Trump's push to impose stricter controls on museums echoes past attempts to dictate cultural narratives. This move raises concerns about artistic freedom and the integrity of historical representation, reminding us of broader battles over truth and influence.

Lion Finance Group faces heightened political risk, prompting concerns over its creditworthiness. Recent rating downgrades reflect challenges within the current geopolitical landscape. Investors should exercise caution and stay informed amidst these developments.

Circle's USDC will soon be able to be used as collateral for U.S. futures trading. This is a big step toward bringing stablecoins into mainstream finance. This change not only makes it easier to buy and sell things, but it also shows that digital currencies are becoming more popular in traditional markets.

Tesla is in a perfect storm because of rising sales, changing politics, and the rise of BYD. This change brings both problems and chances, changing the electric vehicle market and Tesla's future role in it.

History shows that periods of technological retreat often lead to renewed creativity and reflection. By stepping back from our screens, we can reconnect with ourselves, our surroundings, and the world around us, fostering deeper insights and rejuvenation.

Understanding the trade deficit and tariffs is crucial for making informed investment decisions. A widening trade deficit can signal economic challenges, while tariffs may influence market dynamics, affecting industries and stock performance. Stay informed!

In recent trading, the dollar lost ground as the euro surged, fueled by optimistic discussions surrounding a potential resolution to the Ukraine conflict. This shift reflects changing investor sentiment, highlighting how geopolitical events shape currency dynamics.

Senate Republicans are suggesting significant adjustments to the House bill, focusing on tax regulations. These tweaks aim to streamline processes and potentially benefit small businesses, reflecting a balance between fiscal responsibility and economic growth.

Oklo's stock has shown signs of volatility recently, indicating a potential correction is on the horizon. For savvy investors, this might be the perfect opportunity to buy. Keep an eye on the market-consider jumping in when it makes a bounce back.

Discover 12 effective strategies for market volatility in 2025. Learn how to protect investments, anticipate market shifts, and optimize long-term stock market performance.

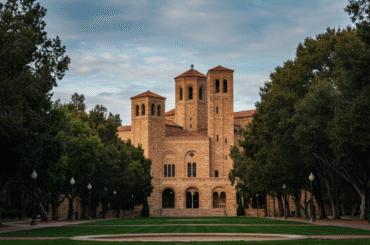

Discover how UCLA is negotiating with the Trump administration to restore $339 million in federal research grants frozen over civil rights concerns in 2025.

Stay updated on Walmart stock price trends with the latest market data, performance analysis, and expert insights. Discover historical charts, dividend information, and forecasts to guide investment decisions in Walmart shares.

Many of us use checking accounts for everyday transactions, but mistakes can be expensive. If you know about these mistakes, you can protect your money from things like overdrafting and missing fees. Let's talk about 11 things people often do wrong with their checking accounts and how to avoid them.

As uncertainty looms over global markets, the US economy braces for impact. Investors are cautious, grappling with fluctuating interest rates and inflation concerns. This turbulent climate could challenge growth, leaving many to wonder what's next for their financial future.

Walmart is making headlines as it takes a bold step into sustainable retail. By committing to a significant reduction in plastic waste and increasing its range of eco-friendly products, the retail giant is reshaping its image and paving the way for a greener future.

In a recent discussion, Adam Back shared his bullish outlook on Bitcoin, predicting that the upcoming price cycle could be "10x bigger" than previous ones. He confidently believes this momentum will push Bitcoin decisively above the $100K mark soon.

In the evolving landscape of crypto, Bitcoin remains a digital cornerstone, while treasuries offer stability. The recent surge in stablecoins signals a shift towards blending traditional finance with crypto's innovative edge, reshaping investment strategies.

In the world of banking, merger and acquisition activity is showing surprising consistency. Our Bank M&A Deal Tracker reveals that despite economic fluctuations, deal-making momentum is mirroring last year's figures, indicating a resilient market.

America's debt is soaring, and it's not just a statistic-it could affect your everyday life. Interest rates rise, impacting loans and mortgages, while government spending cuts could limit vital services. It's time to pay attention; the ticking clock is closer than we think.

How Index Trading Works and Why Investors Use It Index trading offers diverse investment opportunities, reducing risks compared to trading individual stocks. It allows investment in a mix of assets representing various market sectors or entire economies. Traders leverage both technical and fundamental analysis to determine the best times to buy and sell indices. Tools

In a pivotal year for Tesla, mastering the last four turns has showcased our agility in adapting to market shifts. As we head forward, the focus is on sustainable innovation and global expansion. Our journey isn't just about electric cars; it's a roadmap to the future.

Recent analysis reveals that private equity portfolios at major Canadian investors have been lagging behind expectations. As these firms reassess their strategies, many are questioning the long-term viability of their investments in this asset class.

Despite escalating trade tensions and tariff uncertainties, the bond market remains surprisingly resilient. Investors may be overlooking these risks, focusing instead on other economic indicators, which could lead to significant surprises down the line.

As Nvidia approaches its earnings report, investors are on edge. The critical question looms: Can the tech giant sustain its meteoric rise amid fierce competition and market fluctuations? Analysts are closely watching for key indicators that could shape its future.

The rapid rise of on-device AI is transforming our daily lives. From smart assistants to real-time language translation, these technologies enhance convenience and privacy. As processing power grows, the potential for more personalized experiences is limitless.

Stocks found support today as the Producer Price Index (PPI) data came in favorable, aligning with the Federal Reserve's inflation goals. Investors are reacting positively to the signs of steadier prices, boosting confidence in economic stability.

Apple's recent sales figures from China reveal a troubling trend: a sharp decline that seems to be deepening. As consumers shift preferences and face economic pressures, Apple must navigate these challenges to regain its foothold in this vital market.

Gold and silver have extended their gains, buoyed by a weaker dollar, attracting investors seeking safety. Meanwhile, platinum has struggled, losing momentum despite earlier optimism. This contrast highlights the divergent paths of these precious metals in today's market.

In a bold move, E.l.f. Beauty has invested $1 billion in Hailey Bieber's skincare brand, Rhode. This strategic acquisition not only signals confidence in Bieber's vision but also reflects E.l.f.'s aim to expand its portfolio and reach a younger audience.

Curious about Palantir’s valuation in 2025? Discover expert insights on its market cap, financial performance, stock trends, analyst forecasts, and growth potential across AI and government contracts.