AI is doing better than traditional traders on Wall Street in today's fast-paced financial world. You can use these same tools by using advanced algorithms and data analysis. This is how you can improve your trading strategy and stay ahead.

Lowe's commitment to increasing shareholder value is still clear as we look toward 2025. The home improvement giant is ready for steady growth thanks to smart investments and a strong expansion plan. This makes it a great buy for investors who want to get the most for their money.

In this listicle, explore the top ways to make the most of Best Buy's no-interest financing options! You'll discover tips for budgeting, enticing deals on electronics, and how to maximize your purchase power without overwhelming debt. Get ready to save smart!

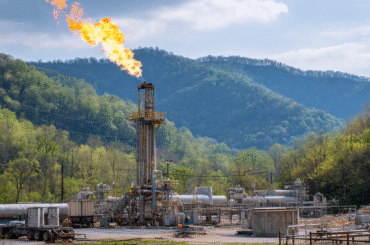

EQT is changing the way energy works in Appalachia by using natural gas as a way to grow in a way that lasts. They're not just powering homes; they're also making the world a cleaner, greener place by combining new ideas with smart ways of doing things.

Investing in Data Monetization Startups Data monetization startups turn raw data into new ways to make money. These companies use advanced data tools to find ideas in customer and business data. Growth is fueled by artificial intelligence, machine learning, and expanding data marketplaces. Popular models include Data-as-a-Service (DaaS) and Insight-as-a-Service. Investors should evaluate market fit,

Webull vs E*TRADE Expected Returns on $1000 Webull and E*TRADE are two popular trading platforms that investors often compare when choosing where to grow their money. Both allow commission-free stock trading but differ in features, account options, and available investment products. Webull attracts frequent traders with advanced tools, while E*TRADE appeals to those who want

Introduction Choosing between Bluehost and SiteGround can affect your website's speed, stability, and overall experience for visitors. These two hosts are popular and each has distinct advantages. Picking the right provider matters for WordPress sites and other business websites because server performance impacts user experience, search rankings, and conversions. SiteGround offers faster performance and

Getting out of debt can feel overwhelming, but small changes can lead to big results. Start by creating a budget that prioritizes essentials and debt payments. Consider leveraging the snowball method, where you tackle smaller debts first, for motivation.

As investors, we often only think about the obvious risks, but there are three potential economic landmines that we should be aware of. If you don't pay attention to these things, your portfolio could go off the rails because of the shadow banking sector's growing instability and the weakness of the supply chain.

Before you embark on your next adventure, don't forget to download these essential apps! From navigation tools like Google Maps to language apps like Duolingo, having the right digital companions can enhance your travel experience and keep you organized.

Smart investors are buying stocks that have many ETH in their treasuries as Ethereum gets close to its all-time high. This strategic move shows that people have faith in the crypto market and that digital assets are becoming more widely accepted.

Looking for the best car insurance in Ohio? You've come to the right place! In this listicle, you'll discover top-rated options that combine coverage, affordability, and customer satisfaction. Get ready to find your perfect policy today!

A lot of older Americans are being scammed out of money through fake phone calls and crypto investments. Because this group doesn't know much about money, scammers take advantage of their trust and confusion to steal millions. It's important to raise awareness and keep weak communities safe.

Today, navigating the real estate market seems hard. Buyers may wonder if now is a bad time to invest because interest rates are going up and prices are going up and down. Yet, opportunities abound for those willing to research and strategize. Timing can be very important.

In the world of investing, not all rallies lead to profit. Typically, rallies conclude in one of three ways: a sharp sell-off, a gradual decline, or a sustainable uptrend. Only the last option truly enriches investors. Choose wisely and stay informed!

Important lessons about money have changed how it is handled over the years. Financial habits have changed thanks to advice on everything from smart investing to good budgeting. This has led to a level of stability that once seemed impossible.

If you stop paying your student loans, you could face serious consequences. Initially, you'll enter delinquency, which affects your credit score. After several months, your loan may default, leading to wage garnishment or tax refund seizures. It's a tough path.

Animoca's Tower cryptocurrency saw an incredible 214% increase in July, showing how fast the Web3 gaming industry is growing. This rise shows that more gamers are interested in and engaged with blockchain-based experiences, which means that digital play has a bright future.

Three stocks that stand out have reached all-time highs as markets keep going up, which shows that investors are very confident. These companies have strong fundamentals and room to grow, which means they could keep making money. This makes them interesting picks for smart investors.

Long-term compounding turns small, regular investments into a lot of money. By reinvesting dividends and letting time work its magic, even small amounts can grow into huge sums. This shows how amazing the stock market can be. Time is really the best friend of an investor.

Bitcoin is close to its all-time high, and many people are wondering if we've reached the top. Some signs point to a mix of hope and caution. Before making any decisions, it's important to stay up-to-date and think about market trends.

Want to add more variety to your portfolio? We will show you the best small-cap stocks you should think about. Find potential gems that could lead to big growth, from cutting-edge tech companies to new healthcare companies.

Nvidia's status as the first $4 trillion company is a major turning point in the tech world. As its AI dominance grows, people who might want to invest in NVDA stock might wonder if now is the right time to do so. Let's look at the things that are going on.

Travel plans can change suddenly, and unexpected events may leave guests worried about losing money. Airbnb has structured refund and cancellation policies to help protect both travelers and hosts, but these rules can be confusing without a clear explanation. Whether a host cancels, a property does not match what was promised, or a personal emergency

Looking for the best credit card options for kids? In this listicle, you’ll discover top picks that teach financial responsibility while offering parental controls. Each card balances convenience and safety, helping your child become financially savvy.

Looking for the best credit card to manage your utility bills? In this listicle, you’ll discover top picks that offer rewards, cashback, and perks tailored just for utilities. Save money while keeping the lights on—let’s dive in!

If you've been eyeing the Apple iPad Air, now's the perfect time to buy! It's currently on sale for just $370, making it an excellent deal for a powerful tablet. Don’t miss out on this opportunity to enhance your tech experience!

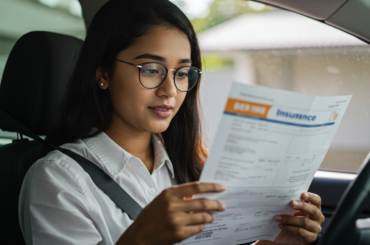

Looking for the best insurance as a first-time driver? You’re in the right place! In this listicle, you’ll find top options that balance affordability with comprehensive coverage. Get ready to hit the road knowing you're well-protected!

A pending home sale means a seller accepted an offer, but the deal hasn’t closed yet. Even with a pending status, the sale can fall through due to financing issues, inspection problems, or other contingencies. Making an offer on a pending home is possible, but sellers aren't obligated to consider it. Backup offers can

Losing a job can be overwhelming, especially when managing loans. Communication is key; reach out to lenders to discuss payment options. Consider options like deferment or forbearance, and revise your budget to prioritize essential expenses.