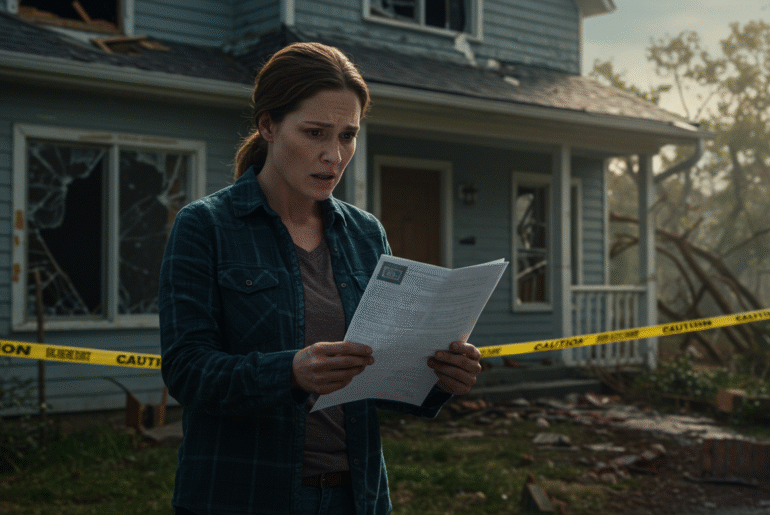

In the aftermath of natural disasters, hope can quickly turn into despair as scammers exploit vulnerable individuals. These opportunists prey on those seeking aid, promising relief while siphoning away resources meant for recovery. Awareness is key.

American Express specializes in premium credit cards with luxury travel perks and a robust rewards program. Revolut focuses on digital banking with low fees, budgeting tools, and multi-currency support. Amex Platinum and Gold suit frequent travelers, while Revolut Metal and Ultra fit digital-first users. Fee structures differ: Amex charges higher annual fees, Revolut keeps

Are you looking to invest in reliable stocks? In this listicle, you'll discover the best railroad stocks that offer stability and growth potential. From industry giants to emerging players, each option is poised to keep your portfolio on track!

Meme pages on social media can help you make real money with many ways to earn. This includes ads, selling things, and posts that sponsors pay for. If you have a loyal group of followers and you post new memes all the time, advertisers and people with big accounts may reach out to you.

Are you new to credit cards and feeling overwhelmed? You're not alone! In this listicle, we've curated the best beginner-friendly credit cards just for you. Discover options that offer low fees, easy approval processes, and valuable rewards tailored to kickstart your financial journey.

Introduction Short-form video platforms like YouTube Shorts and TikTok allow creators to reach large audiences and earn money from their content. These platforms provide different monetization programs, and choosing the right one depends on growth goals, content type, and earning preferences. YouTube Shorts offers ad revenue sharing for steady earnings. TikTok pays creators via

Introduction In 2024, technology supports daily living by improving tasks, boosting productivity, and enhancing hobbies or wellness goals. Devices are available for work, study, fitness, or convenience at home. Innovations offer speed, style, and smarter features, making tools practical additions to routines. AI shapes this year’s most useful devices, from smartphones to laptops. Top

Introduction Choosing the right investing app can feel challenging with many options available. Webull and Robinhood are two of the most popular trading apps that help people access investing. Each platform suits different users depending on experience and goals. Those new to investing may prefer simplicity, while more experienced users may need advanced tools. Comparing

Introduction When you see the leaves start to change, it is a good time to look at your money. The last months of the year can be busy. It helps to pause and review your fall money plans at this time. Doing this can help you finish well and get ready for what is to

AAA membership offers savings on repairs and maintenance in addition to roadside help. AAA-approved shops provide 10% discounts on labor, with savings up to 75 dollars. Extra discounts are available on NAPA Auto Parts and AAA Premium Batteries. Membership levels (Classic, Plus, and Premier) provide different coverage and savings. Online accounts and the AAA

Introduction Choosing between Webull and TradingView for trading can be challenging. Each platform serves a different purpose and offers unique features. Webull focuses on trading and account management, while TradingView provides advanced charting and technical analysis tools. Understanding the strengths of each platform helps traders pick the best option for their needs. Both can also

