Deciding whether to use retirement savings to pay off credit card debt isn't easy. While clearing high-interest debt can provide immediate relief, tapping into retirement funds may lead to penalties and lost growth. Assess your situation carefully before deciding.

In this listicle, you'll discover the best car insurance options in Utah tailored to your needs. From affordable rates to excellent customer service, we'll guide you through top picks that ensure you're protected on the road!

Discover how TSMC’s chip technology, AI partnerships, and financial strength make it a top investment for the growing artificial intelligence market.

Explore the best Fourth of July 2025 deals at Home Depot, save up to 50% on appliances, tools, grills, and more. Find top brands and exclusive online offers now.

Graduates often complain about the job market, but it's time to move on. Taking on responsibility can help you grow. Graduates can set themselves up for success by working on their personal growth, making connections, and being open to new opportunities.

Are you feeling stressed out by your student loan payments? These eight practical ways to lower your monthly bills, from refinancing to income-driven repayment plans, will help you breathe a little easier each month.

Graduates often complain about the job market, but it's time to move on. Taking on responsibility can help you grow. Graduates can set themselves up for success by working on their personal growth, making connections, and being open to new opportunities.

Learn how to choose a profitable blog topic by combining your passion, audience demand, and inclusive finance strategies. Build income and impact with the right niche.

Buying a new smartphone can be a big investment, but paying for it all at once can be hard. Smartphone financing options like Affirm are a good thing because they let you break up the cost into monthly payments that are easier to handle. This flexibility makes it easier to get the newest technology without

If your hospital is leaving Medicare Advantage in 2025, learn how it affects your care, what plans to consider, and how to switch without losing coverage.

Is Dollar Tree stock a good investment in 2025? Explore its financial outlook, recent performance, competitive challenges, and growth strategy in this expert analysis.

Uncover the truth about Social Security myths that could shrink your retirement income. Learn how claiming age, career, spousal benefits, and inflation impact your benefits—and how to make smarter choices.

Get ready for a successful spring with this complete spring garden prep and budget guide. Learn how to prepare soil, plant vegetables, manage pests, and track garden finances for a productive season.

As Alphabet navigates the ever-changing tech landscape, investors are closely watching key indicators. With innovations in AI and digital advertising, opinions vary-some predict a bullish outlook, while others cite economic uncertainties, hinting at potential bearish trends.

Playtika has mastered the art of blending fun and profits, continually engaging players while boosting investor returns. With innovative game designs and strategic growth catalysts, it's a company to watch—though some investors might overlook its true potential.

Looking for the best banks in Maryland? This listicle highlights top institutions that cater to your financial needs. From great interest rates to exceptional customer service, you’ll discover options that fit your lifestyle and goals!

Looking to boost your business savings? In this listicle, you'll discover the best CD rates available right now. Each entry offers detailed interest percentages and terms, helping you choose the perfect fit for your financial goals. Let's dive in!

In a surprising twist, Netflix has unveiled new strategies aimed at attracting new subscribers. From introducing ad-supported tiers to expanding free trials, the streaming giant is recalibrating its approach, seeking to boost its viewer base in a competitive landscape.

Want to save money while you're on the road? Forget about the plane and take a train. Train travel is a cheap and stress-free way to get around, with lower ticket prices and beautiful routes. Find out how to see more while spending less.

When you have pets like dogs, it does not just mean loyalty and love; you need to look at the legal risks that having them may entail. Just like if your pet injures someone, you could face steep financial consequences on top of the physical and emotional toll you may experience. Here’s what you need

Main Points It is important to break the project into clear phases. These phases include starting, planning, doing, checking, and finishing the project, according to the Project Management Institute. A strong project management process can lead to success. It helps ensure that goals are achieved within the project timeline. There are helpful tools and resources

Introduction Finding the right tires is not just about looking at the prices. You need to choose tires that match your driving needs and fit your car. Important things to consider are tire size, the type of terrain you will drive on, and how well they handle different weather conditions. For instance, if you live

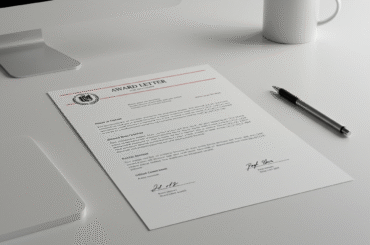

An award letter is an official document from the Social Security Administration (SSA) confirming approval for Social Security benefits. It serves as proof of benefits, allowing recipients to receive their monthly payments or request changes to their benefit amounts. The original award letter is different from a benefits verification letter, which provides more detailed

The Euro is facing significant challenges, leaving currency traders anxious about its future. As economic indicators falter, the question remains: how much lower can Euro futures dip? Understanding the nuances is crucial for navigating this turbulent phase.

Looking to advance your career in healthcare? In this listicle, we highlight the best online healthcare administration programs that offer flexibility and quality education. Discover top options, key features, and what makes each program stand out!

When planning your next adventure, timing is everything! In this listicle, you'll discover the best times to buy international flights for unbeatable deals. From seasonal trends to key booking windows, get ready to save on your dream getaway!

While the U.S. debt often sparks fears of a crisis, the reality is more nuanced. Elon Musk's assertion about investing in infrastructure reflects a crucial truth: strategic spending can drive growth and innovation, countering debt concerns.