Looking to boost your income while sharing your passion for fitness? Discover 19 side hustles you can start today, from personal training to fitness blogging. With the potential to earn up to $20k a month, it's time to turn your love for fitness into a rewarding venture!

Unlocking Kanopy's vast streaming library as a non-resident is easier than you think! Many libraries offer access for non-residents through a library card. Just check your local library’s website for their policies and enjoy quality films and documentaries!

Tax season can be stressful for small business owners who haven't properly organized their finances. Taking the time to get your financial records in order now will save you headaches when it comes time to file. Here are some tips to help small business owners get financially organized ahead of tax season. Reconcile Your Books

We often associate saving money with cutting back. While budgeting is important, one of the most overlooked financial strategies is the value of spending well. That is—choosing products that may cost more upfront but save money (and stress) over time by outlasting cheaper alternatives. When you purchase with intention, you’re not just acquiring an item—you’re

Small towns offer lower costs and less competition, making them ideal for new businesses. Entrepreneurs can thrive by addressing local needs and building strong community connections. Businesses like food trucks, landscaping services, and local grocery stores often perform well in these areas. Using tools like social media and point-of-sale systems can streamline operations and

Medical alert systems give quick help in emergencies using help buttons, wearable devices, and base units. They come in different types, like in-home systems, mobile systems, and special devices with features such as fall detection and GPS tracking. These systems support independence for older adults and offer peace of mind with dependable emergency response

Starting a tax business starts with knowing what tax preparation you need, what you must do, and how to pick the right business structure. Small business owners should learn important tax terms like Schedule C, Medicare Tax, and income tax duties. Getting an Identification Number (EIN) is an important step in setting up a

High-risk driver insurance is meant for people with bad credit, a record of traffic violations, or little driving experience. Things like driving history, age, type of vehicle, and where you live can greatly affect insurance costs. Traffic tickets like DUIs or speeding tickets can raise insurance rates by up to 87%. Young drivers usually

Silver Certificate Dollar Bills, once redeemable for silver, are intriguing collectibles today. Their value depends on condition, rarity, and demand, often ranging from a few dollars to hundreds. Exploring these bills can uncover both history and potential worth.

Transitioning from a paycheck-driven job to one that fulfills your purpose involves self-reflection, skill assessment, and strategic planning. Start by identifying your passions, then seek opportunities that align with your values to create a meaningful career.

Forming an LLC in Georgia is a straightforward process. First, choose a unique name for your business, then file Articles of Organization with the Secretary of State. Don’t forget to draft an Operating Agreement to outline your management structure.

Navigating the process of securing a loan to buy a business can feel daunting. Start by assessing your finances, researching lenders, and preparing a solid business plan. A clear strategy and understanding of your goals will make the journey smoother.

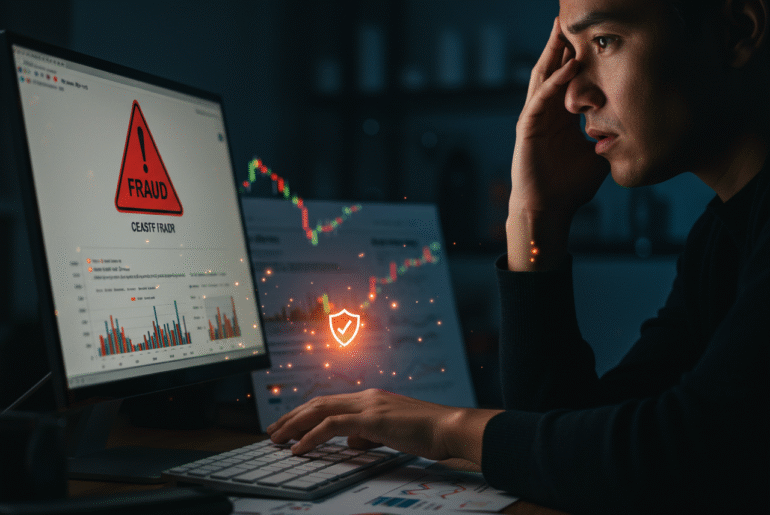

Protecting your brokerage accounts from ACATS transfer fraud is crucial. Always verify account transfer requests directly with your brokerage. Be wary of unsolicited communications and enable two-factor authentication to safeguard your investments. Stay vigilant!

Facing medical debt can feel overwhelming, but you're not alone. Start by reviewing your bills for accuracy, then consider negotiating with providers to set up a payment plan. Explore financial assistance programs, as many hospitals offer support for those in need.

NovoCure Limited has been making headlines, yet achieving profitability continues to evade the company. Despite its innovative treatments for cancer, significant financial hurdles persist, leaving investors uncertain about its future.

Scammers are increasingly leveraging AI to impersonate government officials, creating realistic voice and video deepfakes. This alarming trend poses serious risks, as unsuspecting citizens may be duped into sharing sensitive information or making fraudulent payments.

Are you ready to dive into the world of silver stocks? In this listicle, you’ll discover the best silver investments that can boost your portfolio. From established miners to innovative companies, get insights and facts that will help guide your choices!

In a bid to keep pace with Walmart, Target is ramping up its investment in digital initiatives and enhancing its supply chain efficiency. This strategic move aims to attract more shoppers and improve overall customer experience, signaling Target's commitment to competition in retail.

The digital entertainment industry is constantly evolving as consumer preferences change. Regulatory requirements and platform technologies are also constantly transforming. Companies that can adapt to these changes are better positioned for success in the future. The businesses that thrive focus on long-term strategies rather than chasing temporary spikes in traffic or engagement metrics. iGaming Companies

As YouTube continues to evolve, it seems like ad interruptions are about to get even more frequent. With plans to increase ad loads, viewers may soon find their beloved videos interrupted more often than not. Brace yourself for an even less seamless experience.

MRV Banks offers a range of credit cards designed for diverse financial needs. With competitive rates and rewards programs, they cater to both savers and spenders. Evaluating your spending habits will help determine if MRV's cards fit your lifestyle.

If you’re feeling overwhelmed as the tax deadline approaches, don’t worry! You can still file for a tax extension. This option allows you extra time to prepare your return without penalties, giving you the breathing room you need. Just remember, taxes owed are still due on time!

Each and every business must prioritize revenue. It is derived from activities that are occurring on a continuous basis, such as selling goods, providing services, or making investments. It is helpful to gain an understanding of the primary types of revenue, such as operating revenue and non-operating revenue, in order to gain insight into

Learn why investing books are a fantastic way to get better at financial literacy and make smart investing choices. Understand the basics of investing. Starting your investment journey with clear goals and a personal plan is important. Refer to the best investing books for beginners, such as “The Intelligent Investor” and “A Random Walk

As we closely examine GitLab’s recent performance, it’s crucial to wait for signs of growth stabilization before making any investment decisions. A thorough technical analysis reveals potential bottoming patterns, suggesting a cautious approach may be wise.

Many assume that physically demanding jobs come with high rewards, but the reality often tells a different story. From miners to agricultural workers, these roles can be grueling yet pay far less than you'd expect, revealing a stark disconnect between effort and income.

Luxury group Aeffe faces significant challenges following a disastrous quarter, marked by declining sales and profit margins. The once-celebrated brand grapples with changing consumer preferences and economic pressures, prompting concern among stakeholders.