Looking for the best annuity rates today? You've come to the right place! In this listicle, we'll break down top-rated options available now, helping you make a well-informed decision for your financial future. Don't miss out on maximizing your returns!

WH Smith has positioned itself as a proactive player in the retail market, declaring, "We're a willing buyer." This statement reflects their readiness to adapt and seize opportunities, ensuring they remain a vital presence in our shopping experience.

Bonuses can feel like a financial windfall, but it’s essential to understand how they’re taxed. Generally, bonuses are subject to withholding at a flat rate of 22% for federal taxes, differing from regular income. Knowing this can help you plan your finances better!

Considering nursing school? The average cost can range from $7,000 for a community college program to over $40,000 at private universities. While it’s a significant investment, many find the long-term job stability and salaries worth it.

Starting to invest in your 30s is a smart decision. Begin by setting clear financial goals, exploring retirement accounts like IRAs, and diversifying with stocks or bonds. Regular contributions can help build wealth and secure your future. Start today!

Looking to make your birthday even more special? Dive into our list of the Best Birthday Rewards! From sweet deals and freebies at your favorite restaurants to exclusive offers from retailers, you’ll discover unique ways to celebrate. Get ready for some amazing perks on your big day!

Rollover loans have become a common feature in short-term lending agreements, especially in markets where payday loans and fast-access financing are widespread. While they offer borrowers a way to extend the life of a loan, the longer-term effects on repayment can be significant. These loans allow for deferred payment when funds are tight, which may

As American consumers face potential price hikes from new tariffs, many are finding creative ways to adapt. From meal prepping to bulk buying and cutting non-essentials, everyday Americans are crafting budgets and making choices to stretch their dollars further.

Replacing airbags can be a costly endeavor, typically ranging from $1,000 to $3,000 depending on the vehicle make and model. It's essential to factor in labor costs and potential sensor replacements, as safety should never be compromised.

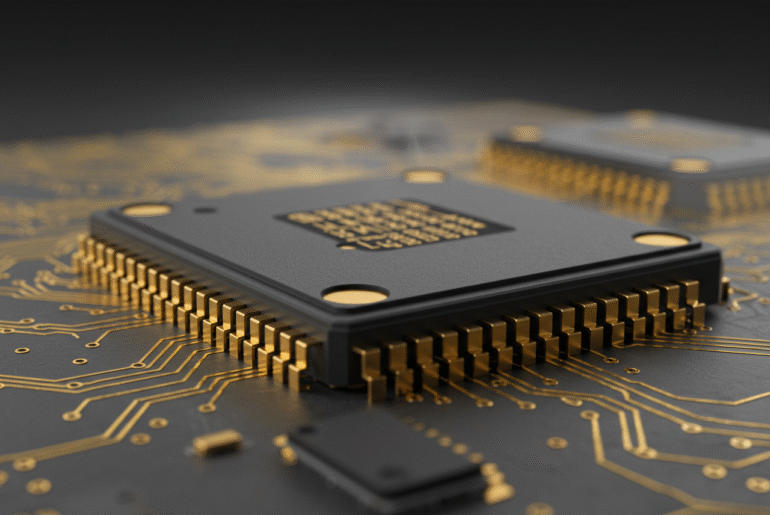

Cathie Wood has made headlines again, investing a staggering $46 million in a top semiconductor stock that's been on a remarkable surge. This bold move aligns with her optimistic outlook on technology's future, showcasing her confidence in the sector's growth potential.

Looking for the perfect website host for your small business? In this listicle, you'll discover the top options tailored to fit your needs. From reliability and support to pricing and performance, we've got all the details you need to make an informed choice!

Did you know that some coins in your pocket could be worth significantly more than their face value? From rare dates to unique mint marks, the right coin can turn a simple quarter into a valuable collector's item. Let's explore ten coins that could surprise you!

If you’ve ever wished you could customize where your macOS notifications appear, you're in luck! There's an app designed to give you that flexibility. With just a few tweaks, you can relocate those pesky alerts for a more organized workspace. Perfect for decluttering!

In recent years, the side gig economy has transformed from mere survival tactics into strategic endeavors. Many are leveraging their passions into sustainable income streams, showcasing how adaptability and innovation can redefine work-life balance.

