Amazon has slashed the price of a highly-rated $40 HD pet camera to just $20, offering pet owners peace of mind. This reliable device lets you check in on your furry friends while you're away, ensuring they’re safe and sound at home.

Feeling stuck with bad credit? Credit cards designed for rebuilding can be a lifeline. They often require a deposit as collateral but can help improve your score with responsible use. Just remember, timely payments are key to making a real difference.

A.K. Best, renowned for revolutionizing fly tying, has passed away at 92. His creativity and expertise inspired countless anglers, leaving a lasting legacy in the world of fly fishing. Best's handcrafted flies were not just tools; they were art.

As investors, we often only think about the obvious risks, but there are three potential economic landmines that we should be aware of. If you don't pay attention to these things, your portfolio could go off the rails because of the shadow banking sector's growing instability and the weakness of the supply chain.

Important lessons about money have changed how it is handled over the years. Financial habits have changed thanks to advice on everything from smart investing to good budgeting. This has led to a level of stability that once seemed impossible.

Travel plans can change suddenly, and unexpected events may leave guests worried about losing money. Airbnb has structured refund and cancellation policies to help protect both travelers and hosts, but these rules can be confusing without a clear explanation. Whether a host cancels, a property does not match what was promised, or a personal emergency

Getting an inheritance can be good and bad at the same time. Know how taxes will affect you, take the time to weigh your options, think about how it will affect your financial goals, and talk to a professional to make smart choices about your future.

Introduction Uber Eats connects users with many restaurants and cuisines through a simple app and website. This article explains how to find restaurants, navigate menus, customize orders, and track deliveries so users can order quickly and confidently. How Uber Eats Menu Works What Uber Eats Is Uber Eats is a food delivery platform that lists

Have you ever been angry because you couldn't get to your own money? Many people don't know about quiet laws that can limit their financial freedom, like fees for dormant accounts and complicated rules about inheriting money.

A Norwegian Cruise Line employee is raising concerns about a sophisticated cruise scam targeting unsuspecting travelers. They warn that fraudsters are posing as official representatives, prompting guests to verify bookings and share sensitive information. Stay vigilant!

As tariffs shift and supply chains waver, it's wise to stock up on essentials. Items like cleaning supplies, non-perishable foods, and personal care products can help you navigate potential shortages. Prepare now to ensure you’re covered later.

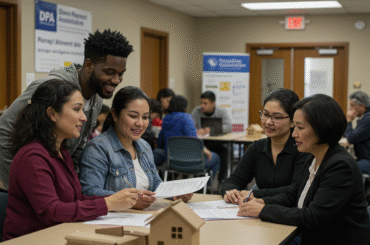

As the dream of homeownership becomes increasingly challenging, down payment assistance is stepping in as a vital resource. This growing tool helps aspiring buyers bridge the financial gap, making it easier to turn their homeownership dreams into reality.

Creating an effective spending plan with Simplifi can transform your financial health. Here are 8 essential hacks to streamline your budgeting: automate savings, categorize expenses, set realistic goals, and review regularly. Stay on top and make your money work for you!

As a parent, it's natural to want to support your adult child financially. However, this generosity could impact your benefits, especially if you're relying on programs like Medicaid or Social Security. Understanding the implications is crucial for your financial security.

In the world of investing, lower expense ratios often mean better long-term performance. When you cut costs, more of your money stays invested, which means it grows and compounds over time. Picking funds with lower fees might be a good way to help your portfolio do better.

Learn about the proposed 2025 Roth changes for high earners, including contribution limits, conversion rules, and strategies to optimize retirement savings.

Investing for the first time doesn't have to be scary. New investors can steadily build financial security by starting with the right mindset, picking the right accounts (like a 401(k), Roth IRA, or brokerage account), and making regular contributions. You can build up a lot of wealth over time with small investments if you spread them out, have an emergency fund, and are patient.

Planning for retirement can feel daunting, but knowing how much to save each month can ease your worries. To retire comfortably by 65, aim to save at least 15% of your income. Adjust this based on your current savings and lifestyle goals for a secure future.

Introduction In economics, unemployment is a vital indicator of economic health. It affects individuals, families, and the broader economy. Unemployment refers to people who are actively looking for work but cannot find a job. Various economic and social factors contribute to this issue, and its impact can be far-reaching. Understanding its causes and potential solutions

As we dream of retirement bliss, it's easy to overlook certain perks that can lead to long-term debt. From lavish travel plans to expensive hobbies, these seemingly harmless choices can strain your finances. Being aware is the first step to financial freedom.

In Episode 220, titled "I carry the baby, the bills, and the stress," we delve into the often-unseen burdens many parents face. This episode highlights the emotional and financial pressures that accompany parenting, offering insights and support for those navigating these challenges.

As investors brace for a muted stock market open, all eyes are fixed on upcoming U.S. inflation data and the highly anticipated summit between Trump and Putin. These events could significantly influence market sentiment and trading strategies.

Introduction Retirement planning focuses on maintaining a steady income to support your desired lifestyle. Income annuities are a strong option for guaranteed retirement income. Consulting a financial professional can help integrate income annuities into your plan, providing stability and peace of mind as you transition into retirement. What are Income Annuities An income annuity is

Joe Biden's policies, from infrastructure investments to tax reforms, aim to reshape the economy significantly. Understanding these changes can help you navigate potential impacts on your finances, whether through adjusted tax responsibilities or new job opportunities.

As we look to 2025, Whirlpool appears poised for potential growth. With innovative product launches and expanding market presence, indicators suggest it could be a savvy investment. Keep an eye on their performance-this company might just be a screaming buy!

Compare Remitly and Revolut for U.S. users. See fees, transfer speed, multi-currency accounts, support, and best use cases for everyday money management.

S&P futures are on the rise as investors keenly await earnings reports and insights from Federal Reserve officials. This keen focus reflects the market's anticipation of economic indicators that could shape future trading decisions.

Stocks are set to plunge before the open as traders react to the recent tariff relief rally. With U.S. inflation data on the horizon, investors are on edge, bracing for potential volatility that could redefine market trends in the coming days.

In a recent announcement, Amazon CEO has delivered disappointing news to loyal shoppers: price hikes are on the horizon. As the company navigates rising costs, customers may soon feel the pinch during their online shopping sprees. Stay tuned!

Joe Biden’s policies, from tax reforms to infrastructure investments, aim to boost the economy but could also affect your finances. Understanding these changes can help you navigate potential impacts on your savings, taxes, and overall financial health.