When planning for retirement, understanding 401(k) contributions is crucial. They are tax-deductible, which means you won't pay taxes on the money you contribute until withdrawal. However, be mindful of annual contribution limits to maximize your benefits effectively.

Financing a shed can be straightforward with the right approach. Start by assessing your budget and exploring options like personal loans, home equity lines of credit, or even credit cards. Don’t forget to factor in ongoing maintenance costs for a complete financial picture.

Spring has sprung, and so have fantastic tech deals! Amazon's Big Spring Sale features top gadgets under $50 that won't break the bank. From smart home devices to handy accessories, these must-haves deliver value and functionality without compromising quality.

When market volatility strikes, certain stocks tend to shine. Defensive stocks, like utilities and consumer staples, provide stability as they cater to essential needs. Additionally, gold and dividend-paying stocks can offer a buffer against uncertainty.

If you’ve been eyeing a Roborock robot vacuum, now is the perfect time to buy! During Amazon's Big Spring Sale, many models are deeply discounted, making it easier than ever to upgrade your cleaning routine with smart, efficient technology.

Impulse control is key to boosting your savings. Start by setting a budget and identifying triggers that lead to spontaneous purchases. Use techniques like the 24-hour rule—waiting a day before buying—to help curb those urges and prioritize your financial goals.

Cutting grocery bills doesn’t have to break the bank! Discover eight affordable gadgets that can help you save money and reduce food waste. From smart scales to meal prep containers, these tools will make budgeting a breeze while keeping your meals delicious.

When it comes to affordable dental care, the secret lies in prevention. Regular brushing, flossing, and routine check-ups can save you from costly treatments later. Invest time in your oral hygiene today, and your wallet will thank you tomorrow!

Deciding on the right business to start can feel overwhelming. Begin by assessing your passions and skills, researching market needs, and exploring potential profits. Don't forget to consider your lifestyle goals and the resources at your disposal. Happy brainstorming!

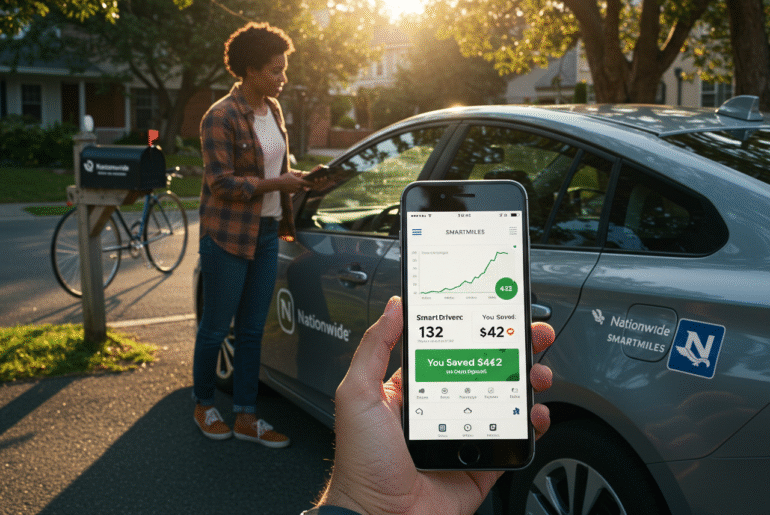

Pay-per-mile car insurance offers savings for drivers who don’t use their vehicles frequently. SmartMiles tracks mileage using a device or mobile app to ensure accurate billing. Combines a flat base fee with a per-mile rate, allowing monthly payments to reflect actual use. Ideal for retirees, remote workers, or infrequent drivers. Comparing SmartMiles with standard

When searching for the best credit union for your business account, consider our curated list that breaks down key features like fees, interest rates, and member support. We promise you'll find options tailored to your unique needs!

Deciding how many credit cards to have can be tricky. Generally, having 2 to 3 cards is optimal for building credit without overwhelming yourself. Track spending carefully; too many accounts can lead to debt and confusion. Balance is key!

