Introduction The right tools are essential for growing a small business, and Envato provides these tools. With services like Envato Elements, available through a subscription, small businesses can enhance their creativity and improve user experiences. They can leverage professional WordPress themes from ThemeForest and access licensed stock images for marketing purposes. Envato's user-friendly design simplifies

How DNS Impacts Your Website – Why a Fast Domain is Important When thinking about the loading speed of a website and the content, you can draw an analogy to the first handshake with your visitor. If it's sluggish and dragged out, you give a bad impression of yourself, and the second handshake may not

Planning an event is a massive undertaking, no matter the size or scale. Whether you’re organizing a wedding, a corporate conference, or a milestone celebration, there’s always a ton of moving parts. From securing the right venue to managing guest lists and catering, it’s easy to feel overwhelmed with all the tasks you need to

Personal bankers provide specialized assistance based on customers' financial needs and goals. Their primary responsibilities include managing customer accounts, overseeing transactions, and offering related banking products. Collaborating with a personal banker helps resolve account issues and plan long-term financial strategies. Personal bankers play a crucial role in career development by offering opportunities to

Insurance costs for older cars depend on factors like the model year, car value, and safety features. Insurance rates for older vehicles can be lower than for newer ones. The price is based on your driving history, where you live, and the coverage you select. Classic car insurance offers agreed-upon value coverage for

Futureverse, a leader in digital items, has purchased Candy Digital, a well-known NFT startup. This strengthens its presence in the NFT market. The acquisition will help Futureverse reach its goal of expanding its product offerings, including trading cards and special NFT collections. Candy Digital adds expertise in NFTs, particularly in sports items such

Envato is a one-stop platform that has a wide range of design tools and resources. You can use Envato Market to buy single assets and Envato Elements for unlimited downloads. Both beginners and professionals can use Envato’s easy-to-reach creative resources. Users can easily create accounts and look for materials that match their design

Bitcoin is the first cryptocurrency in the world. It runs on a decentralized blockchain system and remains the leading asset in the crypto market, with a market cap over $2.07 trillion. Many people are investing in Bitcoin globally. Big companies like Tesla and MicroStrategy are committing large amounts of capital. Bitcoin relies on

Envato Audio has a large audio library. It includes soundtrack options for different projects. You can listen to tracks before buying them. This helps you make sure the audio is right for your needs. Using music on Envato is simple. There are tools to help you find files with an audio preview or

Bitcoin Stocktwits lets you join real-time talks, feel the mood of investors, get price predictions, and create your own watchlists. The platform has lively talks about Bitcoin, popular topics, and forecasts, making it more engaging for crypto enthusiasts. Stocktwits offers market data through Xignite and Coingecko, providing trusted information for users. Stocktwits clarifies

Hitting the road in an RV opens up freedom, but costs can add up fast if you're not careful. Fuel, food, and campsites eat into your budget quicker than expected. Smart planning keeps things affordable without killing the fun. This guide breaks down five practical tips for first-time RV travelers who want to explore more

The Pi Network's Security Circle is key for increasing your mining rate and helping the platform’s global trust graph. Each security circle member gives a 20% boost to your base mining rate. You can have five active members at most. The Security Circle protects the Pi blockchain by building trusted connections among users.

Pi Network is a cryptocurrency project that allows users to easily mine digital currency on their mobile devices. The current exchange rate for Pi Coin is $1.249206 in USD. It has a market cap of $8.83 billion and a trading volume of $1.36 billion. The circulating supply of Pi Coin is 7.07 billion.

Learn how the Pi Network's referral system can boost your mining rate and earnings. Check out the referral code “realfangwallet.” It gives the best bonus chance for 2025-2026. Understand how referral teams and security circles can enhance your Pi cryptocurrency experience. Get easy steps to join the best Pi referral teams and unlock

As pension funds increasingly pour resources into private equity, concerns are rising about dim prospects. With high fees and market volatility, many are questioning whether the potential returns justify the risks involved in these investments.

A credit builder can help establish a good credit history through timely monthly payments. These tools enable credit improvement while building savings in secured accounts. Credit builders share payment activity with major credit bureaus like TransUnion, Experian, and Equifax. Options include credit builder accounts, secured credit cards, and credit builder loans, each tailored

Looking for the best auto insurance in MA? You’re in luck! In this listicle, we break down top options based on coverage, cost, and customer service. Get ready to discover plans that fit your needs and budget perfectly!

SLR Investment offers an attractive 11% dividend, drawing income-focused investors. However, its overall performance leaves much to be desired, prompting a closer look at whether the high yield compensates for underlying weaknesses.

Are you aware that your Android device might be sitting on hidden updates? Many users overlook the minor system updates that can enhance performance and security. Take a moment to check your settings; you might discover features that improve your daily experience!

Exciting news for those seeking financial flexibility! You can now obtain multiple cardless cards throughout your lifetime—previous limits are lifted. This change opens the door to easier budgeting and spending, making your financial management more efficient.

General Motors is poised to outpace Tesla in the electric vehicle market with an impressive lineup of affordable models. As GM ramps up production and expands its EV offerings, it may soon redefine the landscape of electric transportation.

As enforcement dwindles, the wealthiest Americans find loopholes widening and audits fading. The IRS's diminishing resources allow millionaires to strategize their tax obligations, reshaping the financial landscape in ways that leave everyday taxpayers bearing the burden.

Today's tariff changes could directly impact your online shopping experience. Expect higher prices on imported goods, especially electronics and apparel. It's essential to stay informed, as these adjustments may lead you to seek alternatives and rethink your cart.

Permission-based email marketing means you must get explicit agreement from potential customers before sending them marketing messages. This method helps reduce spam complaints. It builds trust because it focuses on getting express permission. Following anti-spam laws, such as the CAN-SPAM Act in the U.S., helps you stay compliant and protect your brand's reputation.

Day trading moves at a lightning-fast pace, and new traders often discover there’s a steep learning curve to becoming consistently profitable. The allure of quick gains can tempt beginners into jumping in headfirst without fully grasping the risks. In fact, a large body of evidence shows that most day traders lose money over time (CNBS),

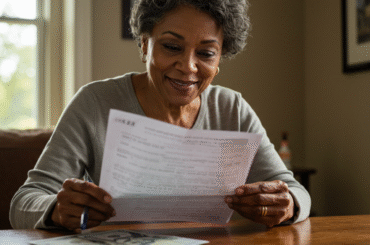

Financial security is important for older adults. It helps them protect their retirement income and manage healthcare costs. A solid retirement plan should account for unexpected expenses, medical bills, and everyday living costs. Understanding Social Security benefits provides a basic income during retirement and can support family members in need. Preventing identity theft

Find out the tools and steps you need to easily build a Shopify store. You can do this even if you are a beginner with no experience. Learn why design, templates, apps, and storefronts are important in making your online shop appealing and useful. Check out a simple guide on how to set