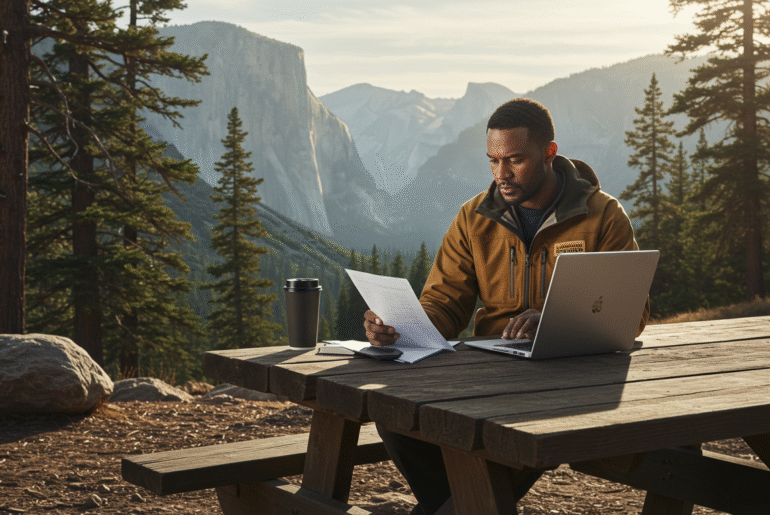

National park workers are facing unexpected challenges as credit card limits are suddenly frozen, leaving many struggling to manage daily expenses. This financial hurdle disrupts their ability to focus on conservation efforts and visitor services.

The "State of Personal Finance 2022 Annual Report" reveals intriguing insights into consumer habits and savings trends. Notably, while many prioritized debt reduction, a significant number still felt unprepared for emergencies, underscoring ongoing financial challenges.

When considering how much to spend on a car, start by evaluating your budget. Ideally, your monthly car expenses should stay within 15% of your monthly income. Factor in insurance, maintenance, and fuel costs to ensure your choice fits comfortably within your financial plan.

Ready to retire two years earlier? Start by maximizing your retirement contributions and consider downsizing your home. Strategic investment choices and reducing debts can also boost your savings. Small lifestyle changes today can lead to financial freedom tomorrow!

Is Apple a stagnant stock or a burgeoning AI powerhouse? With its latest strides into artificial intelligence, many investors wonder if the tech giant is on the brink of a significant transformation. Time will tell if this is dead money or cash cow potential.

Trust has always been the cornerstone for every business. Sometimes unspoken, but always relevant. In the present scenario customers have endless options to choose from. It is also a world where information travels faster than ever. And so, trust is not an option any longer. It’s the currency that helps sustain a brand and fuels

Looking for the best credit cards for airport lounge access in Canada in 2025? From travel rewards to exclusive perks, we’ve rounded up the top options that offer complimentary entry to premium lounges, elevating your travel experience.

Want to make a difference as a teacher? We'll find the best states to teach in. Each one has its own set of benefits, such as high salaries, strong support systems, and lively communities. Jump in and find the perfect place to teach.

Check cashing is a service that allows individuals to exchange their checks for cash without needing a bank account. It's a convenient option for those who might not have access to traditional banking, but typically comes with fees that vary by location.

Struggling to manage your spending? You're not alone. With just a few changes, you can regain control of your finances. Start by tracking your expenses, setting a budget, and identifying your triggers. These 16 actionable tips can help you cultivate healthier spending habits.

Have you ever glanced at your wallet and thought every bill was just worth its face value? Think again! From rare serial numbers to unique conditions, some $1, $5, and even $20 bills can fetch much more than their printed price. Let's explore 17 surprising examples!

Getting the right insurance for your used car is important to keep your money safe and give you peace of mind. There are a lot of providers that offer competitive coverage options, so it's important to know what you need and pick a policy that fits your budget.

Finding affordable car insurance in Virginia doesn't have to be complicated. With options starting as low as $39 a month, you can secure the protection you need without breaking the bank.

The difference between active and passive income is important to reaching your financial goals. Active income requires you to trade time for money, such as through a job or freelance work.

Crypto gambling affiliate marketing is alive and very lucrative, a real chance to make passive income. With the emergence of niche sites such as crypto baccarat sites, affiliates are tapping into an expanding market that values privacy, fast payouts, and borderless gaming options. The Pros: Big Commissions and Global Reach Big Commissions: You get 30-50%

A mortgage prepayment penalty can catch homeowners off guard, costing them if they pay off their loan early. Understanding this fee is crucial. To avoid it, look for lenders that offer no-prepayment-penalty options and read the fine print carefully.

As the economy begins to rebound, now is the time to reevaluate your portfolio. Look at companies like XYZ Corp, ABC Industries, and 123 Technologies, which show strong fundamentals and growth potential during this early cycle recovery. Invest wisely!

A two-party check is a financial instrument made out to two people or entities, requiring both signatures to cash or deposit it. This setup enhances security and trust, often used in transactions like real estate deals or shared expenses.

Bitcoin bulls are making a strong comeback as BTC hovers around the $112K mark, reigniting optimism in the crypto community. Analysts are closely watching market trends, speculating on the potential for further gains as interest surges once again.

Learn how much you can contribute to a 529 plan in 2025, including annual limits, 5-year gift tax election, and state caps. Maximize savings with tax benefits and compliance tips.

What Is a Deferred Tax Asset A deferred tax asset is something that lets a company pay less in taxes later on. It happens when there is a gap between what the company reports in its books and what it gets taxed for. A company might have already paid tax, or it could get to

Looking for the perfect place to enjoy your golden years? In this listicle, you'll discover the best retirement communities that blend comfort, activities, and camaraderie. Get ready to find vibrant environments tailored just for you!

Looking to travel from Seattle to Brussels? Scandinavian Airlines has got you covered with roundtrip fares starting at $497 for Basic Economy and $1,159 for Regular Economy. Both prices include all taxes—making your European adventure more accessible!

CIT Bank is making waves with its Platinum Savings account, offering a generous bonus of $225 for new customers and $300 for existing ones. Plus, enjoy a competitive APY of 4.30%, making it a great time to boost your savings. Don't miss out!

Soft2Bet stands out as a leading iGaming turnkey solutions provider, celebrated for its innovative gamification features and player-centric design. The platform supports over 12,500 games, 1 million live events annually, and numerous successful iGaming brands worldwide. Operators benefit from motivational engineering, advanced retention strategies, and flexible solutions for casinos and sports books. Soft2Bet

If you’re considering a flexible side hustle, becoming a DoorDash driver, also known as a Dasher, might be the perfect option for you. With an ever-growing demand for food delivery, especially in urban areas, DoorDash offers an opportunity to earn money on your schedule. However, before diving in, it’s important to understand how much you

In today’s fast-paced financial landscape, managing personal finances effectively can feel like a daunting task. With bills to pay, subscriptions to track, and the need to budget for both short- and long-term goals, staying on top of your finances is essential. That’s where personal finance apps like Rocket Money come in. Formerly known as Truebill,