What Is an Index Fund? An index fund is a type of investment vehicle, either a mutual fund or an exchange-traded fund (ETF), that seeks to mirror the performance of a specific market index, such as the S&P 500 or the Nasdaq-100. Instead of selecting individual stocks to try and outperform the market, index funds

Wise offers transparent, smaller fees and uses the true mid-market exchange rate, with no hidden markups. XE provides competitive exchange rates with a small margin but does not charge fees on larger transfers. Wise features an intuitive app designed for ease of use. XE supports transfers to over 200 countries, making it ideal for

Summary Business Models: TripAdvisor focuses on hotel reviews and bookings, while Airbnb specializes in vacation homes and peer-to-peer rentals across the United States. Accommodation Types: TripAdvisor primarily lists hotels; Airbnb offers private and unique stays. Pricing Transparency: Airbnb provides clearer pricing, but both platforms may include extra fees not immediately visible. Traveler Suitability: Airbnb

Beware of a new phishing scam claiming to be from the DMV! Victims receive deceptive texts asking for personal information. Stay alert: never share sensitive details via text, and verify any suspicious messages directly with official sources.

Scrolling through social media can feel harmless, but it often lures us into impulsive spending. From targeted ads to influencer promotions, these platforms can make us crave what we don't need, leading to financial strains and regret. Stay aware!

If you’ve closed a bank account and find yourself needing it again, reopening is possible but not always straightforward. Policies vary by institution, so it’s essential to contact your bank directly to understand their specific procedures and requirements.

An index fund is a type of investment that aims to mirror the performance of a specific market index, like the S&P 500. It pools money from many investors to buy a diverse range of stocks, making it a low-cost, passive way to grow wealth over time.

Skateboarders played a pivotal role in revitalizing San Francisco's U.N. Plaza. By reclaiming the space with their passion, they transformed it into a vibrant hub for community engagement, blending sport, art, and culture in a city known for its creativity.

A million pennies is worth $10,000. It's an interesting concept to think about, isn't it? Imagine the weight of those coins-over 2,200 pounds! While we often overlook small denominations, they can add up to significant value.

In 2025, Chase Credit Journey continues to impress with its user-friendly interface and comprehensive credit monitoring tools. It offers personalized insights and tips, helping users understand and improve their credit scores effortlessly. A must-try for anyone!

Feeling overwhelmed by your finances? It might be time for a budget refresh. If your expenses seem to outpace your income, or if you're frequently dipping into savings, these signals hint that a budget overhaul could be just what you need.

Stan Store is an innovative platform that empowers creators to effortlessly sell digital products and services. With user-friendly features and seamless integration, it caters to artists, educators, and entrepreneurs alike—making online selling accessible for all.

Navigating the world of retirement savings can be tricky, but learning to convert a 529 plan to a Roth IRA might be your secret weapon. This strategy not only maximizes tax benefits but could also pave the way for an early retirement, unlocking financial freedom.

In the face of rising costs, many poor Americans are making tough choices about what to cut from their budgets. From skipping doctor visits to forgoing internet access, these surprising sacrifices reveal just how dire their situations have become.

Navigating the world of finance can be daunting, but understanding the 8 types of financial advisors can simplify your journey. From robo-advisors to fiduciaries, knowing who aligns with your goals is key to securing your financial future.

Budgeting can seem daunting, but many common myths hold us back from taking control. From believing that budgeting is only for the wealthy to thinking it restricts our spending, these misconceptions can sabotage your financial health. Let's debunk these myths together!

Deciding between a new or used car can be tough. New cars offer the latest features and warranties, but they depreciate quickly. Used cars are often more affordable and have less depreciation, but may lack reliability or have higher maintenance costs. Consider your budget and needs!

As the financial landscape evolves, many question the 4% rule's relevance in retirement planning. Its creator emphasizes the need for adaptability, highlighting that personal circumstances and market dynamics must guide investment strategies today.

Investing in Canadian bank ETFs is a smart way to gain exposure to the country's robust banking sector. Start by researching top-performing ETFs, consider factors like management fees and dividend yields, and balance your portfolio to mitigate risks.

Top Takeaways A retirement letter informs your employer of your decision to stop working full-time. Include your retirement date, final working day, and contact details. Expressing gratitude in your letter strengthens professional relationships. Offering assistance during the transition supports your team. Giving early notice ensures a smooth process for everyone. Ending on a warm note

The Fasten Credit Card is designed with flexibility in mind. It offers cashback on everyday purchases, no annual fees, and easy budgeting tools. Plus, you can track your spending through a user-friendly app, making it a smart choice for savvy spenders.

Google has just unveiled groundbreaking AI models that enhance video and image processing. These advancements promise to revolutionize media creation, making it easier for creators to generate captivating content and transforming how audiences engage with visuals.

Ever since I got my Sleep Number bed, my sleep quality has transformed. Adjustable firmness has made a world of difference for my comfort. With Memorial Day here, it's 30% off-perfect timing to invest in your best rest!

Despite the excitement around AI advancements, a truly conversational Siri remains elusive. Limitations in natural language understanding, context retention, and emotional intelligence hinder progress. Until these challenges are addressed, our dream AI assistant may stay just that— a dream.

Inflation quietly erodes our wealth, but I've found a beacon of hope in dividend stocks. These steady earners not only provide a reliable income stream but also outpace rising costs, helping to preserve my purchasing power in a volatile economy.

In today's digital age, protecting your bank account is more crucial than ever. Follow these six essential steps to safeguard your finances against hackers and ensure your personal information remains secure. Your financial peace of mind starts here!

Recently, I’ve noticed that some of my favorite smart home products are shrinking. From compact smart speakers to mini smart plugs, these smaller models maintain functionality while saving space. It’s a win-win for organization and tech enthusiasts alike!

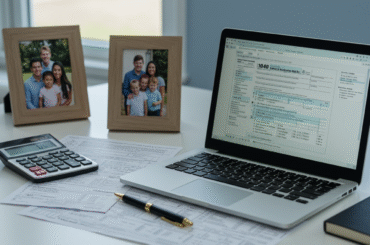

Learn about IRS rules for dependents that can change your federal income tax return and filing status. Understand both the rules for a qualifying child and a qualifying relative, along with any exceptions. See how having dependents can change tax benefits, such as earned income tax credits and standard deductions. Discover how different states

If you own an Asus router, it's crucial to ensure it hasn't been compromised. Recent reports indicate that certain models are vulnerable to hacking. Take a moment to check your router's security settings and update its firmware-protecting your network starts with you!

Remitly (NASDAQ: RELY) has delivered an unexpected boost in Q4 sales, leaving investors pleasantly surprised. The company's impressive performance has driven stock prices upward, reflecting growing confidence in its digital remittance services.