fundamentals and room to grow, which means they could keep making money. This makes them interesting picks for smart investors.

Long-term compounding turns small, regular investments into a lot of money. By reinvesting dividends and letting time work its magic, even small amounts can grow into huge sums. This shows how amazing the stock market can be. Time is really the best friend of an investor.

Bitcoin is close to its all-time high, and many people are wondering if we've reached the top. Some signs point to a mix of hope and caution. Before making any decisions, it's important to stay up-to-date and think about market trends.

Want to add more variety to your portfolio? We will show you the best small-cap stocks you should think about. Find potential gems that could lead to big growth, from cutting-edge tech companies to new healthcare companies.

With a Self-Directed IRA, you can choose your own retirement investments, which can include a wider range of assets, such as real estate and commodities. You can make your portfolio fit your specific financial goals by making your own choices.

Traders are looking at a Broadcom bear put spread that could give them a huge 156% return over the next seven weeks. If the market conditions are right, this strategy could lead to big profits.

Getting an inheritance can be good and bad at the same time. Know how taxes will affect you, take the time to weigh your options, think about how it will affect your financial goals, and talk to a professional to make smart choices about your future.