Archer Aviation's recent earnings report has sent its stock into a tailspin, yet this downturn may overlook the company's long-term potential. With advances in eVTOL technology and strategic partnerships, the current low price could present a promising buying opportunity.

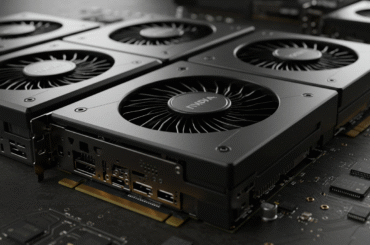

Nvidia's stock seems to overlook the potential of sovereign AI, which could reshape industries and redefine competition. With government investments and regulations on the horizon, it's crucial to consider how this emerging landscape might impact future valuations.

Looking to declutter or start a side hustle? In this listicle, we'll explore the best online selling sites that suit your needs. From user-friendly platforms for beginners to niche marketplaces, you'll find the perfect spot to sell your items and boost your income!

They started small. One team. One brand. One big idea. No massive funding. No fancy headquarters. Just a group of smart people with a clear goal — to do things differently in online gaming. Now? Soft2Bet is a global name. They've grown fast, stayed sharp, and managed to keep that startup spark alive. This isn’t

Student Discounts on Online Classes 2025 help learners save on high-quality education. Discover top platforms, get promo codes, and maximize savings on certificates, professional credentials, and degree programs.

When searching for the best car insurance in Illinois in 2025, look for providers that balance coverage options with affordability. Companies that prioritize customer service and claims efficiency stand out, ensuring peace of mind on the road.

Explore the best scholarships for returning adults in 2025. Learn about grants, financial aid, and scholarships for adults returning to school, including career-focused and need-based options.

Introduction In a world dominated by large corporations, cottage industries provide an excellent opportunity for individuals to turn their unique skills into profitable businesses. These small enterprises prioritize quality and craftsmanship over mass production. This guide explores key aspects of cottage industries, focusing on legal and financial considerations to ensure success. Cottage Industries Cottage industries

Introduction Practicum programs are vital for students and early-career professionals. They allow participants to apply classroom knowledge in practical settings, gaining experience that enhances career readiness. These programs build vital skills, improve confidence, and increase employability. Understanding how practicums work can help you navigate them successfully and leverage them for long-term career growth. Exploring the

Explore the paralegal and lawyer difference, including roles, responsibilities, education, salaries, and career opportunities to make an informed legal career choice.

Discover the best AI tools for solopreneurs to automate tasks, improve customer engagement, enhance marketing, and streamline operations. Learn how AI automation for small business can save time and grow your solo business efficiently.

Learn how Grubhub Customer Service helps resolve order problems quickly. Explore contact options, refunds, and tips for a smooth food delivery experience.

Discover 7 practical tips for effective retirement planning. Learn how to set goals, create a budget, invest wisely, plan Social Security, and secure your financial future.

Discover the credit card trends 2025 shaping the future of payments. Explore digital wallets, eco-friendly credit cards, AI credit scoring, personalized rewards, and enhanced security features in the evolving credit card industry.

Discover the best prepaid travel cards for international travel in 2025. Compare fees, benefits, and multi-currency options from providers like Wise, Revolut, and Chime to save money and manage expenses abroad with ease.

Introduction The vending machine industry offers a profitable opportunity for small business owners. Whether you are starting or already operating a vending business, this guide provides practical steps for growth. By understanding market trends, refining your strategy, and adopting efficient management practices, you can achieve sustainable long-term success. Vending Machine Industry Landscape The vending machine

Introduction Veterans Day is a federal holiday dedicated to honoring those who have served in the United States Armed Forces. It is a time to reflect on their courage and sacrifices. As the holiday approaches, understanding its impact on banking, postal, and retail services can help you plan effectively. This guide provides practical tips to

Introduction Currency conversion is vital for individuals and businesses handling money from different countries. Whether sending money to family, visiting the Philippines, or trading internationally, converting US dollars (USD) to Philippine pesos (PHP) is necessary. This guide provides an easy-to-follow approach to convert USD to PHP efficiently. You will learn how to make smart money

Reselling can be a rewarding venture if approached strategically. Start by identifying niche markets and sourcing quality products at low prices. Use platforms like eBay or Poshmark, and always research trends to maximize your profits and minimize risks.

Imagine transforming any Wikipedia topic into a captivating interactive timeline! This innovative tool allows users to visualize historical events, milestones, and key figures in a dynamic format, making learning both engaging and insightful. Dive in and explore history like never before!

As we dive into 2025, the world of real money games is evolving. Three standout titles are gaining traction: "Crypto Clash," where strategy meets cryptocurrency, "Fantasy Sports League," blending passion with profit, and "Trivia Treasure," testing knowledge for cash rewards.

In a sun-kissed Spanish vineyard, the labor of an unsung engineer is celebrated at last. As the vintner lifts his glass, it's not just the wine that sparkles, but the ingenuity behind the flavors. This toast honors the silent architects of our finest sips.

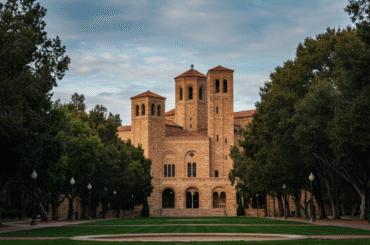

Discover how UCLA is negotiating with the Trump administration to restore $339 million in federal research grants frozen over civil rights concerns in 2025.

In this listicle, you'll discover the best financial books that can transform your money mindset. From budgeting to investing, each title offers invaluable insights to help you take control of your finances and build wealth. Get ready to learn!

As the world becomes less certain, trading options can help you deal with markets that are changing quickly. Here are five stocks that are ready for growth, so you can take advantage of it while keeping your risk low. Stay up-to-date and make smart trades.

A loan shark is an unlicensed lender who offers high-interest loans under illegal terms. Often preying on vulnerable individuals, they use intimidation and harassment to ensure repayment. Understanding their tactics is crucial for financial safety.

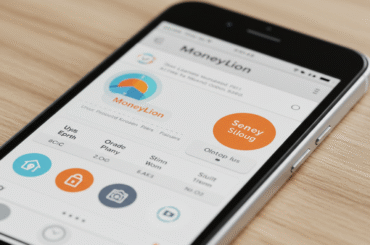

MoneyLion is a financial technology platform that offers banking and investment services tailored for everyday users. As of 2025, it provides features like personalized financial advice, low-cost loans, and tools to help manage your budget effectively.