Of all the subsectors of influencer culture, easily one of the most jarring and irksome is the emergence of finance influencers. In the days before the internet, it took a real, strong, proven knowledge of the market before those with influential presences in the financial industry were able to shift opinions with their words. Now,

Crypto started as a speculative fringe interest, but has quickly turned into a complex financial ecosystem that rivals traditional markets. For modern investors and enthusiasts, the line between strategic fintech investment and high-stakes entertainment has become increasingly blurred. This convergence offers a multitude of pathways for capital growth, ranging from the disciplined analysis of market

Leather creates a strong first impression in any room. The surface feels rich, durable, and smooth. Yet age, heat, friction, and daily use leave their marks. Many homeowners feel worried when their favorite chair or sofa begins to show wear. They fear the cost of replacement. They also feel unsure about which repair steps work

Crypto trading has evolved. In 2026, simply holding assets (HODLing) is no longer the only strategy. Traders now demand Capital Efficiency, the ability to maximize exposure while minimizing tied-up funds. MEXC has emerged as the premier platform for this style of trading, offering a robust Futures engine with high leverage, deep liquidity, and arguably the

Credit card Annual Percentage Rates (APRs) have climbed sharply in recent years. The average interest rate for accounts carrying a balance is now between 22% and 23%¹. That level of interest makes mistakes expensive and slows down progress toward financial freedom. The goal is not to fear credit but to Master Your Cash Flow®. Use

The Wealth Building Formula™ Made Simple(ish) If the thought of math makes you break into a cold sweat, don’t worry. We’re not about to drag you back to high school algebra. But here’s the thing: understanding and working your Wealth Building Formula™ is essential if you want to achieve financial independence. Think of it like

Becoming a consistently successful trader is not simply about capital — it’s about discipline, knowledge, and a trading environment that supports growth. WeMasterTrade brings all three elements together, offering a modern prop firm experience where traders can access capital, strengthen skills, and advance professionally at their own pace. With clear policies, diverse account models, and

For every crypto project, listing a token on a reputable exchange is a major milestone. It establishes liquidity, enhances trust among investors, and opens the door to large trading volumes. With the growing competition in the Web3 space, choosing the best crypto exchange listing service is essential for achieving sustainable visibility and long-term growth. Among

Discover 13 engaging financial literacy games suitable for children and adults, enhancing money management skills through interactive play.

These are the best SECR softwares to boost your ESG strategy: Dcycle EcoOnline Watershed Accuvio GHGi Analytics Mavarick.ai Novisto Envizi Figbytes Enablon If you report in the UK, a SECR software is a must. The right platform does more than generate an annual document. It becomes the place where energy data lives. Calculations run automatically.

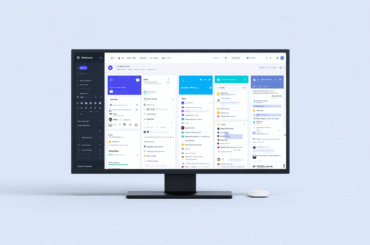

These are the 10 best multichannel contact center software solutions you should consider: Harmonix AI Zendesk Genesys Cloud CX Freshdesk Contact Center HubSpot Service Hub Talkdesk RingCentral Contact Center Aircall 3CX Intercom Handling customer conversations across phone, email, chat, WhatsApp, LinkedIn and social DMs doesn’t have to feel like spinning plates. The new generation of

These are the best AI tools for lead generation in 2025: Genesy Clay Apollo Lavender Cognism Instantly Surfe Amplemarket Wiza Drift AI has changed how sales teams generate leads. What used to take hours of manual research, data cleaning, and repetitive outreach can now be automated and optimized through intelligent software. The new generation of

Saving money can feel overwhelming, but it doesn't have to be. Start small with practical tips: track your spending, set a budget, and make mindful purchases. These simple steps can lead to significant savings over time. Your financial future will thank you!

As a stay-at-home parent, you can explore various passive income streams to boost your finances while juggling family life. From rental properties to print-on-demand services, these 9 ideas can help you earn without sacrificing precious time with your kids.

Elon Musk's support for DOGE could be good or bad for Americans. Some people save money by paying lower transaction fees, but the currency's volatility and uncertainty could cause others to lose a lot of money. It's important to find a balance between risks and rewards.

