Looking to save money while shopping online? Check out these 8 essential browser extensions that can help you snag the best deals, find hidden discounts, and even earn cash back. With these tools, smart shopping just got a whole lot easier!

Deciding between a new or used car can be tough. New cars offer the latest features and warranties, but they depreciate quickly. Used cars are often more affordable and have less depreciation, but may lack reliability or have higher maintenance costs. Consider your budget and needs!

Looking for the best credit cards tailored for average credit? In this listicle, you'll discover top picks that offer great benefits, such as cashback rewards and manageable fees. Dive in to find a card that fits your financial lifestyle!

Investing in Canadian bank ETFs is a smart way to gain exposure to the country's robust banking sector. Start by researching top-performing ETFs, consider factors like management fees and dividend yields, and balance your portfolio to mitigate risks.

Searching for a new job can feel overwhelming. The competition is tough, and the stakes are high. Yet, with the right approach and resources, you can position yourself as a top candidate. This article breaks down practical tools and effective tips that help you maximize your job hunt and land the career you want. Understanding

Crypto trading isn’t a one-size-fits-all game — some traders thrive on rapid-fire decisions, while others play the long game. And when it comes to profit-making strategies, scalping and swing trading are the two paths you can travel on. But which one suits you best? Scalping is all about quick, high-frequency trades, while swing trading focuses

Looking to make your money work harder? In this listicle, you'll discover the best interest checking accounts that offer competitive rates and valuable perks. Get ready to maximize your savings while enjoying convenient banking options tailored for you!

In the dynamic and often unpredictable world of cryptocurrencies, forecasting the price of XRP for 2025 and 2026 involves navigating a range of scenarios driven by regulatory developments, institutional adoption, macroeconomic conditions, and technological innovations. Analysts’ projections for XRP over this period vary widely, from relatively conservative estimates below $2.00 to highly optimistic targets exceeding

Planning for a comfortable retirement involves more than just saving. To aim for a $5,000 monthly income, consider a balanced approach: invest in a diverse portfolio, maximize your retirement accounts, and explore income-generating assets like real estate.

I recently discovered IREN, and it’s clear I overlooked its potential. With innovative solutions and a commitment to sustainability, this company is reshaping the energy landscape. It’s time to pay attention—Iren’s impact is too significant to ignore.

Replacing windows can be daunting, both in time and expense. However, making smart choices—like energy-efficient models and local installers—can ease the financial burden. Prioritize value and quality to enhance your home without breaking the bank.

When planning your next adventure, it's crucial to have the right credit card in your wallet. In this listicle, you’ll discover the best credit cards for international travel that offer no foreign transaction fees, great rewards, and travel perks. Get ready to explore smarter!

Looking for the best credit card in 2019? You've come to the right place! In this listicle, you'll discover top picks tailored for cash back, travel rewards, and low interest rates. Let’s dive in and help you find the perfect card for your needs!

Google has just unveiled groundbreaking AI models that enhance video and image processing. These advancements promise to revolutionize media creation, making it easier for creators to generate captivating content and transforming how audiences engage with visuals.

Despite the excitement around AI advancements, a truly conversational Siri remains elusive. Limitations in natural language understanding, context retention, and emotional intelligence hinder progress. Until these challenges are addressed, our dream AI assistant may stay just that— a dream.

If I had to retire today, I’d focus on reliable dividend stocks that offer stability and growth. Companies like Johnson & Johnson and Procter & Gamble consistently deliver returns, ensuring a steady income stream for my future. Investing wisely means peace of mind.

With digital assets emerging as invaluable in this age, their security is a must to safeguard them. It could be NFTs, cryptocurrency, or intellectual property; these assets are constantly attacked by continuously changing cyber threat actors. Security for your digital assets must be a multi-cut approach based on cutting-edge technology complemented with managed best practices.

Nebius Group is poised to ascend new heights in the tech landscape. With innovative products and a visionary leadership team, they're not just adapting to trends but setting them. As they prepare for their next leap, the industry is watching closely.

Discover the new Citi Strata Card, featuring a $0 annual fee and up to 3X back on your spending. Whether dining out or shopping, this card rewards your lifestyle while keeping costs low—a perfect blend of value and flexibility!

A 529 plan is a tax-advantaged savings account designed to help families save for future education costs. It allows your money to grow tax-free, making it a smart financial tool for covering college expenses or other qualified education costs.

Welcome to our list of the best credit cards for first-timers! Here, you'll discover options tailored just for you-cards with no annual fees, beginner-friendly rewards programs, and easy approval. With these picks, starting your financial journey will be a breeze!

As we approach 2025, choosing the right high-yield savings account can boost your savings significantly. We've rounded up the 12 best options, highlighting competitive interest rates and convenient features to help you maximize your financial growth.

As pension fund managers increasingly eye private equity for higher returns, they must tread carefully. The landscape is fraught with risks, from illiquidity to management fees. Staying informed and cautious is essential for safeguarding retirees' futures.

The way Canadians manage their money has changed rapidly over the past decade. Whether online shopping, digital banking, or investment platforms, convenience and security are now top priorities. This shift also shapes iGaming, where fast and reliable payment methods have become essential. One option gaining attention among Canadian players is iDebit, a direct bank payment

Vendor financing can be a game-changer for businesses seeking to enhance cash flow. By allowing customers to pay over time, vendors create mutual benefits. This guide explores how to leverage vendor financing effectively for sustainable growth.

In a world increasingly focused on overconsumption, the underconsumption trend offers a mindful alternative. By choosing quality over quantity and prioritizing needs, you can save money while also reducing waste and embracing a more sustainable lifestyle.

Crypto trading never sleeps, and neither do AI-powered trading bots, but does that give them the upper hand? As a crypto investor, you must have two choices: Trust AI for non-stop, data-driven trades or rely on human intuition to navigate the market’s twists and turns. Both approaches have their perks and pitfalls. It depends on

Investing’s a rollercoaster—thrilling highs, gut-check lows, and markets that zig when you expect them to zag. If you’re looking to level up from basic stock trades, advanced options trading, like FLEX options, might just be your secret weapon. These tools aren’t about gambling; they’re about precision, giving you flexibility to grow your portfolio, dodge risks,

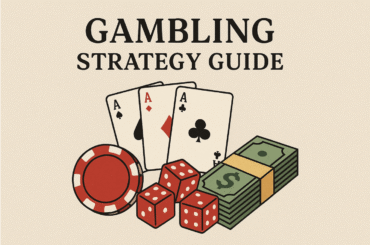

Many players wonder whether casino game strategies can genuinely improve their chances of winning. While luck plays a significant role, certain tactics can influence outcomes in skill-based games. Some methods, like card counting in blackjack, have proven effective, while others rely more on myth than math. For those looking to refine their approach, platforms like

Deciding whether to pay off debt before buying a house can be tough. While eliminating debt may boost your credit score and enhance mortgage options, it’s crucial to weigh your financial situation and long-term goals. Balancing both could lead to a stronger financial future.