Unlock your language learning potential with Qlango's lifetime license for just $35! This limited-time offer allows you to access a wealth of interactive resources and personalized lessons, ensuring you can master a new language at your own pace. Don't miss out!

Introduction TikTok Shop and Instagram Shopping are two of the most popular platforms for Gen Z consumers in the U.S. Both combine social media content with e-commerce features, but they offer different experiences. TikTok Shop leverages short-form videos and live streams, while Instagram Shopping integrates product tags into posts, stories, and reels. Understanding these differences

529 plans will still be the best way to save for education in 2025 because they have high contribution limits, cover a wide range of expenses, and don't usually affect federal aid. ESAs, custodial accounts, and Roth IRAs, on the other hand, are better for specific needs and trade-offs. Start early, set up automatic contributions, and look at the tax breaks, fees, and investment options in each state to find a plan that fits your family's needs and budget.

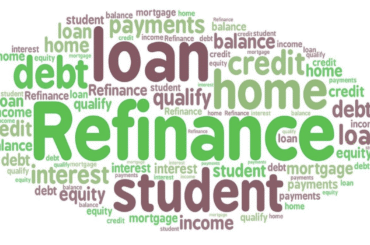

If you stop paying your student loans, you could face serious consequences. Initially, you'll enter delinquency, which affects your credit score. After several months, your loan may default, leading to wage garnishment or tax refund seizures. It's a tough path.

Colleges that don't require student loans are a great alternative to traditional financing because they let students graduate without debt. But be careful: it's important to look into accreditation, hidden fees, and job placement rates to make sure you're making a smart investment in your future.

Want to find the right city that fits your youthful spirit? We'll look at the best cities for young people. These cities have lively cultures, lots of job opportunities, and active social scenes.

Navigating student loans can be daunting, but AI tools like SoFi and Chime are leading the way. They analyze your financial situation and tailored recommendations to help find the best loan options, making the process simpler and more personalized.

Making FAFSA corrections is simple! Log into your FAFSA account, select "Make FAFSA Corrections," and update the necessary fields. Remember to review changes carefully before submitting to ensure your financial aid is accurate.

Don't give up hope if your student loan repayment plan was turned down in August 2025. Find out why your application was denied, look into your options for appealing, and think about other ways to pay off your debt that might be easier on your wallet.

Introduction Knowledge and technology drive economic growth, and investing in education enhances both individual careers and overall economic development. A skilled workforce increases productivity, innovation, and income potential, making continuous learning a critical component of career success. Tuition reimbursement programs play a pivotal role in supporting employees’ educational advancement while benefiting employers and communities alike.

Financial aid suspension occurs when students fail to meet academic standards, jeopardizing their funding. To regain aid, they can appeal the suspension, demonstrate improved performance, or create an academic plan with their school. Understanding the process is key!

Looking for the best online colleges for military service members? You’re in the right place! This listicle highlights top institutions offering flexible programs, tailored support, and benefits designed just for you. Dive in to find your perfect fit!

Student Discounts on Online Classes 2025 help learners save on high-quality education. Discover top platforms, get promo codes, and maximize savings on certificates, professional credentials, and degree programs.

Navigating student loan forgiveness can be tricky, especially with scams lurking around every corner. To protect yourself, look out for high fees, promises of quick forgiveness, and unverified contact methods. Stay informed and trust your instincts!

You're starting to plan for your future now that you're an adult. You might not think life insurance is important when you're thinking about your job, friends, and how to grow as a person. In any case, getting insurance in your 20s is a smart move. It has a lot of benefits and keeps you

Discover UC Berkeley’s out-of-state tuition, financial aid options, scholarships, and application steps to manage college costs effectively.

Discover what the U.S. Department of Education really does, how it impacts schools, and what actions you can take to support better education.

As a financial expert, I often reflect on what I wish I had learned in high school. From knowing the power of compound interest to the importance of budgeting, these lessons could have set the stage for a more secure financial future.

As we look ahead to 2025, borrowers should prepare for potential changes in student loan legislation. reforms may focus on repayment plans, interest rates, and forgiveness options. Staying informed is crucial to navigating your financial future effectively.

Build Legal Skills While You Study Get hands-on experience in the legal field while you study. Enjoy work hours that match your student schedule. Make good money and build important skills. Connect with experienced legal workers and improve your resume. Discover different areas of law and look at career options. Help a mission-focused company that

Navigating higher education financing can be daunting. While both financial aid and student loans help cover costs, they differ significantly. Financial aid often includes grants and scholarships that don’t need repayment, while student loans require repayment with interest. Understanding these distinctions is key to making informed choices.

Work-study programs offer students the chance to earn money while attending college, helping alleviate tuition and living costs. By balancing work with academics, I found it not only eased financial stress but also provided valuable work experience.

As many students breathe a sigh of relief, the student loan payment pause has been extended again. This decision impacts millions, allowing graduates extra time to navigate their financial futures. Here’s what you need to know to prepare.

This guide gives you a straightforward plan to learn bookkeeping. Whether you're just starting out or looking to improve your skills, this resource will assist you: Learn the basics of bookkeeping, including key terms and software like QuickBooks Online. Understand the essential skills and qualities needed to succeed in bookkeeping. Explore learning opportunities such

Learn how much you can contribute to a 529 plan in 2025, including annual limits, 5-year gift tax election, and state caps. Maximize savings with tax benefits and compliance tips.

It's not a crime to take a loan, but it is mandatory that you repay your debt. One method of debt repayment is refinancing. Therefore, in this article, we will discuss the steps you should follow when refinancing your loan. But before we go over each step, we will first define refinancing and explain how

Learn how to apply for a Cal Grant in 2025. Discover eligibility rules, FAFSA steps, key deadlines, and tips to maximize your California financial aid.

Are you feeling stressed out by your student loan payments? These eight practical ways to lower your monthly bills, from refinancing to income-driven repayment plans, will help you breathe a little easier each month.

Graduates often complain about the job market, but it's time to move on. Taking on responsibility can help you grow. Graduates can set themselves up for success by working on their personal growth, making connections, and being open to new opportunities.

Looking to advance your career in healthcare? In this listicle, we highlight the best online healthcare administration programs that offer flexibility and quality education. Discover top options, key features, and what makes each program stand out!