When considering a high-end home, a million dollars might seem like a solid budget. However, in many markets, it's often just a starting point. Luxury properties frequently exceed this figure, especially in sought-after locations. Understanding this can save potential buyers from disappointment.

In today’s volatile landscape, it’s crucial to invest based on current market realities rather than idealistic visions. Acknowledging the present conditions helps us make informed decisions, ultimately leading to more sustainable financial growth. Adaptability is key.

Looking for the best car insurance in NC? You're in the right place! In this listicle, you'll discover top providers that offer great rates and reliable coverage. From discounts to customer service ratings, we've got all the info you need to make an informed choice!

In this listicle, you'll discover the best paying delivery apps that can boost your income. From food to groceries, each option is backed with insights on pay rates and flexibility. Get ready to find the perfect gig that suits your lifestyle!

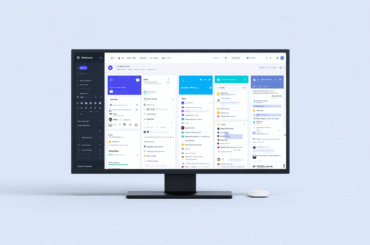

These are the best SECR softwares to boost your ESG strategy: Dcycle EcoOnline Watershed Accuvio GHGi Analytics Mavarick.ai Novisto Envizi Figbytes Enablon If you report in the UK, a SECR software is a must. The right platform does more than generate an annual document. It becomes the place where energy data lives. Calculations run automatically.

These are the 10 best multichannel contact center software solutions you should consider: Harmonix AI Zendesk Genesys Cloud CX Freshdesk Contact Center HubSpot Service Hub Talkdesk RingCentral Contact Center Aircall 3CX Intercom Handling customer conversations across phone, email, chat, WhatsApp, LinkedIn and social DMs doesn’t have to feel like spinning plates. The new generation of

These are the best AI tools for lead generation in 2025: Genesy Clay Apollo Lavender Cognism Instantly Surfe Amplemarket Wiza Drift AI has changed how sales teams generate leads. What used to take hours of manual research, data cleaning, and repetitive outreach can now be automated and optimized through intelligent software. The new generation of

Owning a car and driving everywhere has long been a cornerstone of the American way of life – but that’s starting to change. A recent StorageCafe report shows that more and more U.S. cities are embracing a car-optional lifestyle, giving residents the freedom to rely less on their vehicles and enjoy a range of new

Discover the best months to visit Hawaii for ideal weather, lower costs, and fewer crowds. Plan your trip with expert tips and seasonal insights.

Understanding the difference between a credit report and a credit score is crucial for managing your financial health. While your credit report details your credit history, your credit score summarizes how responsible you are with credit. Knowing both can empower your financial decisions.

In recent months, private equity firms have shifted to a 'risk off' approach, pausing their dealmaking activities. With economic uncertainty lingering, investors are adopting a cautious strategy, focusing on stability over bold acquisitions.

As Amazon dips into correction territory, investors are left wondering: should they panic? Historically, such downturns can be opportunities rather than disasters. Staying informed and assessing the bigger picture may lead to brave decisions, not fear-driven ones.

In recent years, e-commerce has become one of the fastest-growing sectors of the global economy. With online shopping evolving rapidly, entrepreneurs are constantly seeking efficient ways to manage logistics, inventory, and customer satisfaction. One model that has redefined how businesses operate online is dropshipping — a process where sellers market products without holding any physical

With several crypto exchanges blooming in the markets, this platform has marked its presence in the niche. Its major focus areas are derivative trading. It enables users to leverage trade on Bitcoins and other cryptocurrencies. So, there are obviously greater returns to be made. This attracts the paid elite, going for advanced strategies and higher

Cryptocurrency has evolved from the fringes and made its way to the center stage on a global platform. What started as a digital novelty is now forcing institutions, governments, and private citizens to re-evaluate what they know about money and its handling. With innovation paving the way for accessibility and building trust, digital assets are

Saving money can feel overwhelming, but it doesn't have to be. Start small with practical tips: track your spending, set a budget, and make mindful purchases. These simple steps can lead to significant savings over time. Your financial future will thank you!

Creating a wedding budget can feel overwhelming, but breaking it down into six essential steps makes it manageable. Start by setting a total budget, prioritize your must-haves, and keep track of your expenses. With careful planning, you’ll navigate costs confidently.

As we stand on the brink of a new space age, several stocks are poised for growth. Companies like SpaceX, Blue Origin, and others are leading the charge in satellite technology and interplanetary exploration. Keep an eye on these potential game-changers!

Building business credit is essential for securing loans and favorable terms. Start by establishing a legal business entity, obtaining an EIN, and opening a business bank account. Follow these nine steps to elevate your credit score and financial credibility.

Having good credit is essential for financial health. It opens doors to better loan rates, lower insurance premiums, and higher chances of rental approval. With a solid credit score, you're better equipped to navigate life’s big purchases and opportunities.

Looking for the best invoicing software to streamline your contractor business? You're in the right place! In this listicle, we'll break down top options tailored to your needs, covering features, pricing, and user-friendly interfaces that make billing a breeze.

Understanding property insurance is crucial for protecting your assets. From homeowners and renters insurance to commercial policies, each type offers unique coverage. Knowing your options helps ensure you're adequately protected against potential risks.

Discover the key differences between reverse budgeting and traditional budgeting. Learn which method suits your income, savings goals, and spending habits to improve your financial planning.

Accidents happen all the time. However, some could leave not just physical and emotional scars but also a heavy financial burden. If you’ve been injured in one, you will have to face hefty medical bills on top of losing income and even employment, leaving you in an uncertain position. A full recovery will only be

The rise of the gig economy has transformed how millions of people earn a living. From freelance designers and delivery drivers to online tutors and small e-commerce sellers, more workers are turning to side hustles to boost their income or achieve financial independence. Yet, with that flexibility comes a major challenge, managing taxes. Many independent

Blockchain technology has evolved significantly since its beginning in cryptocurrency. What was a specialised innovation now powers financial systems worldwide, efficiently and securely. Payments, especially, have seen a tremendous impact. Since its creation, internal payment processes linked to Blockchain have changed. This transformation has enabled a new level of financial autonomy that traditional banking methods

As AI continues to revolutionize industries, investors should keep an eye on leading stocks like NVIDIA and Alphabet. These companies are at the forefront of innovation, making them promising options for those looking to capitalize on this tech boom.