If you're looking to save money while shopping online, TopCashback is a great option! Sign up today and earn a $10 bonus just for joining. Plus, you'll receive $45 for every friend you refer, making it a win-win for everyone involved!

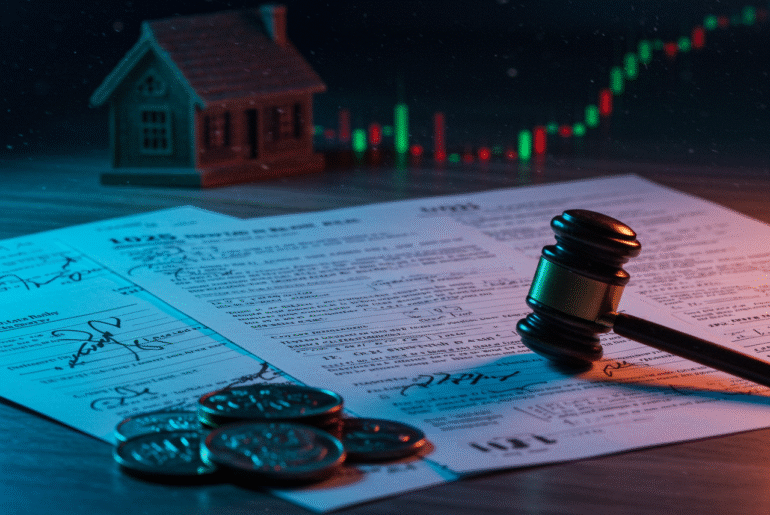

The step-up in cost basis is a crucial aspect of estate planning, directly impacting taxes upon inheritance. Understanding how it interacts with today's estate tax threshold can help families navigate potential tax liabilities more effectively.

Refinancing a high-mileage car can be a smart move. It often lowers monthly payments or secures a better interest rate. However, be mindful of your vehicle's value and potential equity, as these factors can influence lender options and terms.

Managing your money has never been easier. In 2025, neobanks play a central role in the financial lives of millions of users. The quality of their mobile application is now a key differentiator—far beyond simple design. Why? Because almost everything now happens through it: payments, budgeting, investing, transfers, alerts, currency conversion… But beware, not all

A couple years back, the internet went crazy talking about something called crypto and NFTs. All people were talking about was Bitcoin, Ethereum, and these weird cartoon images that people were somehow selling for thousands, sometimes millions, of dollars. If you're like everybody else, it sort of seems cool at first. Like, wait… you can

Introduction: Why This Even Matters As teens, most of us think banking is something we’ll worry about when we get older, maybe when we start college, get our first job, or move out. But here’s the truth: the sooner you learn how to manage money, the stronger your financial future becomes. Opening a bank account

When browsing real estate listings, watch out for words like "cozy," "fixer-upper," and "unique." These terms often signal hidden issues or charm that may require more than just a little TLC. Knowing these red flags can save you from costly surprises!

Android users rejoice! The often-overlooked "Secret" Phone Information page is set for an upgrade. This hidden gem will soon offer more user-friendly features, making it easier to access vital device data, ensuring a smoother experience for all. Stay tuned!

Ready to find the best car insurance in Wisconsin? In this listicle, you'll discover top-rated insurers that offer competitive rates, comprehensive coverage, and excellent customer service. Let's help you choose the right policy for your needs!

As Ethereum continues its impressive surge, many analysts believe Bitcoin's dominance may have peaked. With altcoins like ETH gaining traction, the crypto landscape is shifting. A 99% chance of change? It's time to rethink our investment strategies.

Planning a staycation can be just as fulfilling as a getaway. Start by setting a budget and creating a schedule. Explore local attractions, create themed meals at home, and unplug from daily routines. It's all about transforming your familiar space into a vacation haven!

Budget reports are essential tools for managing your finances effectively. By reviewing these reports regularly, you can track income and expenses, identify spending trends, and make informed decisions to stay on track toward your financial goals.

FEMA, the Federal Emergency Management Agency, plays a crucial role in disaster response and recovery. It provides assistance to individuals and communities affected by natural disasters, helping with housing, repairs, and financial support. Understanding FEMA can aid you in times of crisis.