As defense spending continues to rise, savvy investors are eyeing ETFs that capitalize on this trend. Notably, three options stand out for defense hawks: the iShares U.S. Aerospace & Defense ETF, the SPDR S&P Aerospace & Defense ETF, and the Invesco Aerospace & Defense ETF. Each offers robust exposure to leading defense contractors, making them attractive picks for those bullish on military investments.

Understanding the strike price is crucial for options trading. It’s the predetermined price at which you can buy or sell the underlying asset. A well-chosen strike price can maximize your profit potential and minimize risks when navigating market movements.

After much anticipation, Apple has finally made the new AirPods Max worth considering. With improved sound quality, enhanced battery life, and meaningful design upgrades, these headphones blend luxury with functionality, appealing to audiophiles and casual users alike.

Looking for the best value MBA programs? You’re in the right place! Our listicle highlights schools that offer excellent education without breaking the bank. Expect insights on tuition, curriculum quality, and career outcomes to help you make an informed choice.

MEGI offers a compelling opportunity for investors seeking global infrastructure exposure with an impressive double-digit yield. With a focus on essential assets, it blends stability and growth, making it a noteworthy option for income seekers in today's market.

Ready to snag the best TV deal? In this listicle, you’ll discover the prime times of year for buying a new television. From major sales events to seasonal trends, you'll learn exactly when to strike for unbeatable prices! Get ready to save big!

Transcribing video content has become an essential tool in educational settings, offering numerous benefits to students and instructors alike. Whether you're creating online courses or simply enhancing your classroom materials, the process of converting video to text can improve accessibility, comprehension, and engagement. A video to text converter can simplify this process, making the task

Modern work culture often prizes efficiency over humanity. We’re pushed to streamline, optimize, and automate—until the day feels more like a checklist than a lived experience. But the solution doesn’t always lie in massive structural changes or expensive wellness initiatives. Sometimes, it’s the small cultural shifts—the micro-decisions teams make every day—that make the biggest difference.

When seeking the best credit union for a car loan, you're in luck! In this listicle, you'll discover top-rated options tailored to your needs. Expect competitive rates, flexible terms, and exceptional member service-all designed to drive your dream car home!

Rakuten functions like a virtual shopping mall, giving sellers more control over their online stores. Amazon, by contrast, operates a closed ecosystem. Amazon Prime offers rapid shipping and access to exclusive videos. Rakuten provides cashback and Rakuten Super Points as part of its loyalty rewards system. Rakuten emphasizes brand image and customer experience through

Top Takeaways Access Rakuten promo codes for savings at over 3,500 popular stores Maximize cashback rates during Black Friday, Cyber Monday, and peak shopping periods Receive rewards through Rakuten’s sign-up bonuses and referral programs Explore seasonal coupons for top brands across various product categories Redeem promo codes easily via the Rakuten app or website Stay

How Much Does It Cost To Buy a Domain Name? A domain name typically costs $10 to $20 per year, but pricing varies depending on the registrar, renewal fees, and optional services. Premium domain names are short, memorable, and keyword-rich; these can cost thousands of dollars. Popular top-level domains (TLDs), such as .com.com, are in

Best Credit Card for Employee Benefits Top U.S. credit cards that support work-related spending and reward programs Statement credits, bonus points, and fraud protection features Tools for real-time spending tracking and budgeting Steps and documents required to open an account Tips to maximize usage, spending control, and balance transfers Introduction Employee benefit credit cards offer

H&M vs. Zara: Guide to Fast Fashion Choices H&M and Zara are leading global fast fashion retailers offering trendy clothing at accessible prices. H&M appeals to cost-conscious shoppers and promotes sustainability through its “Conscious Collection.” Zara uses a rapid supply chain and higher-quality fabrics to deliver runway-inspired fashion at a premium price. Each brand has

Becoming a financially independent adult with your own responsibility for money can be daunting, but it’s an important process and can be done responsibly to enable you to reach your goals faster. Whether you’re on the cusp of flying the nest, you’re about to attend university for the first time, or you’re hoping to save