The way people work from home is changing quickly as we look ahead to 2025. Flexibility is still important, and tech, finance, and healthcare jobs pay more. Companies are using hybrid models, which is changing the way work will be done in the future.

The Federal Reserve's decision to hold interest rates steady offers a unique opportunity for financial planning. Now is the time to reassess your budget, explore investment options, and consider how to optimize savings. Make informed choices to thrive financially!

Introduction A reliable budgeting plan can improve how you save money and reach your financial goals. The cash envelope method popularized by The Budget Mom offers a clear way to manage spending using cash and sinking funds. This system involves allocating cash into different envelopes for each expense category. This practice helps you see exactly

Introduction Zero-based budgeting (ZBB) is a budgeting approach where each expense must be justified and approved for every new cycle, rather than relying on previous budgets. This method requires detailed scrutiny of all costs and promotes more efficient money management. It helps businesses and individuals reduce unnecessary expenses and maintain closer control over their finances.

Top See a complete side-by-side comparison of Airbnb and VRBO to decide which vacation rental platform fits your goals Learn how fees, total price clarity, and payment methods differ for hosts Find family-focused options like villas, private homes, and city rentals Compare cancellation rules and guest protection policies Understand platform-specific tools for property managers

In an age where AI and automation threaten many jobs, certain side gigs remain resilient. Personal coaching, skilled trades, and creative arts thrive on human touch, empathy, and unique craftsmanship-qualities machines can't replicate. Embrace these opportunities!

Planning for long-term care costs is essential for securing your financial future. Start by assessing your potential needs, exploring insurance options, saving strategically, discussing plans with family, and staying informed about state aid programs.

Looking to maximize your savings on everyday spending? In this listicle, we break down the best credit cards for gas and groceries. You'll discover options that offer cash back, rewards points, and exclusive discounts-perfect for fueling up and stocking your pantry!

When it comes to securing your financial future, finding the best annuity rates is important. In this listicle, you'll discover top-rated options tailored to fit your needs, expert insights on each choice, and tips for maximizing your investment. Let's get started!

When considering the average stock market return, it's essential to note that historically, the stock market has yielded about 7% to 10% annually after adjusting for inflation. This figure can fluctuate, influenced by market conditions, economic cycles, and investor behavior.

When it comes to mutual funds, recognizing the right moment to sell can be crucial for your financial health. From consistently poor performance to changing investment goals, here are 14 clear signs that it may be time to reevaluate your investment strategy.

Looking for the best banks in California? In this listicle, we'll explore top choices tailored to your needs, from exceptional customer service to competitive interest rates. Discover which banks could help you achieve your financial goals!

Ready to dive into the world of investing? In this listicle, you'll discover the best investing books for beginners that will guide you from basic concepts to practical strategies. Each pick offers essential insights to boost your financial knowledge and confidence!

For frugal retirees, Arizona offers many affordable gems, but some cities are surprisingly pricey. Avoid these 13 ultra-expensive locales to stretch your savings and enjoy a comfortable retirement without breaking the bank. Your wallet will thank you!

Starting a business with no money may seem daunting, but it’s entirely possible. I launched my first venture by leveraging my skills, building strong networks, and tapping into free online resources. With creativity and determination, you can turn your idea into reality.

Nvidia is more than just a tech company; it's a catalyst reshaping industries. While Wall Street fixates on stock prices, it overlooks Nvidia's role in AI and beyond. As its influence expands, savvy investors should pay attention to the long-term power play at hand.

In a bold move, three market-beaters are backing up their buyback trucks, signaling confidence in their long-term strategies. With stock prices fluctuating, they're seizing the opportunity to reclaim value and reinforce their commitment to shareholders.

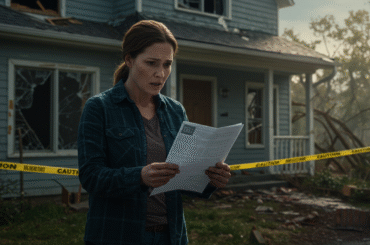

In the aftermath of natural disasters, hope can quickly turn into despair as scammers exploit vulnerable individuals. These opportunists prey on those seeking aid, promising relief while siphoning away resources meant for recovery. Awareness is key.

American Express specializes in premium credit cards with luxury travel perks and a robust rewards program. Revolut focuses on digital banking with low fees, budgeting tools, and multi-currency support. Amex Platinum and Gold suit frequent travelers, while Revolut Metal and Ultra fit digital-first users. Fee structures differ: Amex charges higher annual fees, Revolut keeps

Meme pages on social media can help you make real money with many ways to earn. This includes ads, selling things, and posts that sponsors pay for. If you have a loyal group of followers and you post new memes all the time, advertisers and people with big accounts may reach out to you.

Are you looking to invest in reliable stocks? In this listicle, you'll discover the best railroad stocks that offer stability and growth potential. From industry giants to emerging players, each option is poised to keep your portfolio on track!

Are you new to credit cards and feeling overwhelmed? You're not alone! In this listicle, we've curated the best beginner-friendly credit cards just for you. Discover options that offer low fees, easy approval processes, and valuable rewards tailored to kickstart your financial journey.

Introduction Short-form video platforms like YouTube Shorts and TikTok allow creators to reach large audiences and earn money from their content. These platforms provide different monetization programs, and choosing the right one depends on growth goals, content type, and earning preferences. YouTube Shorts offers ad revenue sharing for steady earnings. TikTok pays creators via

Introduction In 2024, technology supports daily living by improving tasks, boosting productivity, and enhancing hobbies or wellness goals. Devices are available for work, study, fitness, or convenience at home. Innovations offer speed, style, and smarter features, making tools practical additions to routines. AI shapes this year’s most useful devices, from smartphones to laptops. Top

Introduction Choosing the right investing app can feel challenging with many options available. Webull and Robinhood are two of the most popular trading apps that help people access investing. Each platform suits different users depending on experience and goals. Those new to investing may prefer simplicity, while more experienced users may need advanced tools. Comparing

Introduction When you see the leaves start to change, it is a good time to look at your money. The last months of the year can be busy. It helps to pause and review your fall money plans at this time. Doing this can help you finish well and get ready for what is to

AAA membership offers savings on repairs and maintenance in addition to roadside help. AAA-approved shops provide 10% discounts on labor, with savings up to 75 dollars. Extra discounts are available on NAPA Auto Parts and AAA Premium Batteries. Membership levels (Classic, Plus, and Premier) provide different coverage and savings. Online accounts and the AAA

Introduction Choosing between Webull and TradingView for trading can be challenging. Each platform serves a different purpose and offers unique features. Webull focuses on trading and account management, while TradingView provides advanced charting and technical analysis tools. Understanding the strengths of each platform helps traders pick the best option for their needs. Both can also

In the unfolding saga of AI dominance, Amazon and Nvidia present two divergent paths. While Amazon leverages its vast cloud infrastructure to integrate AI into everyday services, Nvidia pivots on its GPU prowess, fueling innovation. Their competition could define the future of AI.

529 plans will still be the best way to save for education in 2025 because they have high contribution limits, cover a wide range of expenses, and don't usually affect federal aid. ESAs, custodial accounts, and Roth IRAs, on the other hand, are better for specific needs and trade-offs. Start early, set up automatic contributions, and look at the tax breaks, fees, and investment options in each state to find a plan that fits your family's needs and budget.