When you trusted someone with your power of attorney, you expected them to act in your best interest. However, if you notice a lack of transparency, disregard for your wishes, or financial mismanagement, it may be time to reassess their role.

After an overwhelming experience of a car crash, seeing an insurance check with your name on it can feel like the best thing that can happen during this difficult situation. The initial shock is wearing off, and the reality of medical bills and car repairs is setting in. That check looks like a quick solution,

In this listicle, you'll discover the best slip and fall lawyers ready to fight for your rights. Each entry highlights their expertise, success stories, and what sets them apart. Get informed to choose the right advocate for your case!

Securities fraud in Ohio is a growing concern, with the Ohio Department of Commerce Division of Securities reporting hundreds of enforcement actions annually against individuals and firms violating state securities laws. Financial exploitation through securities fraud particularly affects retail investors, with reports indicating that investment-related scams cost Americans billions of dollars each year. The state's

Learn how to file Articles of Organization to form your LLC in 2025. Understand key elements, steps, filing costs by state, and tips for long-term compliance.

Managing your tax withholding in retirement is crucial for financial stability. Start by reviewing your income sources-such as Social Security and pensions. Adjust your withholding to avoid surprises, ensuring you meet your tax obligations without overpaying.

Introduction Navigating complex business transactions requires a solid understanding of legal boundaries. One area that often causes confusion is kickbacks. These unlawful payments, prohibited by laws like the False Claims Act, are used to gain special treatment or favors in contracts. Violating these laws can have significant consequences. This article explores the risks associated with

A postnuptial agreement, or postnup, decides how to divide assets and responsibilities if a marriage ends. It offers financial security and clear guidelines, especially for couples with many assets, inheritances, or children from previous relationships. Postnups are legal contracts that differ from prenuptial agreements and provide peace of mind during uncertain times. They encourage

Looking for the best personal injury lawyer? This listicle highlights top attorneys who excel in compassionate service and proven results. You'll find essential info like their success rates, client testimonials, and unique specialties to help you choose wisely.

It's important to teach our loved ones how to spot scams as they get older. Talk to them often about the common tricks that scammers use, tell them to be suspicious of calls or emails that they didn't ask for, and help them set up financial protections to keep their money safe.

Looking to launch your LLC but unsure where? In our listicle, "Best States to Start an LLC," you'll discover the top states that offer favorable tax rates, business-friendly regulations, and a supportive environment. Get ready for valuable insights!

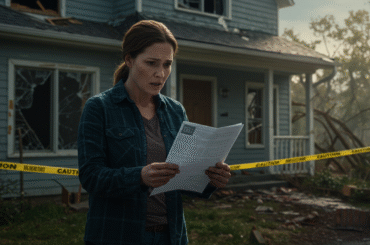

In the aftermath of natural disasters, hope can quickly turn into despair as scammers exploit vulnerable individuals. These opportunists prey on those seeking aid, promising relief while siphoning away resources meant for recovery. Awareness is key.

Running a small business in Illinois requires planning, patience, and attention to detail, especially when it comes to taxes. From state-specific rules to overlooked deductions, tax surprises can catch business owners off guard and lead to costly penalties or missed deductions. Fortunately, with some up-front strategy and routine oversight, you can steer clear of many

Relocating to the United Kingdom can be an exciting chapter, especially if you’re planning to buy property. But for U.S. citizens, the cross-border financial implications, particularly tax-related ones, often come as a surprise. Before jumping into UK real estate listings, it’s crucial to understand how U.S. tax law interacts with your overseas move and property

Many people worry about their Social Security income being garnished by the IRS or creditors. While certain government debts can lead to garnishment, Social Security benefits are generally protected. Knowing these rules can provide peace of mind.

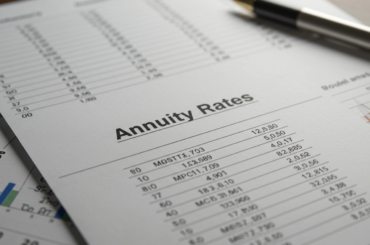

Annuity rates matter when you plan your retirement money. Understanding different kinds of annuity rates can help you make wise money choices. There are set and flexible annuity rates, each with their own benefits and risks. Factors like the health of the insurance company and current interest rates can affect annuity rates. Speaking with

You can sign a check over to someone else (this is called third-party check endorsement). However, not all banks or credit unions accept it. A proper endorsement means you need to sign the back of the check and mention who will receive it. There are legal matters that can change, so it’s important to

A pending home sale means a seller accepted an offer, but the deal hasn’t closed yet. Even with a pending status, the sale can fall through due to financing issues, inspection problems, or other contingencies. Making an offer on a pending home is possible, but sellers aren't obligated to consider it. Backup offers can

With a Self-Directed IRA, you can choose your own retirement investments, which can include a wider range of assets, such as real estate and commodities. You can make your portfolio fit your specific financial goals by making your own choices.

Getting an inheritance can be good and bad at the same time. Know how taxes will affect you, take the time to weigh your options, think about how it will affect your financial goals, and talk to a professional to make smart choices about your future.

Have you ever been angry because you couldn't get to your own money? Many people don't know about quiet laws that can limit their financial freedom, like fees for dormant accounts and complicated rules about inheriting money.

Introduction Natural monopolies exist in markets where a single company can supply the total demand more efficiently than multiple competitors. This typically occurs due to high fixed costs and economies of scale. Industries such as utilities, telecommunications, and transportation often have natural monopolies because the infrastructure costs are too high for new entrants to compete

Before signing a lease, it's crucial to negotiate key terms that can affect your living situation. From rent price to maintenance responsibilities, understanding these 12 essential terms can empower you to secure a better deal for your new home.

Most people view tax season as a stressful, once-a-year event—a mad dash to gather receipts, crunch numbers, and submit a return before the looming deadline. This reactive approach, however, often leaves money on the table and fails to address the bigger picture of one’s financial life. It treats taxes as an unavoidable chore rather than

Explore the paralegal and lawyer difference, including roles, responsibilities, education, salaries, and career opportunities to make an informed legal career choice.

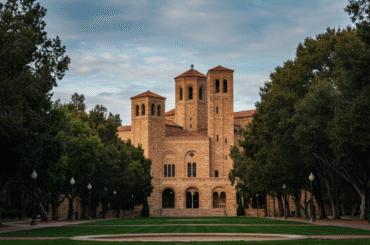

Discover how UCLA is negotiating with the Trump administration to restore $339 million in federal research grants frozen over civil rights concerns in 2025.

A loan shark is an unlicensed lender who offers high-interest loans under illegal terms. Often preying on vulnerable individuals, they use intimidation and harassment to ensure repayment. Understanding their tactics is crucial for financial safety.

A lot of us use checking accounts for everyday transactions, but mistakes can be costly. Knowing about these mistakes can help you keep your money safe, from overdrafting to missing fees. Let's look at 11 common mistakes people make with their checking accounts and how to avoid them.

Learn how Upwork freelancers handle 1099 taxes, self-employment obligations, and deductions to reduce your tax burden effectively.

Wondering if you can write off your timeshare as a tax deduction? While it sounds appealing, the IRS typically treats timeshares as personal property. This means most expenses related to vacation ownership aren’t deductible, but explore mortgage interest deductions if applicable.