Introduction In 2024, technology supports daily living by improving tasks, boosting productivity, and enhancing hobbies or wellness goals. Devices are available for work, study, fitness, or convenience at home. Innovations offer speed, style, and smarter features, making tools practical additions to routines. AI shapes this year’s most useful devices, from smartphones to laptops. Top

Log into today’s online casinos, and you’ll find much more than a row of digital slot machines. The modern experience is vibrant, varied, and designed to keep every type of player entertained. From classic card tables to fast-paced specialty titles, real money games now cover a spectrum that rivals and often surpasses the energy of

The Hidden Menu of the Elite Enjoy amazing luxury with great food on private jets. Find seasonal menus, special dishes, and selected wine pairings. Menus are made just for you based on your diet and likes. Get special options through client services and online platforms. VistaJet works with famous chefs and restaurants for better in-flight

An emergency fund is a safety net. It provides cash for unexpected costs like losing a job, medical bills, or home repairs. The right size of your emergency fund depends on your individual needs, such as how much you spend each month, how steady your income is, and how much risk you can handle.

Introduction Choosing between Bluehost and SiteGround can affect your website's speed, stability, and overall experience for visitors. These two hosts are popular and each has distinct advantages. Picking the right provider matters for WordPress sites and other business websites because server performance impacts user experience, search rankings, and conversions. SiteGround offers faster performance and

A pending home sale means a seller accepted an offer, but the deal hasn’t closed yet. Even with a pending status, the sale can fall through due to financing issues, inspection problems, or other contingencies. Making an offer on a pending home is possible, but sellers aren't obligated to consider it. Backup offers can

Introduction Uber Eats connects users with many restaurants and cuisines through a simple app and website. This article explains how to find restaurants, navigate menus, customize orders, and track deliveries so users can order quickly and confidently. How Uber Eats Menu Works What Uber Eats Is Uber Eats is a food delivery platform that lists

The iGaming world is booming. New markets open up every year. More players. More platforms. More opportunities to build something big — and fast. But while many are racing to launch the next big brand, not everyone is doing it wisely. Some pile on features without thinking them through. Others expand too quickly and crack

Hawkers sunglasses has become one of the first eyewear brands to join Amazon UK's innovative Virtual Try-On service, marking another milestone in a technology strategy that has transformed how consumers shop for fashion accessories online. This latest development validates the digital-first approach that Alejandro Betancourt López has championed since becoming president of the Spanish sunglasses

DigitalOcean's promise to make cloud infrastructure easier to use is helping it grow quickly. By putting user-friendly services and community support first, they're giving developers and startups the tools they need to make cloud computing easy and useful for everyone.

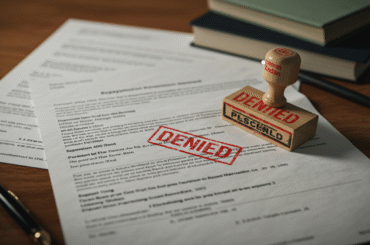

Don't give up hope if your student loan repayment plan was turned down in August 2025. Find out why your application was denied, look into your options for appealing, and think about other ways to pay off your debt that might be easier on your wallet.

Introduction Knowledge and technology drive economic growth, and investing in education enhances both individual careers and overall economic development. A skilled workforce increases productivity, innovation, and income potential, making continuous learning a critical component of career success. Tuition reimbursement programs play a pivotal role in supporting employees’ educational advancement while benefiting employers and communities alike.

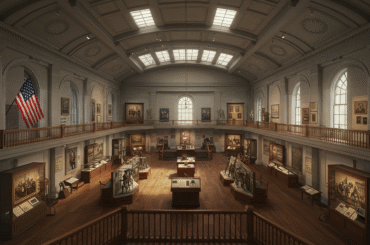

Trump's push to impose stricter controls on museums echoes past attempts to dictate cultural narratives. This move raises concerns about artistic freedom and the integrity of historical representation, reminding us of broader battles over truth and influence.

Preventing Lifestyle Inflation for Long-Term Financial Stability Achieving financial balance means enjoying your income while managing it wisely. One major challenge is lifestyle inflation, which occurs when your spending rises alongside your income. Earning more can provide new opportunities, but higher costs can limit savings growth and compromise long-term financial goals. Learning to control lifestyle

History shows that periods of technological retreat often lead to renewed creativity and reflection. By stepping back from our screens, we can reconnect with ourselves, our surroundings, and the world around us, fostering deeper insights and rejuvenation.