That “get rich this time next year” TikTok you just saved? It might be draining your wallet. One viral TikTok finance advice video promises you can turn $100 into $10,000 overnight. Tempting? Sure. Reliable? Not so much. While scrolling through endless viral money tips feels entertaining, following unverified social media investing guidance can lead to

Log into today’s online casinos, and you’ll find much more than a row of digital slot machines. The modern experience is vibrant, varied, and designed to keep every type of player entertained. From classic card tables to fast-paced specialty titles, real money games now cover a spectrum that rivals and often surpasses the energy of

Customer reviews are extremely effective. They can build trust and create credibility. Programs to reward loyalty encourage repeated business. The combination of these strategies increases their effectiveness. This article outlines efficient integration strategies. It explains how to make the most of both. The integration of reviews into loyalty programs creates synergy. It encourages customers to

Running a small business in Illinois requires planning, patience, and attention to detail, especially when it comes to taxes. From state-specific rules to overlooked deductions, tax surprises can catch business owners off guard and lead to costly penalties or missed deductions. Fortunately, with some up-front strategy and routine oversight, you can steer clear of many

Relocating to the United Kingdom can be an exciting chapter, especially if you’re planning to buy property. But for U.S. citizens, the cross-border financial implications, particularly tax-related ones, often come as a surprise. Before jumping into UK real estate listings, it’s crucial to understand how U.S. tax law interacts with your overseas move and property

In the unfolding saga of AI dominance, Amazon and Nvidia present two divergent paths. While Amazon leverages its vast cloud infrastructure to integrate AI into everyday services, Nvidia pivots on its GPU prowess, fueling innovation. Their competition could define the future of AI.

529 plans will still be the best way to save for education in 2025 because they have high contribution limits, cover a wide range of expenses, and don't usually affect federal aid. ESAs, custodial accounts, and Roth IRAs, on the other hand, are better for specific needs and trade-offs. Start early, set up automatic contributions, and look at the tax breaks, fees, and investment options in each state to find a plan that fits your family's needs and budget.

AliExpress has the lowest prices and the most choices, but the quality and size of the items vary from seller to seller, shipping can take weeks, and returns often need to be sent back to the seller in another country. Zara's curated, trendy pieces cost more, but they always have good quality, ship quickly, have standard sizes, and make returns easy within 30 days.

Many people worry about their Social Security income being garnished by the IRS or creditors. While certain government debts can lead to garnishment, Social Security benefits are generally protected. Knowing these rules can provide peace of mind.

Sarah Lewis, an accountant, is making waves in her community by teaching seven-year-olds how to handle their money. She is only 30 years old. She gives kids the financial skills they need to shape their futures through fun lessons and examples they can relate to.

Choosing between Uber and Lyft can feel overwhelming, as both rideshare platforms offer flexible earning opportunities but differ in pay, app usability, and driver experience. Evaluating these factors helps drivers select the platform that aligns with their professional and personal goals, ensuring a smoother and more profitable experience. Differences Between Uber and Lyft Uber and

Ride-Hailing Comparison and Insights Ride-hailing services like Uber and Didi have transformed urban transportation, integrating advanced technology and AI to enhance user experiences. By examining their services, market strategies, and innovations, riders and drivers can make informed decisions. Comparing Uber and Didi reveals their strengths and focus areas, providing insights for choosing the best ride-hailing

Ride-Hailing App Comparison Ride-hailing apps have revolutionized urban transportation by offering fast, convenient, and accessible rides. Bolt and Uber are two leading platforms in this space, providing quick booking options while differing in pricing, coverage, and additional features. Choosing the right app depends on whether you value affordability, global availability, or extra services. Bolt and

Finding the ideal rideshare app can be confusing with so many options available. Uber offers global reach and convenience, while InDrive provides flexible, negotiation-based pricing. By comparing features, pricing, and safety measures, you can decide which platform fits your travel style and budget. How Uber and InDrive Operate While Uber and InDrive both connect riders

Meme coins have gained attention in cryptocurrencies. Coins like Dogecoin and Bonk have become popular in the crypto market. These coins combine humor with blockchain, attracting both traders and casual observers. Dogecoin has seen growth due to attention from Elon Musk and support from its large community. Bonk takes a different approach, using unique methods

As Nvidia continues to lead in AI and gaming technology, now might be the perfect moment to consider investing. With robust growth potential and innovative advancements on the horizon, this could be a golden opportunity you won’t want to miss.